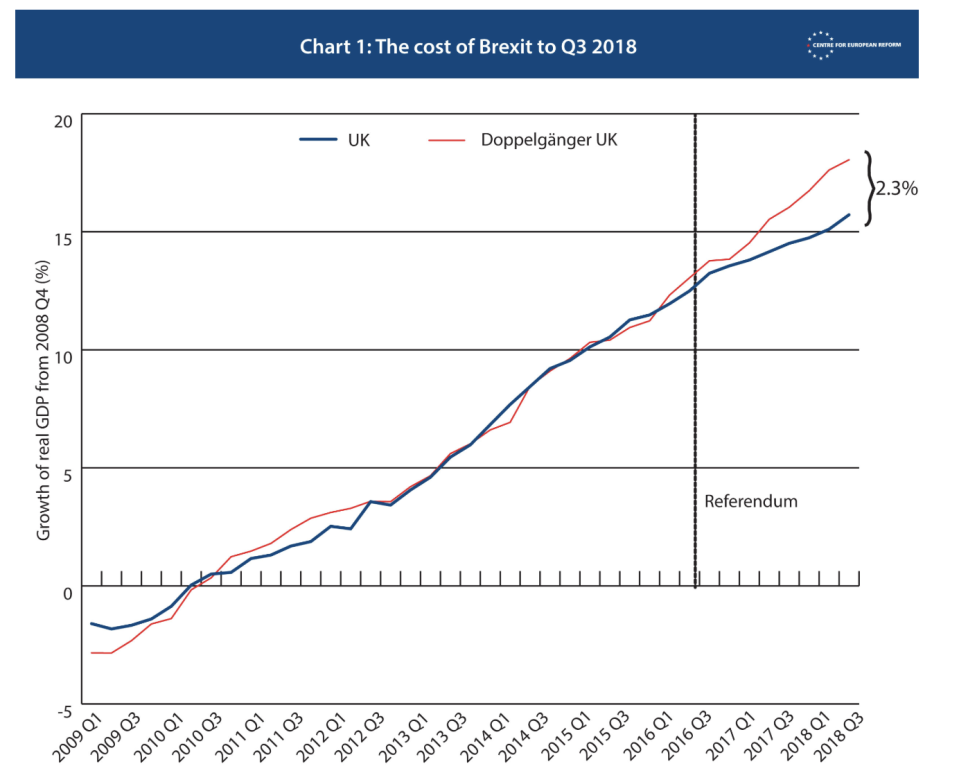

'Doppelgänger UK' shows Britain's economy is 2.3% smaller because of Brexit

Britain voted to leave the European Union over two years ago and on 29 March this year, it will sever ties for good. While Brexit hasn’t technically happened, it has caused the economy to be 2.3% smaller than if Brits had voted to remain in the EU.

That’s according to the major thinktank Centre for European Reform’s (CER) calculation of the cost of Brexit by the third quarter of 2018. To obtain the findings, the CER used a “doppelgänger UK” — “a group of countries whose economic characteristics match Britain’s.”

CER says it used a computer program of a group of 22 countries with advanced economies. Those countries included US (whose growth rate makes up 50% of that of the UK doppelgänger), Germany (28%), Luxembourg (11%), Iceland (10%) and Greece (2%). Those 22 countries are also labelled by the International Monetary Fund (IMF) as fully industrialised from 1995, “to remove any countries that are experiencing faster rates of catch-up growth,” said CER.

It looked at quarterly real GDP and other economic indicators, going back to the first quarter of 2009.

“The structure of each country’s economy — and their growth rates — are different to those of the UK. But in combination, they closely match the UK’s economic performance before the referendum,” said the CER.

It added that those countries did not hold a EU referendum in 2016 and coupled with its similar characteristics by comparing those countries’ economic performances to Britain’s, it was able to assess the cost of Brexit.

The findings also showed that “the knock-on hit to the public finances is £17bn ($22.4bn) per annum — or £320m a week.” More calculations can be found here.

“One way to sanity-check our estimate is to compare the UK’s growth to that of other comparable countries since the referendum. The UK has grown by 3.7% over that period. Compare that to the average of the 22 most advanced economies: 5.6%,” said the CER. “That amounts to a 1.9% gap, not far from our estimate of the cost of Brexit.”

How business investment and jobs growth has been hit by Brexit

The CER’s report falls in line with what data and the world’s biggest leaders have been saying for the last two years. While Brexit hasn’t happened yet, many huge companies have put their business investment and job growth on pause until Brexit happens.

Last month, UK business investment suffered its biggest fall in three years due to Brexit uncertainty. The IMF also said in November that the Brexit process has affected business investment in the UK. Britain’s biggest business lobby group CBI, representing 190,000 firms, also released a study showing that 80% of companies say that Brexit has hit investment. And in September, the Office for National Statistics (ONS) revealed that businesses have invested £22bn less in the last two and a half years because of Brexit uncertainty.

Goldman Sachs CEO David Solomon said recently that the bank will not invest in Britain as much if there is a hard Brexit. He also said: “Our headcount in the UK over the last couple of years has not gone down but it hasn’t gone up either – we have added head count you know on the continent. But I would say that, over time, if this is resolved in a difficult way or a hard way, it’ll have an impact on where we invest and where we put people.”

This supports the latest data by Morgan McKinley’s Employment Monitor that said uncertainty over how Brexit will play out is continuing to hurt London’s financial sector jobs. Looking at data from December, jobs in the City dropped to a seven year low.

Month-on-month, there was a 52% decrease in jobs available as well as a 29% decline in professionals seeking jobs. Hakan Enver, managing director, Morgan McKinley UK pointed out that in 2018 “we saw job numbers fall off a cliff.” Year-on-year, there was a 39% decrease in jobs available and a 29% decrease in professionals seeking jobs.

And in a long line of businesses now abandoning Britain, Sony announced recently that it’s moving its European headquarters from the UK to the Netherlands to avoid disruptions caused by Brexit.

Airbus CEO Tom Enders also released a video to the public saying: “Please don’t listen to the Brexiteers’ madness which asserts that, because we have huge plants here, we will not move and we will always be here. They are wrong … If there’s a no-deal Brexit, we at Airbus will have to make potentially very harmful decisions for the UK.”