Every Question You Might Have About All Those “Buy Now, Pay Later” Programs

Whoops! Your finger slipped and you clicked on some gorgeous Mejuri diamond earrings that are the perfect size—but also $285. Except, wait, right below the price, it says, “Or four installments of $71.25 by Klarna,” and you’re like, Excuse me, what?

“Buy now, pay later” (or BNPL, as the cool kids say) services are becoming more and more popular at checkouts all over your favorite websites. They’re also exactly what they sound like: Services that allow you to break up payments on items in monthly or biweekly installments so you’re not dropping a ton of cash at once. But with ANYTHING financial, there can and will be fine print, so read on below to get into the nitty-gritty.

Q: How does this work?

A bunch of companies—e.g., Klarna, Affirm, AfterPay, QuadPay—offer it. You just sign up for an account, pass a quickie credit check or a “soft” one (the latter doesn’t impact your overall score, and not all companies require a credit check, FYI), then shop for items directly through the BNPL service or through its retail partners’ stores.

If it’s the latter, you’ll see an option to pay in installments when you go to checkout, and you’ll be redirected to the BNPL site. There, you’ll see a breakdown of what your payment plan will look like and be able to set up automatic payments so you know what will be taken out of your account each pay period.

Q: What are the upsides of paying through a BNPL?

Spacing out payments can be a relief to you and your wallet at first, and those companies that run on a biweekly schedule can also line up with when you get paid (if you happen to be on biweekly pay periods, that is). This means you won’t take as much of a hit because it’ll be offset a bit by your paydays.

Basically, think of it as a kind of subscription service, like your Spotify, Netflix, or Birchbox accounts. In the case of BNPLs, though, you pay off the debt in chunks but you’re able to receive/use/wear whatever item you ordered immediately. Another bonus is the special discounts and features certain BNPL apps can offer. Klarna, for example, has price drop notifications and access to exclusive deals and launches, says David Sykes, head of U.S. for the company. It’s also starting a loyalty program soon called Vibe, where shoppers can earn rewards.

Q: Can’t I just use my credit card though?

I mean, yeah, but CCs are kinda the reason these programs exist in the first place. Our generation is terrified of debt, although somehow, most people still opt to do the least re: their credit card bills…as in pay only minimums, not realizing they’ll accrue more debt in the long run thanks to interest. BNPL programs set strict due dates—usually the aforementioned biweekly or monthly installments—so you’re less able to blow off payments. But quick reminder to read what you’re getting into. While CCs have an average national interest rate of around 17 percent, some BNPL plans can charge up to 30 percent—especially if you’re buying something that’s extra pricey.

Q: So I can just ball out and buy everything now?!

Most BNPLs keep you in check with spending caps and warnings. So if you’re late with a payment (it happens!), the company will cut you off until it’s settled. No more damage done. In Klarna’s case, Sykes explains that each purchase is evaluated individually.

“While new shoppers may have a lower spending limit at first, over time the amount they are able to spend may increase as long as the customer demonstrates good spending habits,” Sykes says. But keep in mind that being late at all could have a negative impact on your credit score depending on which company you use.

Q: Sorry, what was that about my credit score?

Some BNPL programs do report to credit bureaus. Meaning: Not being on top of your shit could tank your score. This is important if you want to buy a car or house anytime soon, especially if you’ll need a loan. It’s harder to get approved for one if your credit score is sad, according to SoFi certified financial planner Lauren Anastasio. If you’re smart, though, you can transform this into a benefit. How? Responsible younger folks who need to establish a good credit history can actually use BNPLs to build up their score by paying off everything on time. You reliable adult, you.

Q: How do these companies make $$$?

Late fees and interest. But also: Most of their money comes from charging retailers transaction fees on every BNPL purchase. Basically, they get a cut from each customer’s cart. There’s some crafty ~psychology~ at play here too. They know that shoppers are more likely to buy more stuff if they don’t have to pay full price instantly. More stuff = better business for both the OG seller and the BNPL company. So stores pay them for the promise of impulsive repeat customers who get hooked on getting cool stuff for less money up front. Make sense?

Q: So should I just use this for swanky investment pieces?

Sure, but it also works for smaller purchases too. Anastasio suggests that $100+ purchases for once-in-a-while occasions are best. She admits that even she financed a pricey Gravity Blanket over Black Friday. “It’s okay if it’s uncomfortable to pay for something all up front,” she says, “but buying now and paying later isn’t a habit that you should develop.” It’s easier to keep track of a handful of large payments versus a ton of smaller ones.

