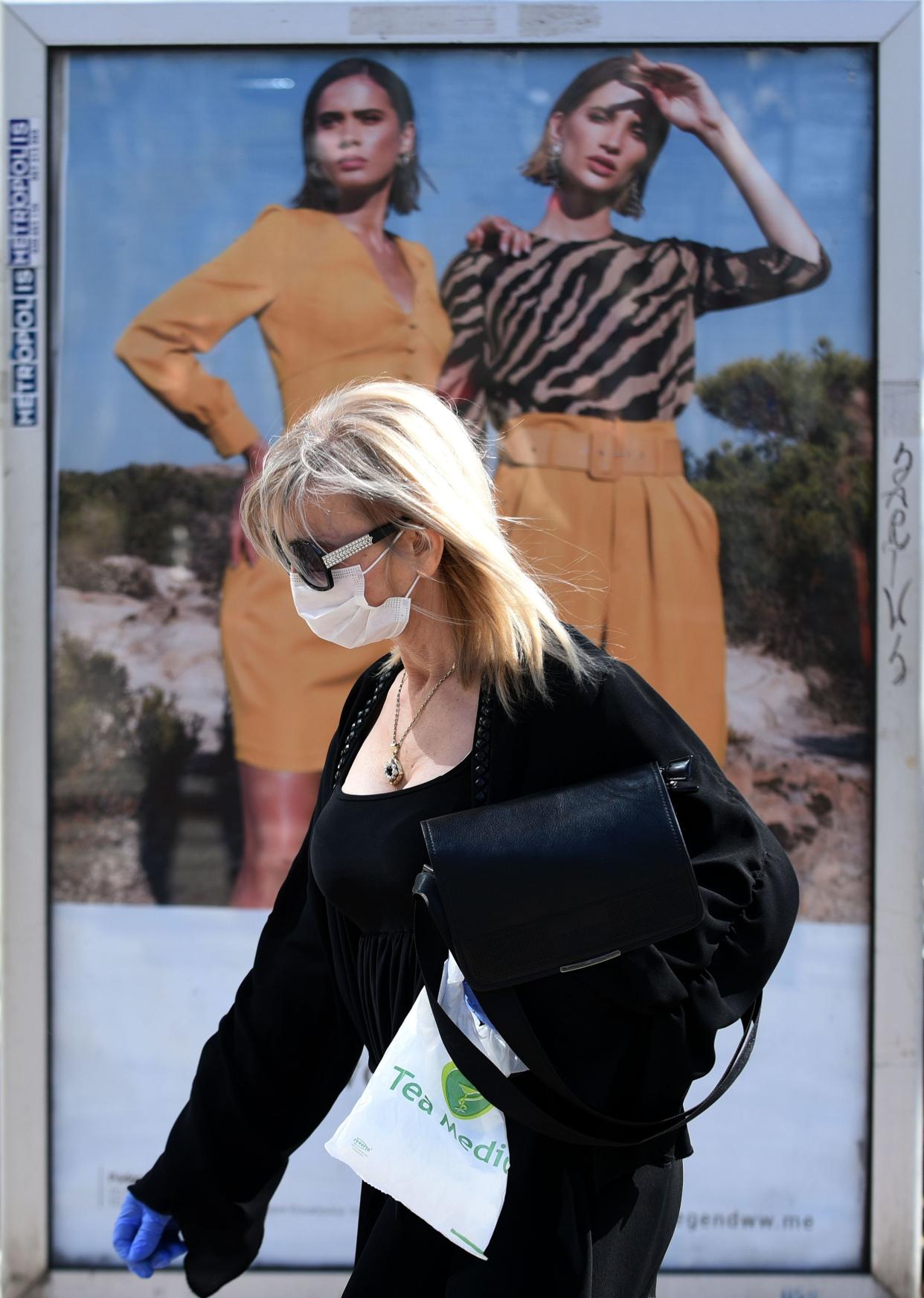

Coronavirus Poised to Be Worse for Advertising, Media Than Last Recession

Click here to read the full article.

The last recession was bad for advertising and media, but the economic fallout from the coronavirus is expected to be even worse.

In the decade since the recession of 2008 and 2009, the media world has become more used to digital operations and subscriptions to build up revenue. But most media entities are still too dependent on advertising to weather unscathed what is expected by analysts to be a drastic reduction by advertisers large and small in marketing spend. Be it online, in print or on TV.

“The Great Recession was a low point in the recorded history of advertising,” research firm eMarketer said in a note. “Total media ad spending declined for two straight years in the U.S. and digital ad spending even dropped in absolute terms in 2009, the only time that’s ever happened.”

Yet advertising and marketing executives are expecting the effects of the coronavirus to outstrip that previous low point. A survey of such executives by IAB with more than 400 respondents found 70 percent have already “adjusted or paused their planned ad spend” for the first half of the year. Another 16 percent are “still determining what actions to take.” Of those, 24 percent have pulled the entirety of their ad budgets. And among all respondents, about 75 percent expect the coronavirus downturn to be worse than the 2008-09 recession.

Already, IAB found that “digital ad spend is down 33 percent and traditional media is down 39 percent.” Last year, digital ad spend in the U.S. overall came in at $129 billion, leaving the decrease so far this year likely around $40 billion. Traditional advertising last year came in around $109 billion, so the loss there is likely around $40 billion as well.

The coronavirus was already expected to take a toll on global ad spending even a few weeks ago, with eMarketer projecting a decrease of $20 billion. Now the projection looks low as global lockdowns drag on, and well below what the more recent estimate from IAB show. Emarketer’s estimate was largely based on the effects of the coronavirus in China, and since then, the pandemic has caused lockdowns in most of Europe and the U.S.

