A Critical Take on BNPL, an Insider’s View

Nandan Sheth, chief executive officer of Splitit, believes the burgeoning buy now, pay later industry is on the verge of “seismic change.”

According to Sheth, Apple’s entry into the BNPL arena further crowds a field that already has big players including Klarna, Afterpay, PayPal and Affirm, and fuels competition over a shrinking customer base. In addition, write-offs are mounting as consumers flock to BNPL services to stretch their dollars amid high inflation, and government regulators are putting BNPL models “under a magnifying glass.”

More from WWD

Sheth, an experienced fintech and payments industry executive having worked at FiServe, First Data, American Express and Harbor Payments, last February became CEO of the 10-year-old Splitit, which enables shoppers to use their credit cards to pay in installments. The publicly held Splitit generated $11.1 million in revenues last year, $396 million in merchants’ sales volume and is currently not profitable.

“I come from the world of financial technology payments where I saw at very large retailers driven by belief that adding installments would drive new sales and new customers, but in reality I started to see some issues with the existing model and the issues were in some cases so profound that the program wasn’t necessarily good for the retailer,” Sheth told WWD in an interview.

“The fundamental reason why traditional BNPL is less than attractive for retailers is they use the merchant as a consumer acquisition channel. So if I’m shopping a retailer and want to use BNPL installments, I enroll and register and by doing that I am actually becoming a customer of the BNPL provider, whether it’s Klarna, Affirm or Afterpay. Once I register with Klarna or Affirm, they will give me installments for that retail transaction, but over time, [they] will market other brands and other offers to me as the consumer, which completely dilutes all the time and effort the retailer has spent to drive loyalty with that consumer. They look at your purchasing history and will send you a coupon from another brand. They have what I call ‘super apps.'”

In the following Q&A, Sheth makes the case for Splitit representing an alternative, “disruptive” BNPL solution, and one that provides less friction for consumers.

WWD: What makes Splitit distinct in the BNPL arena?

Nandan Sheth: We are the only installment provider that gives the retailer an alternative to these programs. We are not a payment brand. We are 100 percent embedded into the retailer’s checkout. There is no brand. There is no Splitit to click on. We automatically, on a white label basis, provide installments for the consumer. We do not sign up the consumer. They do not need an account with us. We do not need to underwrite the consumer in real time. The consumer maintains their relationship with the retailer. We are nothing more than a technology layer that empowers installments. It’s radically different as a business model. The premise and mission of our company is to enable growth for retailers. We are not built to become an advertising app, or a super app. We don’t do any marketing. We don’t harvest any data. We are a b-to-b company. Not a b-to-c company.

These BNPL providers originate a brand new loan every time you sign up for an installment. Every installment purchase you do turns into a loan. The problem with that is if you make 15 purchases a year using an installment provider, you could have 15 entries on your credit report and a credit score [deterring] other providers from granting you a loan. You build this loan portfolio that gets you into trouble. The moment you’re late paying, fees are assessed, and over a period of time, you get a heavy duty interest rate assessed, like 18 percent, on average.

WWD: So how does Splitit work?

N.S.: Because we are not generating a new loan and instead using existing credit available on your credit card, we don’t get consumers into trouble, and for the merchant, our conversion rates are five to six times better than other BNPL providers that underwrite these consumers on the fly. With Splitit, there are no fees to the consumer. There is never any interest. We never charge the consumer a penny. The consumer doesn’t have new loans to worry about. With our share of checkout, meaning the percentage of sales that go through our solution, our platform, is around 15 to 35 percent (depending) on the merchant, which is significantly higher than the other BNPLs.

WWD: You say that Splitit involves less friction for the consumer. How so?

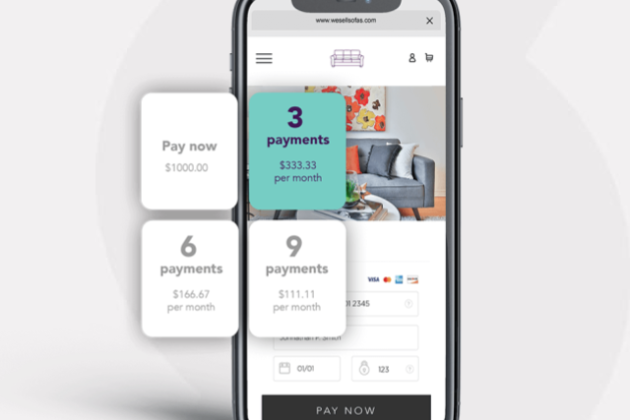

N.S.: With other BNPL services, there is a multistep account setup process. With Splitit, you are not applying. There is no entering your social security number, your address, etc. You just enter your card number with a first purchase and click to choose how many installments you want for the purchase you have chosen. With a second purchase, the card is already on file with that retailer so you don’t even have to put in your card number. Splitit gives you a summary, indicating how many installments for the purchase you have chosen, and a summary of your payments to date. Also, with us you get double the time to pay. If you choose to pay in three, it’s pay in three months. With others, it’s six weeks.

