Everything You Need To Know About Klarna: How It Works, Reviews, Late Fees

Table of Contents

As we do more of our shopping online, retailers want to make it easier for consumers to hit that “Add To Cart” button. Whether through major discounts, free and/or expedited shipping, or other incentives, retailers have to get creative to stay competitive. One of the newest trends we’re excited about is the emergence of all those Buy Now, Pay Later services such as Klarna, AfterPay, Affirm, QuadPay, Sezzle, and PayPal’s Pay-in-4 program. These apps provide an easy way to pay a portion for the purchase upfront, receive it, and pay the balance over a period of time.

Think of it as Layaway 2.0. (Except way better, because you get your items immediately.)

Payment platforms like Klarna break down your total purchase price into smaller and more digestible payments — a structure that can appeal to younger, savvy shoppers on a budget. And who isn’t on a tight budget these days? Although there are many financial tech companies offering buy now, pay later programs, we’ve decided to take a closer look at one in particular in today’s review: Klarna.

What Is Klarna?

Based in Sweden, Klarna provides payment solutions that make purchasing simple and safe for buyers and sellers. It specifically assists in making point-of-sale purchases by offering no-interest loans that allow consumers to buy now and pay later at thousands of stores around the world.

Klarna’s website explains, “We partner with retailers all over the world to make it easy to pay how you like right from checkout. Or, you can use our app and enjoy flexible payment options anywhere online.” For example, let’s say you have your eyes on a pair of designer sneakers that cost $750. Klarna customers can have the shoes delivered immediately but pay for the shoes with a series of smaller payments over a period of several months.

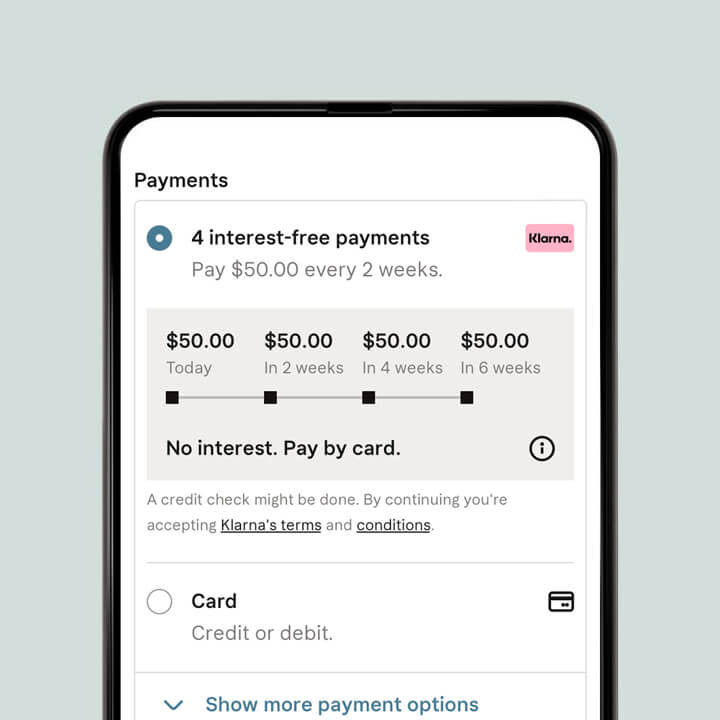

Klarna’s website explains it this way: “Split the cost of your purchase into 4 interest-free payments, paid every 2 weeks. No interest. No catch.”

How Does Klarna Work?

Klarna is an app that allows you to make purchases without full payment upfront. When initiating the purchase, you pay 25% of the total order and receive the items, which are shipped immediately. You then make 25% payments every two weeks thereafter until the entire balance is paid in full. Think of it as the reincarnation of layaway. However, this time you get to take your items with you immediately.

For example, if you make a $100 purchase, you would pay $25 at checkout. The three remaining $25 payments would be billed to your debit or credit card every two weeks until you’ve paid the full $100. Sounds amazing, right? Yeah, we think so too.

Of course, there are late fees for missed payments. We’ve outlined the company’s late-fee policy below. In general, if you miss a Klarna payment, a late fee of $7 will be added to your next bill (plus the cost of your missed payment).

