Dry-ish January Is Here

Going dry this January doesn’t have to mean totally sober.

With an increased awareness around the negative effects of alcohol — hangovers, anxiety and reduced brain volume, according to brain disorder specialist Dr. Daniel Amen — a new approach called “California sober” is gaining traction. It’s a mostly dry lifestyle supplemented by other substances, notably cannabis, and first took off in California, hence the name. To meet the demand, a crop of new low-dose THC products, including drinks and snackable gummies, are hitting the market, alongside a more curated, recipe-centric approach to cannabis.

More from WWD

“There’s suddenly a lot of alternatives at a moment when consumers en masse are starting to recalibrate their approach to alcohol,” said Lucie Greene, futurist and founder of firm Light Years.

While data from market research firm Circana shows that dollar sales for certain alcoholic beverages like beer are up, there is also a decline in other categories like wine. Furthermore, within the beer and wine categories, nonalcoholic versions are posting the strongest growth, experiencing a 28.7 percent and 38 percent increase in year-over-year dollar sales respectively over the latest 52-week period.

“Alcohol consumption has been relatively flat for the general population,” said Cara Piotrowski, client insights consultant at Circana.

The sober-curious movement started with the adoption of nonalcoholic beverages like Ghia and Kin Euphorics, which are infused with botanical extracts, adaptogens and nootropics. While these products provide wellness benefits, consumers are seeking something a bit stronger to take the edge off. With changes in regulations, cannabis seems to be the answer.

Currently, marijuana is completely legal in 25 states, with many others having decriminalized the drug, approved it for medicinal use or allowed CBD oils formulated with THC. Additionally, the 2018 Farm Bill removed hemp from the definition of marijuana, meaning many hemp-derived THC formulas — those with a THC concentration at or below .03 percent dry weight/volume — can be sold and shipped nationwide. With this, dispensaries are seeing a shift in consumption.

“We’re seeing an uptick in sales, people wanting to actually feel good the next day,” said Geraldine Hessler, vice president of marketing at New York City dispensary Gotham. “Up until now the only legal choice has been alcohol and now people have options.”

While experts agree consumers are reconsidering alcohol consumption across the board, one generation is leading the charge when it comes to the California sober lifestyle: Gen Z.

“[There’s] a big generational shift away from alcohol compared to older generations with Gen Zs,” Greene said, adding that this cohort is focused particularly on the deleterious impact of alcohol on mental health.

A report from Berenberg Research shows that Gen Zs drink 20 percent less than their Millennial counterparts did at the same age. GenZ content creator and podcast host Kate Glavan is one such example. She began experimenting with weed following a stress fracture she experienced in the midst of marathon training. While it helped with pain and quickly became part of her daily running routine following her injury, it also became a means for being social, as she doesn’t drink.

“A lot of the reason I was sober is because I [went] to NYU,” she said, explaining that she felt nervous being under the influence of alcohol in New York City.

Now, Glavan, 25, has found her groove with weed, using it on nearly all of her runs and socially.

“If I do go out maybe I’ll take an edible or something like that,” she said. On social media, Glavan has shared some of her favorite THC brands, including Cann, Rose Los Angeles and Offfield.

“A lot of my friends are on the same wavelength,” she said. “They maybe don’t drink or maybe they’re curious about weed or they want to try that versus alcohol the whole night.”

However, it’s no secret that alcohol and weed aren’t entirely comparable. Having a few martinis may not be the same as hitting a joint or eating an ultra-potent edible, but an array of brands are aiming to bridge the gap by shifting toward low-dosed products and drinks.

For example, Cann, which describes itself as a “cannabis-infused social tonic,” has created a drink that fits into social settings the same way alcohol does.

“[A lot of people] want to close down the dance floor, but they don’t want to feel horrible the next day and that’s a common experience,” said Cann cofounder Jake Bullock. “But because alcohol is so ingrained in our social culture, in everything we do, it’s really hard.”

