Britney Spears’ Divorce Lawyer Just Shared a Finance Plan Even Non-Megastars Can Learn From During a Breakup

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

"Hearst Magazines and Yahoo may earn commission or revenue on some items through these links."

There has been a notably high volume of high-profile celebrity divorces in 2023, from Ariana Grande and Dalton Gomez to Britney Spears and Sam Asghari. What does this pair of exes have in common beyond their breakups? Well, Britney and Ariana are both represented by Laura Wasser, the best divorce attorney in Hollywood the world.

Whether you're famous or not, divorce = stress, and part of Laura's job is helping her clients navigate it. But on top of the psychological toll that accompanies a split, there's often a financial one too. Even in 2023, women's household incomes tend to plummet after a divorce, and that's where Laura's friend, Ellevest founder and CEO Sallie Krawcheck, comes in. Part of Sallie's core mission is to give women the tools to maneuver situations like divorce without breaking the bank. (It's part of Laura's mission too; she's the Chief of Divorce Evolution at divorce.com.)

Below, Sallie and Laura offer practical advice for protecting your assets and preserving your sanity while going through a divorce—and yes, we know what you're thinking: These may or may not be the same tips Laura gave Angelina Jolie in 2016 or Kim Kardashian in 2021!

Tip #1: Get educated

Laura Wasser: I'm coming up on 30 years in my profession, and there were plenty of years where Mrs. Somebody came into my office; she was dressed to the nines and she said with shame, 'I have no idea what our finances are. I don't know what we spend or what we earn, and I'm so embarrassed.' And I'd say, 'Well, okay, you can be embarrassed. But you are never ever going to be in this situation again, because you're going to learn now.'

In the past 10 years, I've seen a shift in people (particularly women) wanting to know more. They don't abdicate that financial responsibility to their spouse or significant other. They are full partners, not just, 'Oh, I'm gonna make a casserole for your boss when he comes over for dinner and bring your slippers to you while you smoke your pipe.' There has been an evolution.

And that's the first thing to do in this situation, too: get educated. Get educated about your finances and also, to the extent you have children, get educated about what the custody laws are in your state. And then retain a divorce lawyer.

Sallie Krawcheck: There's research that says 77 percent of women divorcees say they've been hit with a "financial surprise." And let's be honest, not many of those surprises are positive. It can be things like, 'We don't have as much money as I thought we did.' It can even be secret accounts. It's 77 percent. It's not 15 percent, it's not 20 percent, it's more than three quarters!

If you back up, the way to have this not happen is to be engaged with the money. The more often a couple talks about money, the happier they are. Something like 75 percent of couples that talk about money once a week are very happy versus every month, where it's less than half.

We can talk chicken and egg, but in discussing extremes with money, being happier and talking about it often is on one side. And on the other, there is no domestic abuse without financial abuse. Money is power across the spectrum, and it can be a power struggle or it can be a means of sharing power.