Spy’s Review: We Tested Klarna, And We’d Use It Again

Below, I’ll answer some common questions about Klarna. Before joining Spy as an E-Commerce Editor, I personally used Klarna (and other Buy Now, Pay Later services) at several retailers without issue. The initial approval process took mere minutes, allowing me to sign up quickly without any hard inquiries to my credit profile.

Klarna started me off with a limit of $600 and began increasing it gradually once I showed financial responsibility through on-time and sometimes early payments. I have used it with several retailers without issue, most frequently with ASOS, Macy’s and DSW, and I can tell yoou that the shipping of my items remained the same as it would if I had used a credit card. So in my experience, Klarna works as smoothly as promised.

When using it at ASOS, I was able to apply coupons as normal and take full advantage of the ASOS Premier 2-day shipping that I purchased from the retailer a while back.

As far as returns are concerned, the process was just as easy, if not easier, than the purchase itself. A return to ASOS (following their return guidelines) resulted in a full refund to the debit card that was used to purchase through Klarna. I also returned an online purchase from DSW in-person at a physical location and the process was just the same — a full refund to the debit card that I had used during my purchase with Klarna.

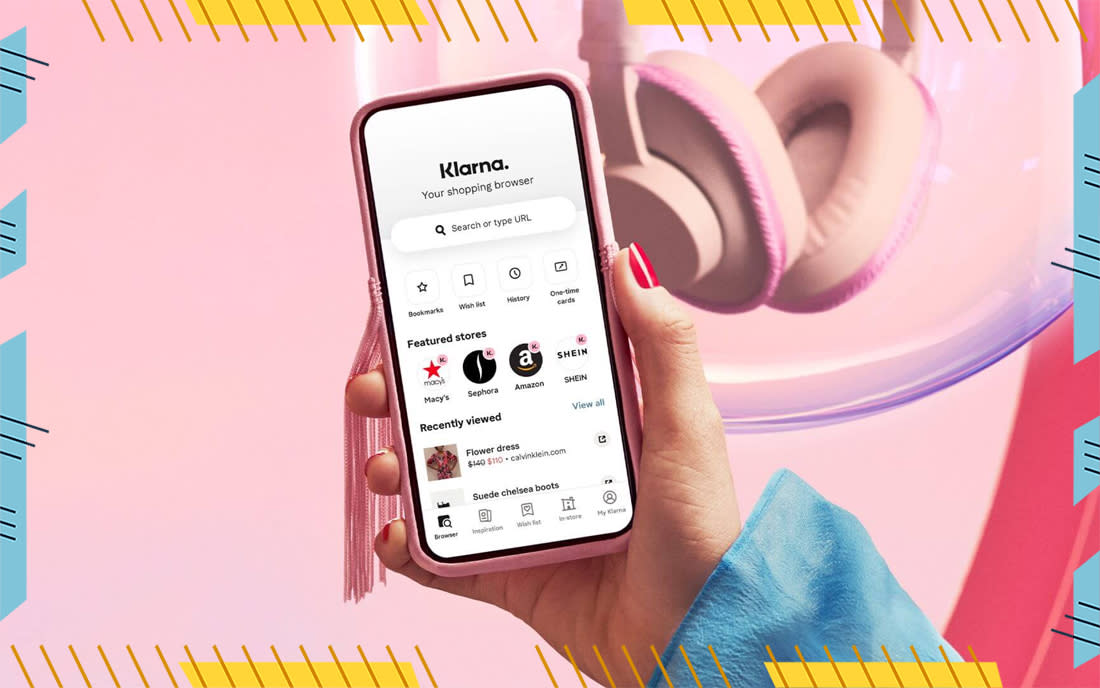

I’ve only made purchases directly from the retailers through the Klara app. However, they also have a browser extension that will allow you to easily “pay in four” on your desktop or laptop. You can also use the app for in-store purchases at just about any retailer.

The Verdict: From my personal experience, I can truly say that the Klarna platform is safe, quick and simple to use. It allows me to fill my cart up with items that I can try before I actually buy while initially paying a fraction of the price. That said, I’ve pretty much become obsessed with using the app to buy purchases when I’m short on cash, unsure about sizing, or just trying to make my purchase price feel a bit more palatable.

