Exclusive: Abel-Hodges Named CEO of Calvin Klein

- Oops!Something went wrong.Please try again later.

In a changing of the guard at Calvin Klein, Inc., Steve Shiffman has exited his role as chief executive officer and has been succeeded by Cheryl Abel-Hodges. The move is effective today.

Most recently, Abel-Hodges, a 13-year veteran of parent company PVH Corp., was group president of Calvin Klein North America and The Underwear Group. In her new Calvin Klein global role, she reports to Stefan Larsson, the new PVH president, who began June 3.

More from WWD

Tommy Hilfiger Taps Sophia Hwang-Judiesch as President, North America

Stefan Larsson Said PVH+ Is Pushing the Company Through Tough Macro

During an exclusive interview Sunday with Emanuel Chirico, chairman and chief executive officer of PVH, and Abel-Hodges, the two executives discussed the future of the Calvin Klein business and the opportunities for the brand, which is currently in a turnaround situation after the tumultuous tenure of Raf Simons, chief creative officer, who left abruptly in December after 28 months.

Since that time, Calvin Klein has ceased production of the Collection business; closed its Madison Avenue flagship; seen the departure of Michelle Kessler-Sanders, president of Collection, and experienced numerous job cuts, including 50 employees in New York and 50 employees in Milan. PVH had invested between $60 million and $70 million in the Calvin Klein Collection (renamed Calvin Klein 205West39NYC) and said it would cost $150 million to restructure the business. In addition, the women’s Calvin Klein Jeans for North America was licensed this month to G-III Apparel Group.

Shiffman, who had been instrumental in bringing Simons on board in 2016, had served as Calvin Klein ceo since 2014, before which he was president and chief commercial officer of CKI. He joined PVH in 1992 and was a member of the group’s corporate operating committee. Shiffman earned $3.69 million in compensation in 2018, down from $4.4 million in 2017.

“We both came to the conclusion that it just wasn’t working the way it needed to work going forward, and it was time,” said Chirico.

Abel-Hodges has done “an amazing job” in her role as president of The Underwear Group, he said, and is the best operator at Calvin Klein Inc., which last year generated revenues of $3.7 billion, up 7.4 percent from a year ago.

“I have great confidence that Cheryl is the right person to lead the Calvin Klein brand. Her strong management abilities, together with her consistent track record for operation excellence, will provide strong direction for the Calvin Klein team,” said Chirico. “I believe this leadership change, coupled with our incredible management teams around the world, will allow us to capture the brand’s long-term growth potential.”