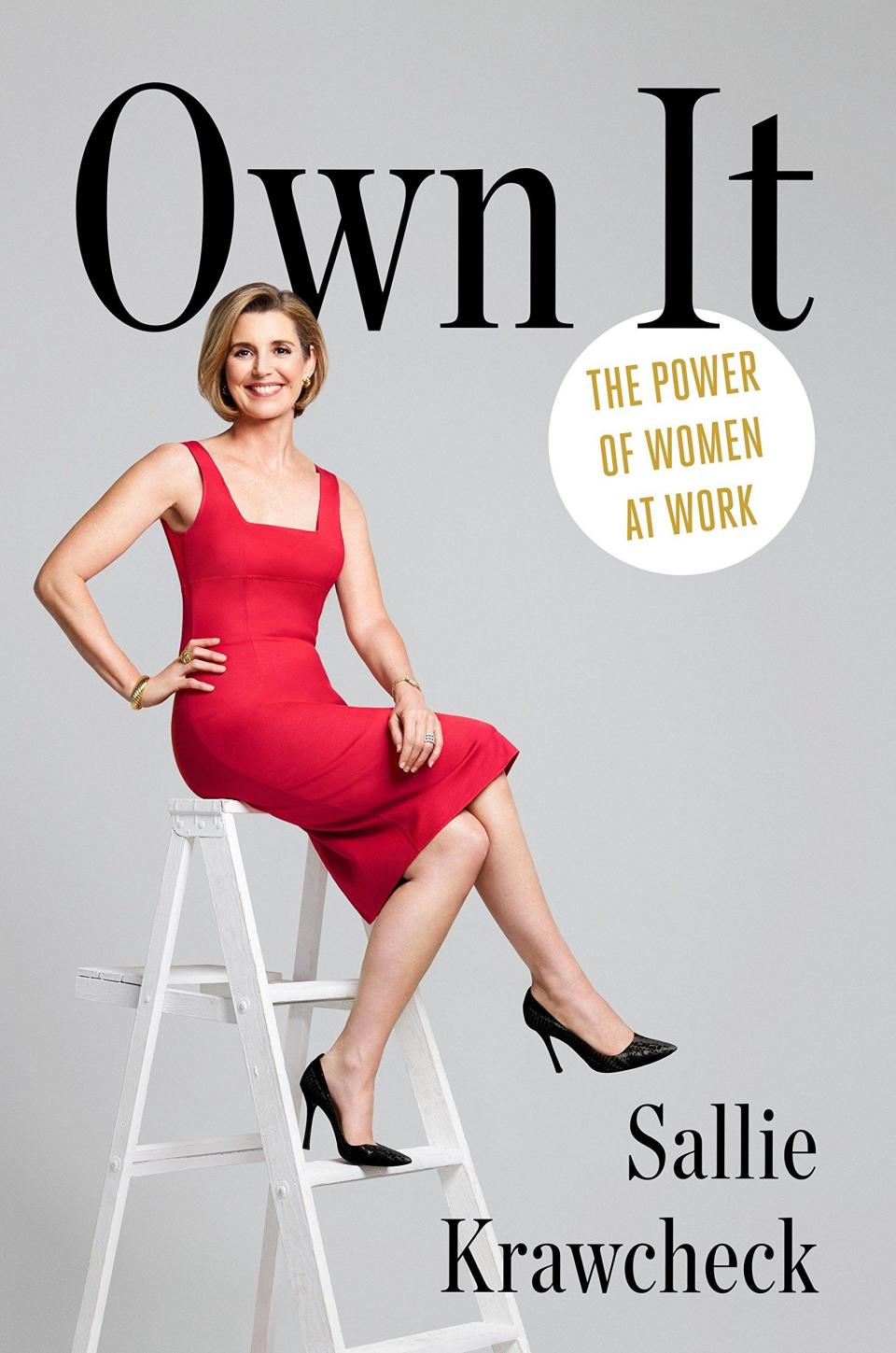

'Own It: The Power of Women at Work'

amazon.com

$17.44

Tip #2: Build your wealth as best you can, even before you enter divorce territory

Sallie Krawcheck: Investing has historically been the scalable means to build wealth in this country. It's either that or buying a house, and buying a house is not available to a lot of people because it takes a lot of money already. But investing is available, and you don't need to know every last thing about investing in order to do it.

There are negative societal messages we women get like, 'You're not supposed to want money. You're not greedy, right? It's unattractive.' Reshma Saujani talks about how boys are taught to be brave, while girls are taught to be perfect. This drive for perfection coupled with negative messages mean we tend to over-try and overanalyze. But the most important thing you can do is have your hands on the money.

In the United States, a woman's household income tends to fall about 40 percent after a divorce, and that keeps women in marriages they don't want to be in. But if you're building your own wealth, your household net worth does not have to fall. And investing is the means to get your money working.

Tip #3: Recruit a team to help

Sallie Krawcheck: Start with a financial advisor. In fact, women who go through divorces tend to leave their joint financial advisor. They say, 'That belongs to him, I need my own.' It can be a smart thing to do, to get someone who is solely in your corner, who operates in your best interest and can act as a quarterback to help you understand finances and get them invested and managed the right way.

Laura Wasser: And get them early on. If that person is going to come in and help you educate you about the finances in your state, then keep them throughout the process and afterwards. Use them from start to finish.

I think in some instances, and my colleagues won't like me for saying this, those people are going to be even more important than the lawyers because the law is really not that complicated in most states. You're applying the law to your situation. But what is a bit more specific is how you come out of this marriage or relationship and move on into the future. That's why I think a financial advisor can be so important, whereas with your divorce attorney, you'll likely say, 'Hey, thanks for everything. I hope I don't ever see you again.'

Tip #4: Prenups matter, so figure out your situation

Laura Wasser: Sadly, I have spent the last 2 or 3 years trying back-to-back-to-back prenup cases, meaning my client has had a prenup and the other party has tried to say that it wasn't valid or that it was unconscionable and so unenforceable.

'It Doesn't Have to Be That Way: How to Divorce Without Destroying Your Family or Bankrupting Yourself'

amazon.com

$20.99

It may have something to do with my litigation prowess, but likely it has more to do with the fact that judicial officers like to uphold prenuptial agreements. There are very heavy statutory regulations around them, meaning both parties must have attorneys. There must be full disclosure. We don't have juries in family law, and most judicial officers understand the law and understand what the parameters of a prenup is, in terms of, Did you have full disclosure? Did you have a lawyer advising you? Did you have a subsequent waiting period after you got the last draft? If all those boxes are checked, they're going to uphold the prenuptial agreement.

