A ‘Brand-friendly’ Marketplace at Off-price

Some brands hesitate to post on digital marketplaces, concerned their images and products aren’t properly portrayed online and get lost in a sea of other brands of inferior quality, affecting perceptions.

But the Simon Property Group contends it’s created a better way.

More from WWD

“We have taken the marketplace concept to a place where it’s much more brand-friendly,” said Neel Grover, chief executive officer of Shop Premium Outlets. “We’re more of a shop-in-shop experience rather than a pure marketplace because we really collaborate with brands.”

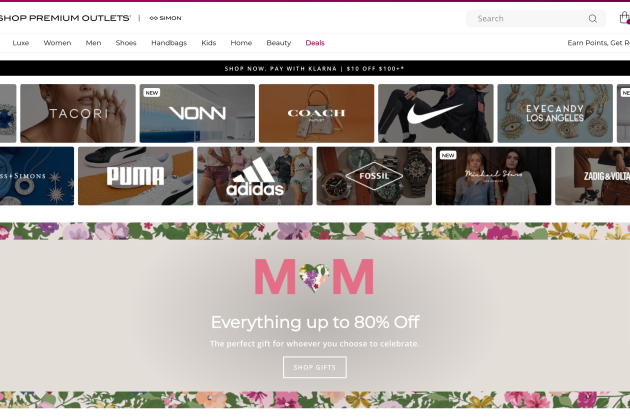

Shop Premium Outlets, a joint venture of the Simon Property Group and the Rue Gilt Group, is an online marketplace where consumers can shop for fashion, footwear, home and other merchandise advertised at up to 70 percent off regular prices. Launched in 2019, Shop Premium Outlets can be considered an offshoot of the Simon Premium Outlets division, providing another channel for the brands and retailers in Simon’s 70 premium outlet centers to generate sales, and for Simon to capture another revenue stream.

SPO has headquarters in Boston and four months ago, opened a second headquarters in Irvine, Calif., largely for drawing talent. “More than half our team now is here in Southern California because a lot of us were together at Buy.com and Rakuten building marketplaces,” said Grover, who joined SPO in March 2020. “At SPO, many of our team had the good fortune to have sold billions of dollars of merchandise in a marketplace environment, competing with Amazon for almost two decades.”

In the following Q&A, Grover, the former CEO and president of Buy.com; director of Rakuten USA, and CEO of Bluefly, makes his case for what makes SPO unique and explains how it operates.

WWD: Besides only selling premium and luxury brands at off-price, what sets Shop Premium Outlets apart from other online marketplaces?

Neel Grover: Because of our Simon ownership, we deliver a brand-right environment for premium and luxury brands. Our sole focus is on sale, clearance and outlet inventory. It’s all off-price. I consider us more of a shop-in-shop type of experience than a pure marketplace. Brands get their own storefront on our site. They can highlight their look, their feel. We use their assets. We use their video content or editorial content. We work very collaboratively with brands, almost like an extension of their own site and team. We help them decide what products to promote, but they ultimately make the decision. We give them a lot of flexibility, a lot of data, and help them with decision-making, with what works best for them.

WWD: More specifically, how does SPO create, as you say, “brand-right” presentations?

N.G.: It’s a combination of our model as well as the tech layers we have added on top. We do use Shopify as our front end, but we have added a lot of layers onto that. Really, our tech team is the foundation of our platform. We have an experienced, significant tech team that have worked together on complex tech solutions, many for almost two decades and much of it in a marketplace environment. We actually have two former chief technology officers on the team…and often times, depending on where that product came from, they may or may not have digital assets correlating with those products. So if a product is made for outlets, they may not have ever shot photography for it because it is only going to reside in the [outlet] store. We also have offerings to enable full production, meaning we can shoot the photos, we can create the descriptions. We can take the product in on consignment, and deliver for them. We can enable them to ship from store. And we are doing more and more livestreaming from different outlets, so the brands can highlight their products and their full store inventory without having to go through a full production photographing everything.

WWD: Nordstrom says customers shopping Rack off-price stores often graduate to shopping Nordstrom full-line department stores. Does Simon see shoppers graduating from its outlet channels to its shopping malls?