With this in mind, the Cann team created low-dose beverages, with between 2 and 5 milligrams of THC, so people can sip on them the same way they might a beer or glass of wine. Bullock credited the brand’s success to positioning it as an alcohol alternative in social settings, and said more than 9 million units will be sold this year. Prices range from $25 to $211. Distribution-wise, in more restrictive states, the brand is only available in dispensaries but in some states, like Minnesota and Connecticut, Cann can be found in liquor stores, bars and restaurants.

According to Hessler, beverages have become a significant category that customers are embracing more and more, especially during Dry January.

“In New York state we’re seeing 5 to 6 percent of category sales coming from beverages specifically,” said Eddie Brennan, chief executive officer of New York-based cannabis brand Ayrloom, which produces edibles, tinctures, balms and gummies in addition to beverages and is available in dispensaries.

Other companies are also betting on between 2 and 5 milligrams of THC, including Sweedies, which launched in October with Mood Rings, $36, a bag of fruit snack-style gummies. Currently, the brand is only available in dispensaries, though it will ship nationwide in early March with its new, entirely hemp-derived formula.

“The goal was snackability, making it actually feel like a treat replacement,” said cofounder Olivia Sheehan, adding many customers use it as a wine alternative. “It’s a great going-out tool or shareable party moment.”

Founders agree consumers appreciate these low-dose options, as it’s easier to get a light buzz similar to sipping alcohol and it’s less intimidating.

“Everything we are producing is towards a light-to-medium tolerance,” said Nathan Cozzolino, cofounder of edible brand Rose Los Angeles. “Everybody has an edible nightmare story. We wanted to reprogram that thinking.”

Rose Los Angeles, which is available direct-to-consumer nationwide and at select dispensaries, is taking a farm-to-gummy approach to differentiate itself. It builds its yearly lineup around California’s seasonal produce, partnering with local farmers and chefs to create unique recipes like Plum Miso Caramel, $45, created in collaboration with bakery Acid Bakehouse. Cozzolino said the brand typically does between eight and 10 collabs a year. This flavor-first approach helps further postition cannabis in line with alcohol, as it has a similar nature to a craft cocktail.

In the midst of dry January, founders are considering the California sober trend more and more. For Rose Los Angeles, it came in the form of a campaign comparing the price of alcohol to cannabis per social session. For Cann, it’s meme-like posts about partaking in Dry January.

Many believe bars and restaurants are eyeing the trend for the future. As it’s becoming more common to see a phony Negroni or a Kin Euphorics spritz on a menu, cannabis-infused drinks could be next.

“Some states… [have] clear regulations around this and bars and restaurants have gotten comfortable putting these products on the menu. Usually they’re capped [by THC concentration],” Bullock said.

Cann is currently available at several restaurants and bars in Connecticut, including Kawa Ni, Don Memo

and The Whelk.

Experts predict innovation and conversations will expand far beyond January and new year’s resolutions.

“As more and more people experience alternative ways of consuming other than smoking and realize there are a lot more options, it is going to expand and it will grow with the customer,” said Hessler, adding that half of Gotham’s daily customers are first-timers.

High Lights

A look at THC-infused products for a California sober approach.

Ayrloom Unflavored Beverage Enhancer, $65

Although Ayrloom has drinks, gummies, vapes and balms, its Unflavored Beverage Enhancer allows users to infuse their chosen drink with a customized amount of THC.

Cann The Starter Pack, $72

Cann’s social tonics, infused with 1 to 5 milligrams of THC and 4 to 15 milligrams of CBD, provide a buzz and function similar to that of alcohol for those going California sober.