So having a valid and enforceable prenuptial agreement is huge. The only remaining issues are generally going to involve kids, because you can't include child support or child custody in a prenup. But usually, a prenup creates a roadmap for what will happen when people get divorced, and that is extremely helpful.

It's another reason why it's good to understand finances prior to entering into a marriage, to be able to track what's happening during the marriage so you won't have those unpleasant surprises Sallie spoke about.

Sallie Krawcheck: We hear from so many women, 'Oh, a prenup? What if he or she thinks I want to get a divorce? We're negotiating the divorce before we're negotiating the marriage?' Women are taught to want to help and get along and be the peacemaker, so this can feel a little scary because it can become contentious when all you want to do is be in love.

We hear the same thing, by the way, when we talk about getting involved in the management the money. We've heard it from multimillionaire women: 'What if I do that and he thinks I want a divorce?' And so it's interesting, these societal messages. This is just something where you need to have a glass of wine, read your Cosmo, get your mojo up, and just get in there and recognize that a little bit of unpleasantness for potentially a lot of gain and a lot of protection is worth the trade-off.

Tip #5: Don't try to "make up" ground lost with risky investing

Sallie Krawcheck: If you've taken a financial hit in your divorce, do not invest in a riskier fashion to try and "make it up." You need to recognize that you are where you are. What's always going to make sense for individuals is a diversified investment portfolio, personalized to you based on your age, what you want to achieve with it, where you are in the country, what your earnings profile is, etc.

If you can be in the market for 10 or 15 years, you historically have had a 98 or 99 percent chance of a positive return. So let the past go. There were good years, there were bad years, and there were terrible years. But trying to make it up in the markets is not an advisable strategy.

Tip #6: Take care of your emotional health, too

Laura Wasser: I think you really have to embrace the fact that this is the next chapter. This is not a sad death. This is the first day of the rest of your life, and you are going to be stronger as a result of coming through this. It's definitely a challenge, but it's a challenge filled with promise.

Sallie Krawcheck: That's exactly right. In finance, we have a concept of a sunk cost; it's money you spent on something that you can't get back, and you shouldn't make decisions going forward based on money you spent that you can't get back. I think there's an emotional sunk cost to coming out of a divorce. There's nothing you can do about the past. It is what it is. Do I wish I'd never met my first husband? I'm gonna say yeah. But there's nothing I can do about that, and so closing that chapter and moving forward is for the best.

I will tell you, from a financial point of view, that when you do what Laura and I have been talking about—you get your finances in order, you know how much you've got, you've got the budget straight, you're investing—you're going to be really surprised by how doing that financial hygiene turns a source of stress into a source of strength.

Our research clearly shows that when you get yourself on top of it and start to approach financial wellness, the stress actually falls away. There's a bright side to it. It's just getting through what is a challenging time.

Finally: Divorce can be a good thing! And it can reflect larger, positive cultural shifts

Laura Wasser: Something going on with a lot of my clients and what I'm seeing here in Southern California is that we're in the middle of one of the worst strikes in history for the writers and the actors. So you've also got people who have more time on their hands. They're angry about our reproductive rights getting rolled back, they're feeling their power by going to see Barbie and Taylor and Beyoncé. And they're like, 'I don't need this. I'm the one making this money and I'm not comfortable, not working, and have this spouse who's either also not working or never was working.' A lot of people have said, 'I'm out.' So it's compounded by what's going on here economically.

Sallie Krawcheck: We've always seen this in pop culture. Where pop culture has done a real number on women historically has been the negative messages we've received around money. That we're not good at money, we're buying too many lattes. I mean, my God, the talk around Pumpkin Spice Latte season is peak sexism, right?

We're mocked for our financial choices, we're told that financial planning is hard and trading is complicated. Men, by the way, are getting very affirmative messages around money from media, messages of abundance whereas we get messages of scarcity. And so we've always fed on the diet of pop culture. What I'm loving about this summer is we flipped the script.

Broadly, this has been a summer of women stepping into their financial and economic power. It's been a tough few years for women with the collapse of Time's Up, the collapse of the Women's March, and the rollback of reproductive rights. And it felt like this summer, women said, 'You know what? I'm taking control. I'm going to do a range of things. I'm going to see Barbie unapologetically in full pink gear. I'm going to see Taylor Swift. I'm going to see Beyoncé. And we're collectively going to save the U.S. economy from a recession in the process.' That is literally what happened.

Part and parcel of this is we're seeing some high profile people saying, 'I'm leaving him. I've build the confidence. I feel the strength. I'm stepping out on my own.' This is the summer where women went from being told to be empowered to saying, 'We have power. It's power and money. It's financial and economic. And we're using it.'

For further women-first financial planning and guidance, check out Ellevest.com. Bonus treat: Use the code COSMO to get one free month of the Ellevest digital offering here.

You Might Also Like