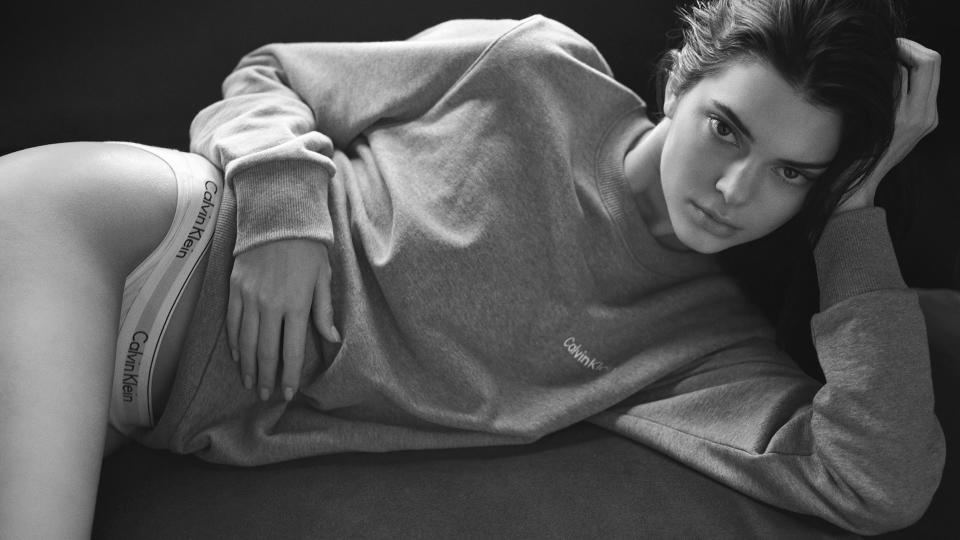

Mario Sorrenti/Courtesy Photo

Abel-Hodges has been group president of Calvin Klein North America since 2018, as well as president of The Underwear Group, a role she assumed in 2015. She led the development of PVH’s innovative underwear platform, overseeing design, merchandising, product development and planning for all of the group’s underwear and women’s intimates businesses. Earlier, she served in various senior leadership roles, including president of wholesale sportswear for Izod and president of Calvin Klein Underwear. Prior to joining PVH, she was vice president of sales for Lauren Sportswear at Ralph Lauren Corp. She started her career in the Bloomingdale’s executive training program and held posts in management, sales and marketing at Liz Claiborne Inc., Bernard Chaus, Carole Little and May Co.

Chirico said the main reason he selected Abel-Hodges is that she’s done “an amazing job” since CKI acquired Warnaco in 2012 and appointed her head of the Underwear division. “She’s had a real focus on working with our teams globally and really bringing everything together. One of the challenges when you’re running a global brand is how do you bring all the teams together and how do you align Europe and Asia, and her ability to do that has been fantastic,” said Chirico.

“She’s our best operator, by far, in the company and she’s demonstrated that over the year,” he added. He said that as the company has gone through changes over the past 12 months, it has found that there’s nothing fundamentally wrong with the Calvin Klein brand. “ It’s one of the strongest brands. We’ve had some real operating issues with the Calvin Klein business,” he explained.

According to Chirico, it starts with product, particularly on the jeans side, “and that’s the category where we’ve had our biggest miss.”

“And our North American retail business, Cheryl’s had those businesses reporting to her for the past nine months and we can see the improvements,” said Chirico. “All the Calvin Klein businesses that we directly operate report to Cheryl. We can see the difference that she’s really made with that, and we think she can bring that to the rest of the organization.”

Now that CK women’s jeans have been licensed to G-III for North America and women’s Collection is gone, Chirico said the main divisions are the large marketing/merchandising group that coordinates all product from around the world; the marketing team that coordinates all the go-to-market strategies, a significant licensing business, which will now directly report to Abel-Hodges, and the aspirational component of the brand, which formally was the Collection business. Now that will be made up of various capsules and collections. Abel-Hodges described that as the InCKubator part of the business, which will focus on how they bring ideas to the consumer, which could be marketing or product ideas, fashion moments or collaborations. “It’s really a way and a breadth to go to market to consumers but just in a different way,” she said. Asked if that would be a big revenue generator, she replied, “It will be an engagement idea for us at this point.”

“It’s important to try new things and do new things, and engage with consumers in a different way, and we’ll certainly learn,” she said. Abel-Hodges added that her responsibility will also include the commercial side of the business — all the Underwear businesses (Calvin Klein, Warner’s, True & Co., Nike men’s underwear) as well as Calvin Klein North America, which spans all its retail operations, including the outlet business, as well as Calvin Klein men’s sportswear and men’s CK Jeans.

Mario Sorrenti/Courtesy Photo

Abel-Hodges will also supervise Underwear, but there are two executives who will run wholesale and retail in North America for the underwear and apparel business. David Law has been named executive vice president of wholesale, North America for the Underwear Group, men’s sportswear and jeans. He had been in global merchandising. Sam Archibald is president of Calvin Klein Retail North America.

Following Simons’ departure, CKI said it would search for a new creative head to oversee all product design. Abel-Hodges said the company is still talking to candidates and meeting people for that position.

“That search is underway, and Cheryl has to make that decision,” said Chirico, noting that person will report to Abel-Hodges.

“What’s important to know is we have a very strong and well-organized merchandising and design team today globally, as well as really good regional design groups, so there’s a lot of talent in the organization,” said Abel-Hodges. “I really look forward to working with Stefan on the business strategy and the product strategy. There are great people in place and tremendous talent in the organization.”

Whether there’s a plan to re-launch a Collection business going forward, Chirico said, “Those things are all on the table to be determined. To be honest, we’re trying to figure it all out. If we do it, it can’t be the way it used to be. That whole process is somewhat dated. It has to be truly connected to the consumer. We need to be much more of today, and digitally focused — social media is becoming more important. Over the next 12 months, I think that will flesh its way out as the teams come together. Cheryl will have to direct that strategy.”