WWD: Why has BNPL taken off?

N.S.: The primary reason is that consumers are attracted to a 0 percent installment program for certain types of purchases and it’s become easier and easer. You are going to see consumers use installments for purchases of $50, $100, $150, $200. It’s easier than applying for unsecured credit, and with us it’s interest free, and having no application makes it even easier.…The reality is with consumers, some of it is based on need; some of it is over-stretching to make purchases they can’t afford. Unfortunately that is the reality. Some of it is based on people spending outside their means and there are other segments that don’t have access to credit.

WWD: With Splitit, what happens if people just don’t pay?

N.S.: We take 100 percent of the risk. The retailer bears no risk.

WWD: Doesn’t knowing the credit line of the customer reduce your risk?

N.S.: You are absolutely right. Our default rate is among the lowest in the industry because we tap into existing credit. Our default rate is between seven and 10 basis points, which is much lower than others.

WWD: What other challenges do BNPL companies have?

N.S.: With the legacy BNPL business model, it’s very hard to [reach] profitability. Number one, there are write-offs when consumers don’t pay and the BNPLs can’t collect, anywhere between 2 or 4 percent. Those charge offs are unsustainable to having a profitable business. Number two, they’ve got high marketing costs to acquire consumers. This is not me talking. If you do research, you see it everywhere. You see valuations going down. Secondly, retailers are realizing BNPL providers are acquiring consumers from their channel, and then those consumers become customers of the BNPL platform which earns all the lifetime value for that customer.

WWD: Doesn’t Splitit have marketing costs?

N.S.: Sure, we have a little bit of marketing costs. I am trying to market to Louis Vuitton and Target. My marketing is b-to-b. Anyone with a credit card can use my product. I don’t need to acquire consumers so we have zero consumer marketing costs.

WWD: Are you worried the industry is coming under increasing regulatory scrutiny?

N.S.: I encourage it. The Consumer Financial Protection Bureau looking into this is a very good idea. In some cases, the industry is not promoting responsible purchasing behavior, and acting in somewhat predatory lending practices. With us, it’s very different. The CFPB talks to us. They assess that we are not originating new credit so there is no regulation needed for us. Frankly, if they wanted to regulate us in some capacity, we would be open to it because we want this to be a safe experience for consumers. The industry should be regulated. However, with the Splitit model, we are already regulated by credit card rules.

WWD: How does Splitit make money?

N.S.: We charge the retailer a fee per transactional play. That’s the only way we make money right now. Depending on the duration of the plan, whether it’s three, six, nine, 12 or 24 months, the range is anywhere between 65 basis points to over 2 percent. The differences are driven by the duration of the plan. If it’s a pay in 12, it’s typically a little bit more expensive than a pay in three because we have more cost of capital.

WWD: How has inflation impacted your business?

N.S.: As prices go up and consumers need to buy the same products, we have seen growth in our portfolio at the lower ticket level. Before, anything below $250 we had very little growth, but we did really well with transactions over $250. Now, transactions lower than $250 are also growing, which tells you consumers are using installments for different products and services than they were in the past.

WWD: Isn’t BNPL really an evolution of those lay-a-way plans of the ’60s?

N.S.: BNPL is not new. The difference is in those days, when you walked into a Kmart, it was a Kmart layaway fund. It wasn’t a Klarna layaway plan. We believe that giving the control back to the merchant and having them call the installment plan, the Home Depot installment plan or the Louis Vuitton installment plan, is absolutely the way to go because it builds trust between the consumer and the merchant. We want to be the intel inside. We don’t want to be identified. If merchants say, “powered by Splitit,” no problem. But we don’t want to be a brand that, frankly, gets in the middle of the consumer and the merchant. My job is be an enabler — an invisible enabler actually.

WWD: Is BNPL getting like the streaming service industry, where there are so many choices?

N.S.: It’s cluttered. It’s confusing. There is a lot of friction. The more payment brands added to the checkout, the more confusion it creates, which is exactly why we are invisible.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.