‘Dumb Money’ Is Based on a True Story of Viral Revolution

- Oops!Something went wrong.Please try again later.

"Hearst Magazines and Yahoo may earn commission or revenue on some items through these links."

THE GAMESTOP STOCK story is almost too good to be true—and yet, it is. In case you were living under a rock during the middle of the pandemic, there was a group of day traders who took on Wall Street—and won. Basically, a group of hedge fund managers were looking to short GameStop, betting on the company to fail. Instead, these day traders pump up the value of the stock, causing Wall Street to take a massive loss. Sounds like something you’d see in a movie, right? Well, now you can.

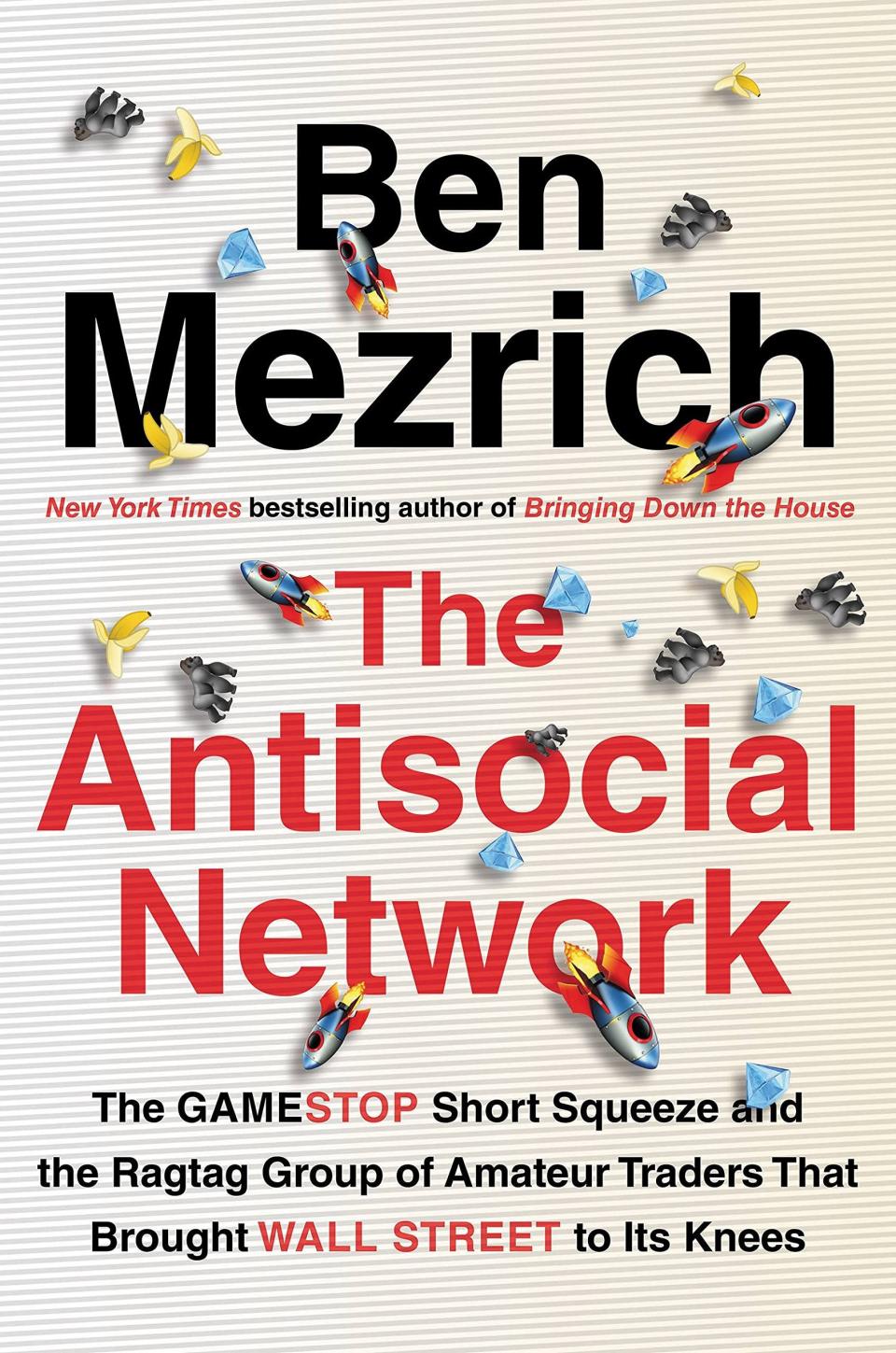

Dumb Money is based on the book by Ben Mezrich, The Antisocial Network, and charts the larger-than-life true tale of what happened back in early 2021 as a sort of David versus Goliath battle that exposed the ways in which systems are rigged against the populous. The fallout from the saga is still unfolding in many ways, but it’s never a bad time to make a compelling movie about such a deep subject.

With that in mind, you may watch the movie and have questions about some real-life people behind the actors and where they are now. If you do have those queries, well, we have answers—and decided to dive into where each of the main characters from the film are now.