Chirico emphasized that the European, Asian, South American and Australian teams all report to Abel-Hodges in New York. Brand position, marketing and direction of the brand and how it all comes together fall under her purview.

According to Chirico, “The challenge we face in North America is not a top-line sales problem. It’s the impact that we’ve seen in our jeans business and retail business on profitability. Our top-line growth opportunity is in Europe, Asia and South America, where the Calvin business has been growing by single digits. I think that will continue. In Europe, we’ve identified over the next three or four years, a $1 billion opportunity in Europe and on a percentage basis, Asia will be the fastest-growing market, driven by China.”

Discussing the significant European opportunity, Chirico noted that there, the brand has Calvin Klein women’s sportswear and CK Women’s Jeans, which are produced in-house by CKI. Chirico said Calvin Klein in Europe is a $1.1 billion business at retail. The Tommy Hilfiger business in Europe is twice as large. “Every other region in the world, the Calvin brand is larger than the Tommy brand, except in Europe. We think we have the team in Europe that really knows how to go to market and the opportunity to develop it,” said Chirico.

Today, the European business has three pillars that make up 90 percent of the business. They are men’s and women’s jeans, underwear and intimates, and accessories. “There’s a very small men’s and women’s sportswear business, a very small ath-leisure business (that’s very big in North America and Asia), a very small footwear component to the business. There are these major pockets,” said Chirico. Usually, he said, the biggest business is men’s and women’s sportswear and all the classifications. “In the case of Europe, it’s just the opposite,” he said. “The ability to round that out and add at least another $1 billion in sales is very much ahead of us for Calvin.”

Chirico said G-III focuses on North America. “We learn a lot from them, and take inspiration from their lines, in Tommy and in Calvin,” he said. Asked why CKI gave up the women’s piece of CK Jeans, Chirico said, “[G-III] is doing $1.1 billion in wholesale sales, that’s a huge business. The women’s piece here is better coordinated and merchandised as a group, their go-to-market, with the heft that they have and the relationship with Macy’s…They just do women’s much better than we do. I think they do it better than anyone. They’ve been our long-term partner for 15 years. The two companies work exceedingly well together.” He said they have no plans to license the CK men’s jeans to G-III.

Calvin Klein Accessories, under several labels, is doing over $600 million in global retail sales, he said. “We do believe it could be a much bigger business,” said Chirico. Ulrich Grimm, executive vice president of shoes and accessories design at CKI, oversees all accessories.

Calvin Klein Underwear throughout all the regions generates $1 billion in reported revenue. Total Underwear sales, including Warner’s and Olga, is over $1.5 billion in sales.

Chirico noted that a key aspect in the company’s turnaround efforts is bringing the marketing message back to Calvin Klein’s core DNA.

Reflecting on the changes that the company has made over the past year, Chirico said, “Raf is a creative genius and a really good person. We just have to be honest: We lost our direction. We were alienating our core consumer. There was too much high-fashion and esoteric marketing and direction and it really hurt our core business. Our consumer that has been with us and the younger consumer were totally confused with what the brand was standing for. What’s been really positive in the last six months — and Cheryl has been intimately involved with this — is bringing the marketing message back to the core DNA of the brand.”

The best vehicle the company had to drive profitability was #MyCalvins, where consumers took pictures of themselves posing in their CK Jeans and Underwear. “Those were deep connections,” he said. “If somebody is willing to put on a pair of Calvin Klein Jeans and Underwear, and take a selfie…for us to walk away from something like that…”

Chirico said there are no plans to put any other PVH divisions into the Madison Avenue flagship, which closed this spring. The lease still has a few years left, and it would be subleased to another unrelated company, he said. Chirico said the retail model has changed.

“The high-end fashion retail business and what we’re doing globally is smaller stores that are high technology stores, highly digital, highly engaging the consumer, and less of the ‘museums’ to brands, or some would say, ‘mausoleums’,” said Chirico, adding the Calvin Klein flagships in Europe are much more modern. Over the next three years, he’d like to open 10 flagships in key U.S. markets, but much smaller footprints. The stores would have the InCKubator product, and key core products, such as underwear and jeans. That would be a higher-end capsule, not the G-III product.

