These Brands Are Buying Into Resale — and Here’s Why

The adoption of resale fashion has been swift and explosive, with brands one-upping each other in the name of sustainability, new faces — and good press.

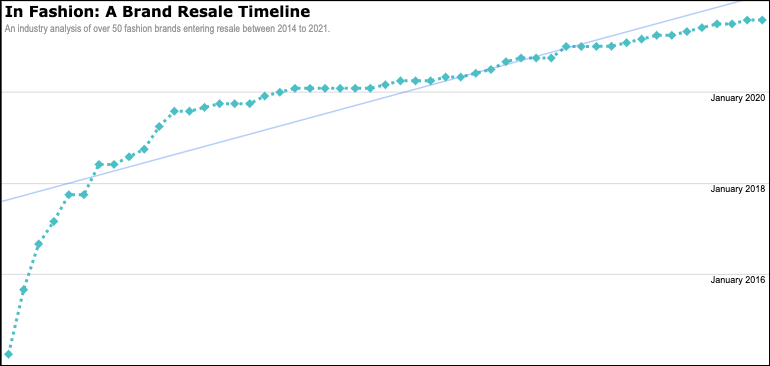

There are more than 50 fashion companies that have recently entered or invested in resale, including luxury brands like Burberry, mass market brands like Levi’s, retailers like Nordstrom, fast-fashion players like H&M and direct-to-consumer labels like Boyish Jeans. And traction has dramatically increased since early efforts in 2014.

More from WWD

Archival Images From DNR: Street Style, Retailers and Stores

Standout Fashion Moments from the 2021 NBA Draft: See the Photos

Decades-old Swedish children’s clothing brand Polarn O. Pyret is one early bird, having first partnered with ThredUp in April 2014. Perhaps seeing the writing on the wall, fast-fashion giant H&M was an early investor in resale platform Sellpy in 2015, while a year later eco-athleisure brand Prana turned to zero-waste repair and resale with The Renewal Workshop.

Many resale partners are being enlisted to help brands get into the space, in many cases, taking on the dirty work of reclaiming, inventorying, repairing, photographing, merchandising and listing used goods to give them a life beyond landfill.

The Service of Resale

On behalf of brands, marketplace partners like Fashionphile, ThredUp, Goodfair and The RealReal provide reselling, branded or white-label resale services such as closet clean-out bags. From there, there’s a host of players with similar sounding names offering other services to support resale.

Reflaunt, for one, is a website button that links to other resale marketplaces while Recurate is a pandemic newcomer specializing in peer-to-peer brand-owned resale, as is Treet. Treasuring the brand-owned resale experience, Trove and Archive (each helping brands operate low-cost branded resale) are also in the mix. On the other hand, start-ups like Kept Sku coalesce excess inventory from multiple brands to assemble resale “surprise boxes.”

Back in 2018, ThredUp introduced its Resale-as-a-Service (RaaS) business program, which facilitates modern resale for a number of brands and retailers all in the name of fostering “circular fashion and sustainability” rather than material benefit for the reseller as the company does not earn revenue from RaaS.

As per ThredUp’s S-1 filing, the RaaS partnerships serve as “marketing for us and our RaaS partners, building brand awareness, creating additional channels of supply and generating strategic benefits for us and our RaaS partners.” Today, the platform boasts 21 retail and brand partners, including legacy retail partners like Walmart, Macy’s, J. Crew-owned Madewell and J.C. Penney.

Reporting the strongest growth amid the pandemic, resale fashion saw a tipping point last year, with some 20 brands and retailers entering the space, among them Christy Dawn, Arc’teryx, Athleta, Banana Republic, Gap, Frye, La Ligne, Nordstrom, Abercrombie and Fitch, Hollister, Reebok, Phillip Lim, Walmart, Toad&Co., Frame, Cos, Gucci, Levi’s and Rent the Runway (which partnered with ThredUp for a resale component before going full throttle in June 2021, allowing a buy-now option on all of its pre-worn merch).

Why Brands Enter Resale

While each brand has its opinions on resale and its own inroads into it, the premise for entering resale is much the same to start — new customers, new streams of revenue and sustainability.

Launching its SecondHand vertical in October 2020, Levi’s used resale to get back old jeans from customers and ink new favor with Gen Z.

Speaking to the sweep of Gen Zers shopping secondhand, Levi’s chief marketing officer Jennifer Sey, said at the time: “They love the hunt. They feel they get something a bit more unique when they are shopping vintage and in this age when ’80s and ’90s retro looks are so in, they prefer to buy the real thing.”

Customers bring used Levi’s into a store where items are reviewed to determine their worth. Then a gift card is issued for between $15 and $25, applicable toward a future purchase. The denim is then priced from $30 to $100.

Since October 2019, M.M.LaFleur has been operating its clean-out bag partnership with ThredUp, but the women’s wear brand eventually launched its own in-house program called Second Act in partnership with Archive.

The brand found high engagement and high return on store credit through ThredUp but discovered only 4 percent of garments sent to ThredUp by M.M.LaFleur customers were M.M.LaFleur items, which, in the words of founder and chief executive officer Sarah LaFleur, “made us wonder if customers desired an alternative option.”