EMarketer admitted that its ad spending forecast was finalized in early March, saying in a newer note that “events have unfolded rapidly since then — but with little clarity on how economic trends will shake out this year.” While its full ad spend forecast has not been updated to reflect the coronavirus, the firm is already estimating that search advertising, normally a stronghold of digital ad buying, alone will decrease in the first half of this year by between $6 billion and $8 billion.

“What happens after [coronavirus measures are lifted] depends on when ‘after’ is,” the firm added. “We hesitate to speculate about demand that is lost vs. pent up, for example, without having a better idea of how long the time period is [both indoors and with depressed income].”

On Friday, new U.S. government projections around the coronavirus showed that, should 30-day “stay at home” or lockdown orders be lifted soon, as President Trump has insisted, a new wave of the disease would come up. With lockdowns expected to continue into the foreseeable future, comparisons to the Great Depression are starting to come into conversation when financial experts discuss the economic effects of the pandemic, which has in just a few weeks brought much U.S. business to a halt and cost almost 17 million people and counting their jobs.

Kristalina Georgieva, managing director of The International Monetary Fund, which surveils the global economy, on Thursday said plainly in a podcast that “we anticipate the worst economic fallout since the Great Depression.” She added that, if the pandemic is fading by “the second half of the year,” and only then allowing for a “gradual lifting of containment measures” and a reopening of the world economy, there could be a “partial recovery.” But even that won’t start until mid-2021, if then.

“I stress there is tremendous uncertainty around the outlook,” Georgieva said. “It could get worse depending on many variable factors, including the duration of the pandemic.” She did not say it could get better.

Simply put, a global depression does not bode well for the media world at large and the advertising many outlets and operations get a vast majority of their revenue from.

Despite most forms of media, from online news to TV, seeing levels of consumption, readership and engagement they’ve not experienced in decades, if ever, as public appetite for information and entertainment soars, it is simply not translating to what would normally be a corresponding increase in ad sales. Already, close to 30,000 news workers, many in smaller markets at local papers, have lost their jobs because of coronavirus effects, according to counts by Poynter and The New York Times. But the perception of the media is improving, too, with Pew Research Center finding last week that 54 percent of Americans think media coverage of the pandemic is “excellent or good.”

Nevertheless, Moody’s Investor Service has repeatedly pointed to media and advertising as negatively exposed to the coronavirus effects, as its revenue is driven by advertising from non-food retail and automotive sectors. News worker union NewsGuild is now pushing for a stimulus package for the industry, telling the U.S. Congress on Thursday that the entirety of news operations “is seeing plummeting ad revenue created by business closures.”

Such reductions, although not entirely played out, as the world is only a couple of months into a coronavirus economy, reflect the positions of many company executives that make advertising decisions.

In addition to the IAB survey, in a late-March report, eMarketer found that all 200 ad and marketing executives it surveyed separately had in one form or another limited their advertising. Be it pulling a campaign that was already live, pausing all advertising outright, or cancelling a planned campaign entirely.

Even Google, which holds the largest share of the online ad market, is going to take a sizable hit. Rohit Kulkarni, an investment analyst at MKM Partners, is expecting the company’s ad revenue to drop by as much as 16 percent in 2020 and another 8 percent in 2021. During the last recession, Kulkarni said Google’s revenue fell by 15 percent over the course of two years, noting it was a much less diversified company then with YouTube and cloud services still a nascent part of the business. Still, today the search engine’s $135 billion ad business is at least 40 percent driven by sectors being hit hard by the coronavirus fallout, like traditional retail, restaurants, travel and auto.

“Global ad spend is highly correlated to global GDP growth,” Kulkarni said in a note. “We think online ad spend trends will have a higher [volatility] as it can be turned on or off quickly.”

During her podcast, Georgieva said the IMF is expecting 170 of its 189 member countries, including the U.S., “will experience negative per capita income growth this year.” She did not project growth, or a return to positive territory, for 2021.

For nearly all types of media companies, revenue from ads tends to be between 40 and 60 percent of a company’s total revenues.

Lifestyle and news publishing tends to be on the higher end of the range. Condé Nast, for instance, is a roughly $1 billion company that, after years of diversification efforts, still gets just over 60 percent of its revenue from print and web ads. The New York Times, which has already warned of an impending hit to the business from the coronavirus but has a strong digital subscription business (a move that came out of the last recession), is a roughly $1.8 billion company and about 30 percent advertising-based as of the end of 2019.

Even a major TV and film conglomerate like NBCUniversal gets about 40 percent of its revenue from ads. The company generates around $13 billion in ad revenue and last year counted $33 billion in revenue overall. Already this year, the company has taken a significant hit with the yearlong postponement of the 2020 Olympics, which it had sold over $1 billion in TV ad spots for. Whether the games actually happen next year is uncertain still, as Toshiro Muto, the head organizer of the games, admitted nothing was certain.

“I don’t think anyone would be able to say if this is going to be possible to get [the coronavirus] under control by next July or not,” Muto said in a press conference.

With the cancellation of all sports for the last two months, ones that could well affect the seasonal return of all sports leagues later this year, eMarketer warned that the impact on TV advertising could be severe, although it’s still working on projections. TV ad spend was expected to increase 2 percent in 2020, up from a decline of 2.5 percent last year.

“The biggest remaining unknown is whether the U.S. will enter a severe recession during or after the COVID-19 outbreak, and for how long,” eMarketer said in a note. “If an extended economic crisis plays out, and if a significant drawdown in consumer spending ensues, then many additional ad spending metrics will also have to be reassessed.”

For More, See:

What Are People Shopping for During Coronavirus Lockdown?

Coronavirus Causes Dip in Podcast Listening

What’s Working Now? Branding on Instagram Amid Coronavirus

WATCH: How Fashion Is Fighting Coronavirus

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.