Abel-Hodges cited one innovation as the Amazon fashion collaboration with Calvin Klein last November, which was “a new way to bring a consumer into a retail environment.” Consumers could buys jeans and underwear in a pop-up environment or digitally, and one could personalize the product. “We’ve learned how we can bring product to market in a very different way,” she said. The immersive experiences for CK Jeans and Underwear were in New York and Los Angeles.

Asked whether the company can survive without the “halo” of a designer collection, Abel-Hodges said, “I think we’ll see. The brand has been largely identified by big classification businesses likes jeans and underwear. The brand is very strong, it’s strong globally and the consumer is connected to this brand through marketing and product.”

Elaborating on the Collection concept, Chirico said, “What we have done is we’ve taken running a high-fashion label like Calvin Klein Collection, which was a major marketing investment. Obviously we did business there, but we were losing a tremendous amount of money. But we always looked at it from a marketing investment. What we’ve done is taken that loss and reinvested back into the core businesses in marketing. If we felt it was the right thing to do, to go back to something like what we did before, the financial resources are there to do it. We won’t do it exactly how we did it before. There’s always going to be a halo, aspiration piece to Calvin Klein that we clearly understand and that we’re investing in constantly. It may be different than where it is. That’s what Cheryl and Stefan need to come to terms with over the next nine to 12 months working with the chief marketing officer, [Marie Gulin-Merle].”

They might do collaborations with guest designers or influencers. “Everybody tries to have a global influencer. If you’re going to be a global brand, you need regional influencers. How many influencers/celebrities/sports figures are truly global?” Chirico asked.

Abel-Hodges said provocative advertising will remain a hallmark of Calvin Klein. “That’s who the brand is. The brand is sensual, we’re out there, we’re a brand that likes controversy and wraps its arms around that. It’s an inclusive brand and pushes everyone forward,” she said. She said all the marketing is done in-house.

The conversation then turned to e-commerce, and Abel-Hodges called it the fastest-growing piece of the business. The company has a global platform and Gulin-Merle is working on reimagining that. In each region, there are guidelines set globally for photography, messaging, and brand marketing. “It’s very important and connected to our store business as well to create an omni-unified business experience,” she said. Gulin-Merle, who is both chief marketing officer of Calvin Klein and chief digital officer of PVH, reports both to Abel-Hodges and Mike Shaffer, executive vice president, chief operating and financial officer of PVH.

In fact, Abel-Hodges stressed that culture is a very important part of the Calvin Klein experience.

“It’s not only a company that talks about inclusion and activism, we’re proud of that work. We’re open to new approaches, and we’re bringing different experiences. The culture piece is very important to us collectively. We don’t know where the next great idea comes from, and we want to encourage people to think differently and be open to different ideas,” she said.

Describing her management style, Abel-Hodges, said, “I like an organization that’s dynamic. I like an organization where people are empowered to make decisions, to build culture. I want people to be good at what they’re good at. I like to lead, where we talk about community, where we’re honest and open, and it’s a really big business. I’ve been at PVH for a long time…it’s a very unusual place. People are celebrated for who they are.

“Everything we do isn’t right, but we always learn something,” she continued. “That is something I like to instill in the team. It may not all work, and there are a lot of good ideas out there. But we’re learning through that process. I want people to feel safe in the thought that we can try a lot of things. We’ve very fiscally responsible. We’re really good open communicators and we’re honest about what’s happening in the business, but we have to take risks and we have to learn from what we’re doing. Yes, we should move ahead or no, we should not.”

Asked about a WWD interview last October when Chirico had said things were going really well with Simons, Chirico replied, “I think things started strongly with Raf overall. His heart was in the right place…the execution just wasn’t there. It was too much a focus on the high-end, collection business, and not enough focus on the marketing and product side for the core businesses that drive the brand and are totally connected with the consumer. It was no one’s fault specifically…it didn’t work, obviously. I know [Simons] is disappointed and we’re disappointed. He couldn’t have been a better gentleman in trying to make things work… Steve brought him in, but I approved it.”

Best of WWD