The Antisocial Network: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees

amazon.com

$13.49

Keith Gill

While Dumb Money is a bit of an ensemble piece, the de facto lead is unequivocally Paul Dano’s Keith Gill. A middle-class, 34-year-old dude with a wife and young child, Gill once worked as a financial analyst at the life insurance firm MassMutual before resigning in January 2021—which just so happened to align with the peak of the short squeeze. Like in the film, Gill uploaded his takes on the stock to a YouTube channel as the user “Roaring Kitty.” He also cross-posted these videos to the r/WallStreetBets subreddit—cat t-shirts and headbands included.

It was on this subreddit in 2020 where Gill initially stated his significant stake in GameStop (~$50,000 of his life savings), where he laid out his claims that Wall Street hedge fund managers overly shorted the company. He believed that by holding the line, he could send the stock upward. Ergo, the now meme’d to death, “to the moon” ideology.

Gill eventually was called to testify about his involvement in front of Congress in February 2021, where he stated he acted of his own accord. “I did not solicit anyone to buy or sell the stock for my own profit,” he declared. The last video he uploaded to YouTube (titled Cheers everyone!) was on April 16, 2021. He posted on his Twitter X account in June 2021, but has seemingly retreated from the online world since.

— Roaring Kitty (@TheRoaringKitty) June 19, 2021

It’s unknown how much money he ultimately made off the stock situation. Estimates did have his investments reaching around $48 million in value at its peak, according to reports.

Gabe Plotkin

As played by Seth Rogen, Gabe Plotkin is the CEO who took a major wash in the whole situation. His firm, Melvin Capital, shorts GameStop and loses 53%, which equates to roughly $6.8 billion. At one point, Melvin was losing over a billion a day. Plotkin shut down Melvin Capital in June of 2022, returning the cash to its investors. However, Plotkin still has enough wealth and, ahem, capital to continue operating: he founded Tallwoods Capital LLC, “a private single-family office founded in 2022 that manages the personal wealth of Gabe Plotkin and his estate. Headquartered in Miami Beach, Florida, Tallwoods invests in multiple asset classes, including public equity, private equity, and real estate.”

In 2019, Plotkin purchased a minority stake in the Charlotte Hornets before working with Rick Schnall to purchase the team from the majority owner—a former NBA star who you might know: Michael Jordan. As it stands now, Plotkin is the team’s co-chairman.

Kenneth Griffin

Kenneth Griffin, portrayed by Nick Offerman, is another major figure—especially to Plotkin. His own hedge fund, Citadel, ended up providing a $2 billion bailout to Melvin Capital. Forbes currently lists his net worth at a staggering $34.3 billion. Normally, with that amount of money, you'd think he wouldn’t care about how he’s shown in a movie, but that’s not the case; Puck reported that he’s got a “nasty behind-the-scenes legal fight over his depiction” and “has hired at least two separate law firms to send Sony Pictures threatening letters.” Griffin walked that back in an interview with CNBC where he stated he wasn’t moving forward, declaring, “...I have other things to do with my life” before stating he wished Daniel Craig was in the role instead.

Steve Cohen

Steve Cohen, played by Vincent D’Onofrio, extends a life line to Melvin in the form of $750 million from his own hedge fund, Point72, to help during the surge. Fun fact: This isn’t the first time Cohen’s had a hand in a pop culture event—the man himself is the loose inspiration for Billions lead, Bobby Axelrod (Damian Lewis).

Once upon a time, Cohen’s former company, S.A.C. Capital Advistors, pled guilty to insider trading, having to pay a $1.8 billion fine and was prohibited from managing money for two years. He’s now the current owner of the New York Mets—a little purchase he made for himself during the peak of COVID.

Vlad Tenev and Baiju Bhatt

Played, respectively, by Sebastian Stan and Rushi Kota, Vlad Tenev and Baiju Bhatt are the co-founders of the day trading application, Robinhood, which was the primary platform r/WallStreetBets users leveraged to buy and sell GameStop stock. Despite having a “power to the people” ethos and mission, their clearing broker company, Robinhood Securities, decided to stop users from trading the stock. The freeze was viewed by many as a way of kowtowing to the hedge fund managers and Wall Street. During testimony, Tenev stated the freeze decision came from a need to meet federal clearinghouse deposit standards and nothing else. Both are no longer listed as billionaires by Forbes.

Other vital Dumb Money True Story Bits

Dumb Money does also feature a number of other investor characters as a way of highlighting the impact on everyday people. Riri and Harmony (Myha’la Herrold—who also stars in Industry, HBO’s financial drama which featured an episode about this very tale—and Talia Ryder) are composite characters to provide another perspective on how the saga played a role the lives of all kinds of people.

America Ferrera’s Jennifer Campbell is based on a real-life, single mother RN named Kim Campbell. In Mezrich’s book, it's stated that Campbell saw her shares get as high as $50,000 before the freefall, before ending her tale on an ambiguous note about whether or not she’d actually sell.

Anthony Ramos’ Marcus isn’t based on a real person, but provides a decidedly interesting perspective as a GameStop employee who begins investing and then cuts bait when he makes some money.

Oh, and then there’s Pete Davidson as Keith’s brother, Kevin. The real-life version of Kevin took to Instagram prior to the film’s release to humorously debunk Davidson’s portrayal of him, including that he hates weed and works “7 days a week,” before jokingly stating, “Wow...can’t wait to see the movie.”

You Might Also Like