Enbridge (ENB) Misses on Q4 Earnings, Ups 2023 EBITDA Guidance

Enbridge Inc. ENB recorded fourth-quarter adjusted earnings per share of 46 cents, missing the Zacks Consensus Estimate of 56 cents. The bottom line also declined from the year-ago quarter’s 54 cents.

Total quarterly revenues of $9,888 million declined from $9,893 million in the prior-year quarter.

The weak quarterly results were primarily driven by lower contributions from the Renewable Power Generation segment.

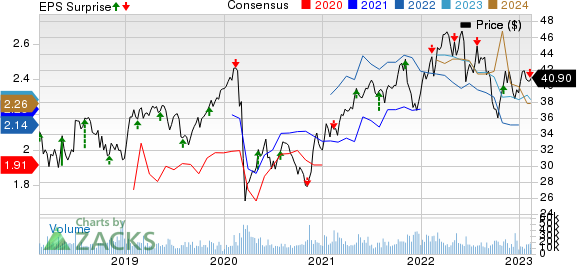

Enbridge Inc Price, Consensus and EPS Surprise

Enbridge Inc price-consensus-eps-surprise-chart | Enbridge Inc Quote

Segmental Analysis

Enbridge conducts business through five segments — Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services.

Liquids Pipelines: The segment’s adjusted earnings before interest, income taxes, and depreciation and amortization (EBITDA) totaled C$2,327 million, up from C$2,108 million in the year-earlier quarter. Higher contributions from Mainline System, Gulf Coast and Mid-Continent System primarily aided the segment.

Gas Transmission and Midstream: The segment’s adjusted earnings totaled C$1,117 million, up from C$922 million recorded in fourth-quarter 2021. Higher contributions from the U.S. Gas Transmission primarily aided the segment’s performance.

Gas Distribution and Storage: The unit generated a profit of C$467 million, up from C$450 million in the prior-year quarter due to increased contributions from Enbridge Gas Inc.

Renewable Power Generation: The segment recorded earnings of C$122 million, down from C$140 million in the prior-year quarter primarily due to lower North America wind production and higher operating expenses.

Energy Services: The segment incurred a loss of C$62 million, narrower than a loss of C$83 million recorded in the fourth quarter of 2021.

Distributable Cash Flow (DCF)

In fourth-quarter 2022, Enbridge reported a DCF of C$2,663 million, representing an increase from C$2,487 million a year ago.

Balance Sheet

At the end of fourth-quarter 2022, Enbridge reported long-term debt of C$72,939 million. It had cash and cash equivalents of C$861 million. The current portion of long-term debt was C$6,045 million. ENB’s long-term debt to capitalization was 54.9% at the end of the fourth quarter.

Guidance

For 2023, Enbridge projected EBITDA of C$15.9-C$16.5 billion, indicating an increase from C$12 billion reported in 2022. The company expects DCF per share of C$5.25-C$5.65 for the year, the mid-point of which suggests an increase from C$5.42 reported in 2022.

Enbridge sanctioned C$8 billion of organic growth projects in 2022, bringing its total backlog to C$18 billion.

Zacks Rank & Stocks to Consider

Enbridge currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Marathon Petroleum Corporation’s MPC adjusted earnings per share of $6.65 comfortably beat the Zacks Consensus Estimate of $5.54. The bottom line was favorably impacted by the stronger-than-expected performance of its key Refining & Marketing segment.

In the fourth quarter, MPC repurchased $1.8 billion of shares and further $700 million worth of shares from the start of this year till Jan 27. Marathon Petroleum, which gave an additional $5-billion share repurchase approval, currently has a remaining authorization of $7.6 billion.

Halliburton Company’s HAL fourth-quarter 2022 adjusted net income per share of 72 cents surpassed the Zacks Consensus Estimate of 67 cents. The outperformance reflects stronger-than-expected profit from both its divisions.

In more good news for investors, Halliburton raised its quarterly dividend by 33.3% to 16 cents per share (or 64 cents per share annualized).

Valero Energy Corporation’s VLO fourth-quarter 2022 adjusted earnings of $8.45 per share beat the Zacks Consensus Estimate of $7.45 per share. The strong quarterly results were driven by increased refinery throughput volumes and a higher refining margin.

Valero can benefit from the Gulf Coast export volumes, as fuel demand recovery gets support from Asia economies. The Gulf Coast contributed 59.4% to the total throughput volume in the fourth quarter of 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Enbridge Inc (ENB) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report