Read on to learn more about exactly how Klarna works for consumers, retailers, and the company itself.

Does Klarna Run A Credit Check?

When it comes to a credit check, Klaran’s website notes, “We do not always perform a credit check on you, nevertheless, as a responsible lender, we want to make sure we’re helping our customers make the right financial decisions for their circumstances. When a credit check is performed, we verify your identity using the details you provided and we look at information from your credit report to understand your financial behavior and evaluate your creditworthiness.”

They never perform a credit check during the signup process or when downloading the app. They may perform a soft check when deciding whether to let customers pay in 4 interest-free installments or in 30 days.

Can You Use Klarna In-Store?

Yes, Klarna can be used to make payments in-store. Simply select the retailer, set a spending budget, and view your payment plan. Add the one-time card to your Apple or Google wallet, and tap to pay. That being said, not all retailers accept Klarna, so check with the store before trying to pay with Klarna at the register.

What’s The Catch To Using Klarna?

There is no catch that we’ve found, although you should understand the late fees and non-payment penalties, which we’ve outline below. As an alternative to credit cards, this Buy Now, Pay Later service allows you to shop when you want and pay the balance in four smaller payments over time. The company charges no interest or fees as long as payments are made on time. A tagline on the fintech company’s page reads, “Klarna is the smoothest & safest way to get what you want today and pay over time. No catch. Just Klarna.”

What If I Miss a Payment with Klarna? Does Klarna Charge Late Fees?

Klarna does charge late fees if your payment is not processed on time. Their website reads, “If we are unable to collect a biweekly payment on the scheduled day, we will try again. If the payment is unsuccessful when we retry, a late fee of up to $7.00 and the missed payment will be added to the next scheduled payment.” According to Klarna, “Late fees will never exceed 25% of your order value. To keep you in the loop, we’ll send you an email notification if your payment was unsuccessful.”

What Happens If I Need To Return A Purchase?

Returns are simple with Klarna. All you have to do return the product according to the retailer’s return policy. The process is easy to handle within the app using the “Report a return” feature to pause your payments while the return is in process.

If the retailer offers full refunds, the money for your returned items is immediately credited back to the original payment method. If it’s a partial return or partial refund, the credit will be applied to the remaining balance. If the partial refund was more than the remaining balance, then the amount will be automatically refunded to the original payment method.

For example, if you placed an order for $200 and paid the first installment, then a refund of $75 is issued, the refund will be equally deducted from the upcoming payment installments. This means that the second, third, and fourth installments will be $25 each going forward.

*Remember that all returns are subject to the store’s return policy.

What Stores Accept Klarna?

Thousands of stores accept Klarna both online and in-store. Klarna also allows you to create a “one-time card” that can be used at any online retailer(see below). Here’s a listing of some of the more popular retailers that accept Klarna directly:

Adidas

All Saints

Alternative Airlines

Asos

Bloomingdales

Bose

Brookstone

Canada Goose

Creed

Diesel

Dish

Etsy

Farfetch

Fender

GameStop

Golf-clubs.com

H&M

Hurley

Jetson

JBL

LG

Lockly

Lonovo

Macy’s

Nike

Nokia

Nomad

North Face

Ouai

Overstock

Reebok

Rimowa

Rug Doctor

Sephora

Sonos

Superdry

TaylorMade

Turkish Airlines

Vaio

and More

What Is Klarna’s One-Time Card?

Klarna also has an option that lets you create a “one-time card” that can be used at any online retailer. Their website notes, that the one-time card is a “virtual single-use card to use for shopping at any US-facing online store.” The single-use card can be used just about anywhere. However, Klarna states that they sometimes decline certain transactions to “promote financial wellness and best meet our regulatory, ethical, and risk standards.”

These purchases include payments for:

Bill or rent payments

Food or delivery services

Gift card providers

Governmental agencies

Medical care

Online gaming or gambling

Rideshare services

Subscription services

Selling of drugs or alcohol

How Does Klarna Make Money?

Although it sounds too good to be true, Klarna does not charge interest or fees for its standard Pay in 4 payment options. It makes money from retailers by charging them a transaction fee on your purchase.

More from SPY