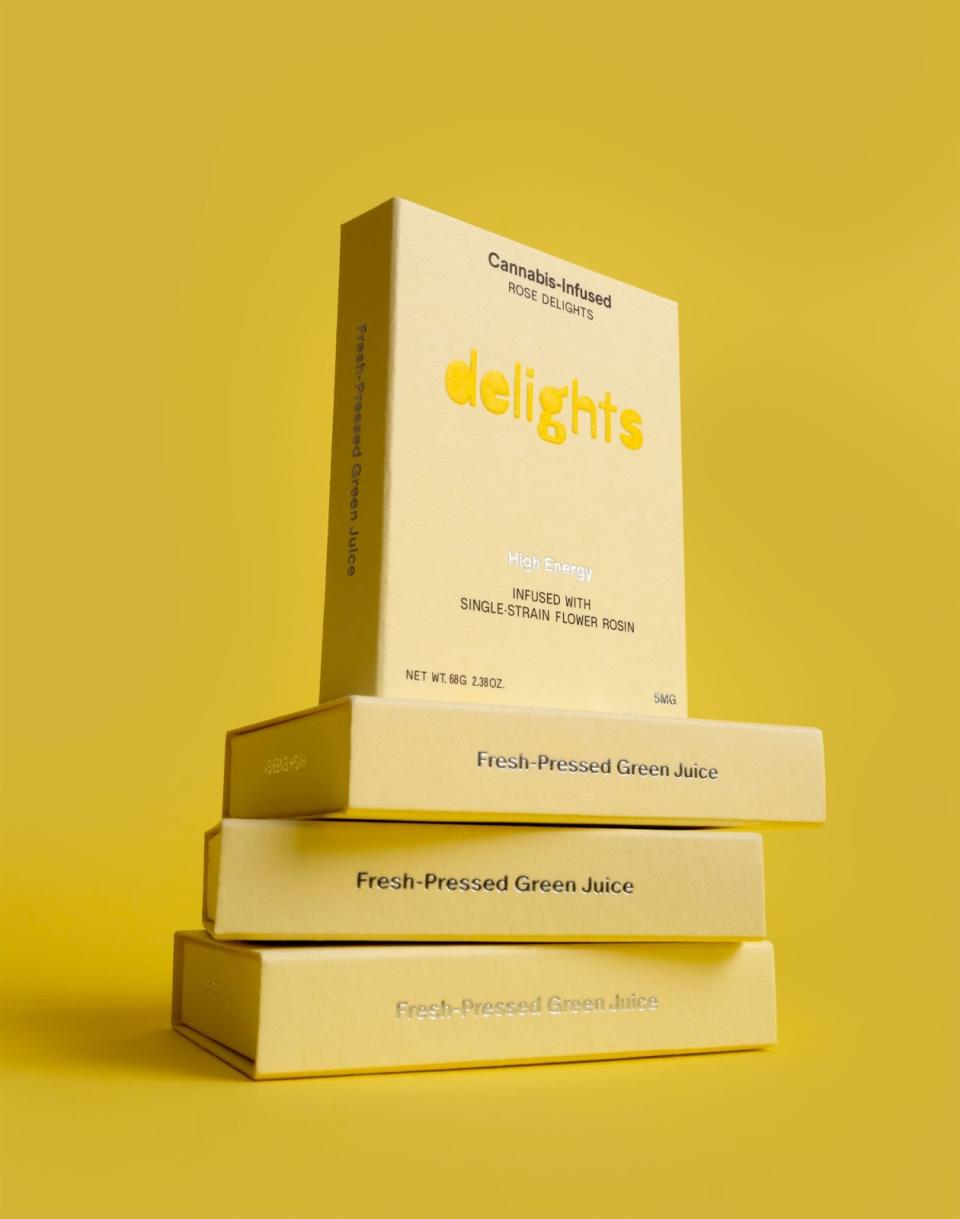

Rose Los Angeles High Energy Rose Delights, $40

Rose Los Angeles has taken a fresh approach to the category by partnering with farmers and chefs to create seasonal products, as well as popular mainstays like its High Energy Rose Delights.

Sweedies Mood Rings, $36

Sweedies Mood Rings are referred to as “fruit snacks for adults.” Each bag comes with 10 snackable gummies that have 5 milligrams of THC and 5 milligrams of CBD total.

Nowadays Low Dose Cannabis Infused Beverage, $60

Nowadays may look like a typical spirit, but instead it’s a cannabis-infused mixer. This version features 6 milligrams of THC per dose, though the brand also offers a 2 milligram option.