Q: What happens if you’re on multiple BNPL programs?

Since every retailer partners with a specific program, you could be tempted to sign up for more than one. Before you do: Think of this like having multiple credit cards. You’ll have to stay very on top of all your accounts to ensure you can still, you know, pay rent. Many BNPLs also use auto-pay settings, which could spell overdrafting if you’re not on top of things (ugh).

However, some services, like Klarna, offer ways to use the payment method for all retailers—not just its partners—by buying and shopping directly through its app. This way, you can avoid signing up for a bunch of BNPLs and potentially losing track of your finances, since all your payment schedules (and even helpful shipping and tracking info!) is all together in one place.

Q: How can I budget for extra purchases through a BNPL program?

You might already know this, but essentially, your money is grouped into essential costs (rent, utilities, loans, transportation, health care, groceries) and discretionary income (anything left over to spend). Sykes suggests to map out your budget and then decide what to do with your discretionary income, whether you’d like to put it aside for savings, to pay off debts, or to use on other things you need or want, be it streaming subscriptions, eating out, or a fancy new pair of running shoes.

Anastasio also recommends the 50-20-30 rule, which means 50 percent of your income should go toward fixed expenses, 20 percent should go into your savings, and then you have 30 percent left over for discretionary spending. Sure, there might be a couple of months when you go over on one of these percentages, but they’re good benchmarks to keep in mind to stay on top of your finances.

Q: Should I just wait and save up, then?

“In a perfect world, I’d want you to ask, Am I willing to save for this?” says Anastasio. But she does stress that no one’s life is meticulously preplanned and it’s impossible to foresee future purchases that come up. So if you need to use a BNPL for a job interview outfit or a luxe Insta-bait bag (right this way, sorry!), go ahead.

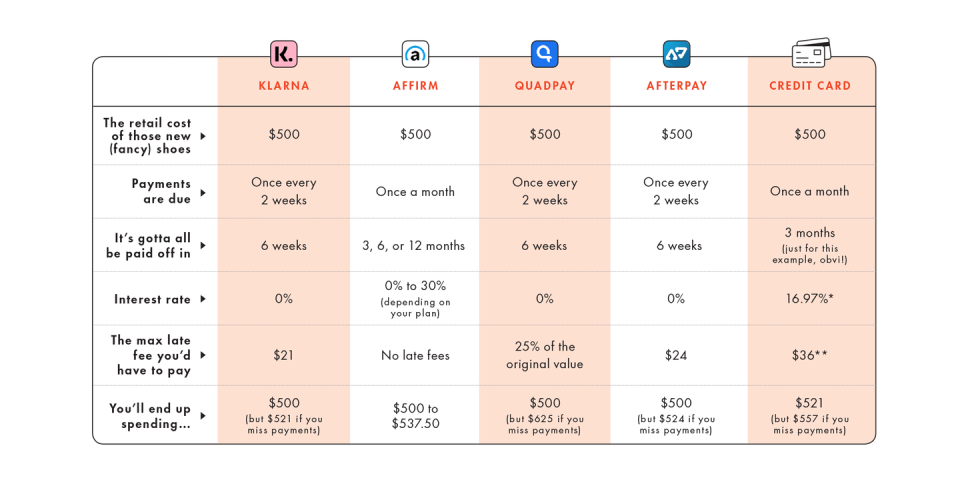

Just one scenario played out across the most popular BNPLs and an old-school CC.

*The average credit-card interest rate from 2019’s third quarter, according to the Federal Reserve.

**The average maximum late fee, according to a 2019 U.S. News consumer credit-card study.

Editor’s note: In the April 2020 issue of Cosmopolitan, we listed Afterpay’s maximum late fee as “25 percent of the original value.” We’ve corrected it here. In the instance of a $500 purchase, the maximum late fee would be $24 if you were late on the last three payments. Afterpay’s late fee caps at $24 or 25 percent of the order value—whichever is lower.

We also listed Klarna’s maximum late fee as $35. We’ve corrected it here to $21. The $35 fee refers to Klarna’s financing product, which is different than “pay in four installments” product. The first payment is taken at checkout, so no late fees can be applied. The three subsequent payments may be subject to a $7 late fee, which comes to a maximum of $21.

You Might Also Like