LaFleur said the decision to start Second Act was partly inspired by Eileen Fisher.

“We’d always looked up to Eileen Fisher and the sustainable ways her business encourages customers to recycle and resell their clothing. We had actually explored launching resale in-house several years ago (pre-pandemic), but taking in used garments would require a large operational lift, which we weren’t prepared to undertake,” LaFleur said. “When our customers experienced changes in their lifestyles or jobs, they often asked us about the best way to clean out their closets, while also saving money and reducing waste. This interest only increased as a result of COVID-19. We were also aware that there was a market for M.M. products on other sites, including third-party resale sites, Facebook and our Customer Slack Channel…[and] we’d seen a very positive customer response to our closet clean out workshops and content.”

The secondhand solution inspired more M.M.LaFleur women to shop quality on a price point — “as well as allowing her to sustainably clean out her closet (giving a dress a second life reduces the CO2 impact by 79 percent),” LaFleur said, adding that the “game-changer for us was the low operational lift offered to us via Archive, the peer-to-peer platform we use to power Second Act.”

So far, 75 percent of M.M.LaFleur cashouts are for store credit, and on average, customers spend 3.1 times the credit they receive, according to the brand. And the response from customers has proved the effort worthwhile.

Nordstrom also first entered resale with its temporary “See You Tomorrow” pop-up (powered by Trove, to which it still partners) before fully entering the space with thrift marketplace Goodfair in January.The partnership aims to democratize pre-loved items with Goodfair vintage picks priced between $40 to $80. Items are refreshed frequently and live permanently on-site under Nordstrom’s Sustainable Style vertical.

But how are these programs shaping up?

In surveying a handful of brands on resale sentiment, WWD found one brand had gained 25 percent new customers from its resale partnership and three times the spend on store credit. Another brand responding to the survey said it plans to increase investment in resale for damaged items (expanded from just peer to peer). One brand agreed it would continue its marketplace partnership, and another teased the launch of its own resale channel — separate from a third-party provider.

The brand, soon to launch its own resale channel, said: “We’ve definitely been able to drive new customer acquisition.…[Resale] is a good onramp for customers who are more price-sensitive and can help fund their purchases with the sale of older clothing.”

This onramp is already being noted by platforms like The RealReal. In one year of partnering with Stella McCartney, The RealReal reportedly drove a 65 percent increase in customers selling Stella McCartney items.

White-label Resale Is Red Hot

White-label resale services are one solution brands seek to help them control their entire resale experience — without much additional effort behind the scenes. Companies like Trove, Archive, Reflaunt, Recurate, Treet and Kept Sku are all aiming to win brand buy-in with their services.

Former Gap Inc. executive Wilson Griffin and former Retail Industry Leaders Associations executive Adam Siegel, launched Recurate in February 2020 as one such white-label resale solution. The company scored a $3.25 million seed round in April to take its marketplace shopping experience (which conveniently integrates into a brand’s website complete with imagery, descriptions and shopping cart) to the next level.

“In the rapidly developing recommerce market, brands should be taking steps to own their resale market,” said Griffin, Recurate’s chief operating officer. “Consumers have voted with their dollars to make resale a regular part of their buying habits, so brands should be doing everything they can to make resale a seamless part of their value proposition. Not only because it’s the most sustainable way to shop, but also because it is the key to unlocking additional revenue and loyalty.”

Saying it is still the early stages of brand-led resale, Griffin noted: “The secondhand market will continue to grow and brands that aren’t providing their customers new models like resale and refurbishment will fall behind. Consumers will ultimately decide which models and experiences they prefer, and we believe the programs that bring the most benefit to the individual seller and buyer will succeed.”

In 2021, Momentum Continues

Already this year, more than 14 brands have entered the resale market, including direct-to-consumer brands like Boyish Jeans, Coclico Shoes and Époque Évolution, which partnered with Treet, while Cuyana, Vera Bradley and Fabletics have partnered with ThredUp.

Kering-owned Alexander McQueen partnered with Vestiaire Collective, just before Kering announced a $216 million investment in the reseller in March. Resale partnerships can come before or after initial investments are made, as Richemont, for example, snapped up Watchfinder in 2018, before rolling out its resale partnerships at Net-a-porter and Mr Porter this July.

August has already proved eventful, with new partnerships being forged in-store and online.

Fashionphile entered a long-term partnership with Neighborhood Goods this month, offering a physical presence to its luxury goods. Previously, the reseller saw Neiman Marcus take a minority stake. Meanwhile, New Balance launched its “New Balance Renewed” program with The Renewal Workshop. H&M recently launched its own “Rewear” resale marketplace in Canada, and URBN announced its “Nuuly Thrift” platform anticipated for fall 2021.

While none of the brands that have entered resale, or recently invested in it, have demonstrated a decoupling from volume-based growth, which is a nuance circularity experts tend to justifiably harp on, resale has proved at least one viable step toward fashion realizing greater sustainability.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.