A Decade In, ThredUp Spots These Resale Trends to Watch

What can a decade of resale reporting tell us? The answer, according to resale marketplace ThredUp, is multifaceted, but one thing is certain: resale just keeps on growing.

Releasing its 10th annual resale report Tuesday, which started a domino effect amongst the resale market, ThredUp said resale saw its greatest year yet, growing 58 percent in 2021 in the U.S., from $27 billion to $35 billion. In 2021, 244 million consumers, broadly, said they shopped or are open to shopping secondhand. The report leverages data from GlobalData retail, which included a survey of some 3,500 U.S. consumers.

More from WWD

ThredUp said all these secondhand scores helped to displace 1 billion new clothing purchases last year. (ThredUp alone accepts about 60 percent of what it’s sent and has processed 125 million items to date).

Resale enthusiasm aside, the report emphasized the growing moral disconnect Gen Zers have with their clothing. While 74 percent of fast-fashion shoppers believe their consumption style has a “significant impact” on the planet, still 72 percent of them admitted to shopping fast fashion because it’s a good value. That same portion also consider themselves “thrifters.”

ThredUp president Anthony Marino described the theme as a “collision course” that fast fashion and younger consumers are on.

“What comes through in the data is there is a cry for help in being addicted to this product [fast fashion],” he told WWD. “It’s really what’s powering the growth of resale among younger shoppers.”

That fast-fashion addiction may prove a temptation amid financial constraints, yet the report still says shopping categories like fast fashion and rental will flatten amid resale’s ongoing rise.

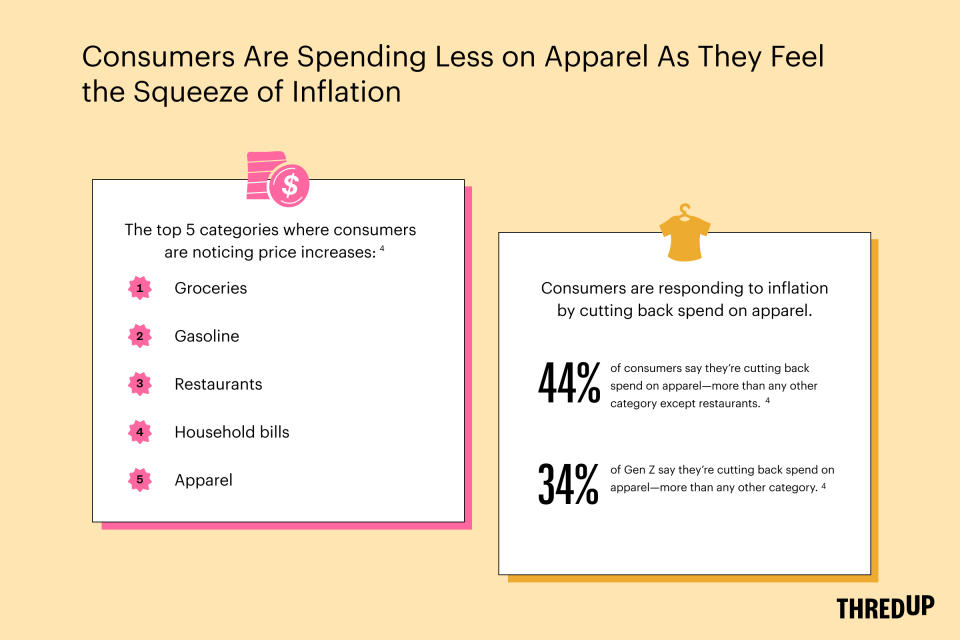

Taking that a step further with the state of the economy, some 58 percent of consumers say secondhand is helping to ease the strain of inflation, since price consciousness is still the leading factor for shopping — used or otherwise.

Courtesy ThredUp

Earlier this month, the company reported its annual earnings. While ThredUp increased its top-line revenues, the company wasn’t profitable — even with revenues up 31 percent to $72.6 million.

With the broader resale picture poised to be worth $218 billion by 2026, there’s much left to conquer. ThredUp is investing further in technology, including search, merchandising and an ever-evolving assortment. The company will also open its biggest distribution center yet in Texas this year.

Another core insight in the report is how brands are still elbowing into the resale space at a growth rate of 275 percent for all branded resale programs. In 2021, there were some 30 Resale-as-a-Service (Raas) partners enlisted with ThredUp, (not to mention the other resale players in the mix like Trove, Archive and Recurate). But Marino said there’s more in store as brand-owned resale continues to grow.

“It’s early in that wave,” he said. “There’s been such acceleration in the number of brands taking on circularity take-back programs, resale shops. I think we’re seeing more interest than ever because they want to answer one question: what should my brand resale strategy be?”

He added that “Our resale partners are generating profit from Day One,” signaling to a recent report produced by ThredUp called the “Recommerce 100” showcasing which brands are participating in resale. “We hope it encourages brands to experiment and be thoughtful but be ambitious.”

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.