N.G.: Given our Simon ownership, we really want to drive our customers into the full-price funnel. When a brand decides to put their off-price product or outlet on our site, we are their front end. We market to the millions of shoppers we have access to. It drives customer sales in a brand-right way and then we share that customer data with them so they can then market that consumer back into their own full-price experience. So we often introduce customers into their brand, and then they can market them into their full-price experience.

WWD: Given all the macro dynamics — inflation, recession worries, the volatile stock market — how is SPO performing?

N.G.: I think both the off-price and the luxury sectors are doing very well right now. We finished the fourth quarter up 100 percent year-over-year. We finished the first quarter up over 200 percent, for SPO. We are definitely seeing more off-price consumers looking for that value with great brands.

WWD: What are the challenges to make off-price online work effectively?

N.G.: A lot of the brands have wanted their outlets to be a certain distance away from mainstream shopping. Luxury brands don’t want to make it super accessible to get off-price product. We fundamentally had to get brands comfortable with our experience. That is really why we go so far to help a brand to be an extension of the brand’s experience. The brand can choose what assets, what products, what price, how it’s promoted, where it’s promoted, if it’s promoted. We give the brands a registration wall before the products show up. You need to log in before you can see the products. Certain brands want that extra protection. It makes it more difficult to Google and find the products. It’s not easily searchable. We can keep their products out of Google search.

WWD: How has SPO been enhanced since its onset two years ago?

N.G.: We launched the unified checkout in August 2020. We launched buy online, pick up in store in summer 2021, which is not broadly offered yet, but we have a lot more brands bringing that on. We tie into their capabilities. We are also launching an app, our first version, later this quarter. Three months ago, we soft launched our loyalty program. You will see some unique items in the loyalty program.…The other big thing is the livestream events. We started that in the fourth quarter of 2021. We’ve done it with brands like Max Mara, Theory and Fossil. You will see us do quite a bit more of that this year. We are going to do events with multi brands.

WWD: What kind of data are you gathering and how do you use it to enhance shopper engagement?

N.G.: We collect a lot of data on browsing behavior. We do have different pieces of AI to help serve up other [product] options shoppers may like within that same brand. We really try to keep people within the brand when they are looking at the brand. We can also share some of that data, on an anonymized basis, with brand partners. They learn from the data to help their businesses on our site and potentially help them with businesses on their sites. They compare that data to an anonymized set of competitors’ data to understand how they are doing on our site. Our merchant team really has to understand the brand’s product, ethos and overall e-commerce. They work closely with the brand’s team to provide helpful data.

The other piece we focus on is enabling the store inventory, so not necessarily for pickup in store, but just ship from store. We can tie into their POS systems to enable their local inventory to be seen and that way they can utilize their stores as mini DCs and ship from their stores to customer directly…Most brands ship from their warehouse. But we do enable brands that are shipping from their stores. Our warehouse is in Kentucky. We get the items in first before they are ever lit up for sale on our site. We do that if the brand for whatever reason doesn’t have the capabilities to drop ship.

WWD: SPO is relatively new. How popular is the site and how’s its retention rate?

N.G.: We are gaining new customers at a rapid pace but also keeping our existing customer base very engaged. We are a very sticky site. Between the Simon Property Group and Rue Gilt, our two parent companies, we have a combined data base of nearly 40 million shoppers and billions of in-store shopper visits. We have brands that are driving tens of millions of dollars of sales on our platform. We are growing our customer file quite fast. We have direct relations with over 200 premium and luxury brands. We are selective on who can come on. When I ran Buy.com and Rakuten, we had over 7,000 marketplace partners. We want to grow our brand list with the right brands. I won’t say there is a target number, per se. They have to be premium and luxury brands. If they have a relationship with Simon, that’s great. If they don’t, that’s OK. We have a lot of direct-to-consumer brands, that don’t have physical footprints.

WWD: Would you include a start-up or emerging brand?

N.G.: We would. There are some great niche brands that resonate really well with consumers. They can put their toe in the water with Simon and see where they are getting a great concentration of consumers and open up a physical location in that location.

WWD: Does your website siphon sales from Simon centers?

N.G.: Quite the opposite, we are driving people to the stores. We are highlighting the pick up in store capability as well as our livestreaming events. When we do a livestream event, we show off the entire store and showcase 10 to 20 products that are for sale.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.