These Are The Best Ways to Manage Your Online Subscriptions

If you purchase an independently reviewed product or service through a link on our website, SPY.com may receive an affiliate commission.

Table of Contents

We live in an interconnected culture of convenience, where everything you could ever want is available at the click of a button. Open an app and call a car to pick you up in four minutes. Buy a computer charger online and find it on your doorstep in 24 hours. Swipe for romantic and sexual suitors from the comfort of your couch.

Today's Top Deals

These Amazon Security Cameras Are Going for Less Than $20 Each Right Now

Over 34,000 Users Gave These Fat Burner Supplements 5 Stars on Amazon

Yes, It’s Possible To Get AirPods for Less Than $100 — But Hurry, This Deal Won't Last Long

Sometimes, though, that digital consumption is so embedded in your lifestyle that it runs in the background, eating away at your wallet. Yup, we’re talking about subscriptions. The model itself is a blessing — imagine having to pay each time you opened Netflix or Spotify — and as a result, it has been adopted everywhere. Besides the obvious ones, like streaming and music services, you can pay monthly for everything from vitamins and contact lenses to alcohol and fruits and vegetables.

But with that ease of access comes a tendency to pile up on subscriptions, particularly when they lure you in with free trials that you quickly forget about. Luckily, there are a number of tactics — both DIY and automated — for how to manage online subscriptions.

How to Manage Subscriptions Manually

When taking stock of your financial affairs, it’s best to be brutally honest, particularly when it comes to subscriptions. Do you really need that yoga subscription that you only use a couple of times a month? Do you get three bags of coffee delivered per month when you only end up using two? Making these distinctions will reveal opportunities to save money and they’ll add up in the long run.

You can also take a more regimented approach by setting up subscription budgets. If you’re committed to spending no more than $20 per month on streaming services, for example, you might discover that you don’t use HBO Max enough to justify the cost, allowing you to cancel it and stay within your budget.

Things like free trials and automatic renewals tend to sneak up and charge you before you’ve even realized it. Set a calendar reminder for expiring free trials to ensure you’re not charged, and turn off automatic renewals for subscriptions you’re not committed to using beyond the current term.

Proactive tactics like these will help eliminate excess expenses in your life, leaving you with a smarter, more effective financial lifestyle.

How to Manage Subscriptions on an iPhone

First thing’s first. If you want to see what subscriptions you currently have running through Apple, you can do so easily on your iPhone.

Open the Settings app.

Tap your name at the top of the screen.

Select Subscriptions.

Depending on whether or not you’ve linked all your Apple devices, this should show a complete list of apps and services you currently or used to subscribe to. Click on each individual app to edit or cancel the subscription.

How to Cancel Subscriptions on Android

Android users can follow a similar process for identifying and cancelling subscriptions with ease:

Open the Google Play store and ensure you’re signed in to the correct account.

Tap the hamburger menu and select Subscriptions.

Click on individual subscriptions to make adjustments or cancel.

How to Manage Subscriptions with Google Sheets

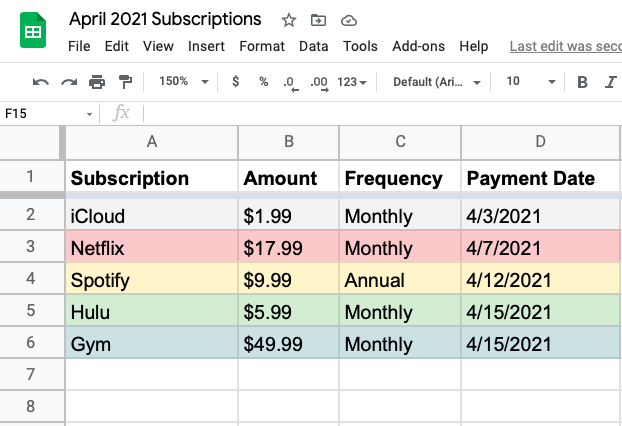

If you want to track your online subscriptions manually and avoid syncing up with an automated app, you can easily do it yourself in Google Sheets. There are a number of money management templates out there, but here’s how to start from scratch:

Create a new Google Sheet.

Label three columns — Subscription, Amount, Frequency and Payment Date.

Use new rows for each subscription service you use (Netflix, Hulu, Apple Music, etc.).

The most optimal way access this info is to bust out the ol’ printed bank statement, manually highlighting each subscription fee and entering them into your spreadsheet. This will show you exactly how much you spend per month, and potentially identify some services you can cancel.

If you’re a little more experienced with Excel or Google Sheets (and scoff at the idea of using a paper bank statement in 2021), most banks let you download monthly statements as a comma-separate value (CSV) file, making it easy to manipulate in Google Sheets or Excel.

Download your bank statement as a CSV.

Upload it to Google Sheets.

Depending on how it’s formatted, create a new column for Expense Type.

In the Expense Type column, label which ones are Subscription Services.

Filter out everything that’s not marked a Subscription Service.

The Best Apps for Tracking Online Subscriptions

The DIY process takes a little elbow grease, so if you’re more interested in having an app do the work for you, we’ve got a few suggestions as well. The following apps vary significantly when it comes to features (some offer tons of financial services) but all of them give you the ability to track and manage your subscription services. The main factor to consider is whether you want to input those subscriptions yourself (which isn’t too different from the DIY method) or have an app securely connect with your bank. That’s is the real differentiator here.

1. Trim

BEST OVERALL

Trim syncs with your bank to offer a comprehensive window into your finances, allowing you to manage subscriptions and track your spending. It’s free at the onset, and only charges a 33% fee on any savings netted through its bill negotiation service. Better yet, you don’t need the premium version to have Trim cancel any unwanted subscriptions for you, so if that’s your main priority, Trim is the best fit. For premium users, Trim waves the 33% savings fee, offers access to financial planners and negotiates with your credit card company for lower APRs. Trim has a mobile-optimized website, but not a true app.

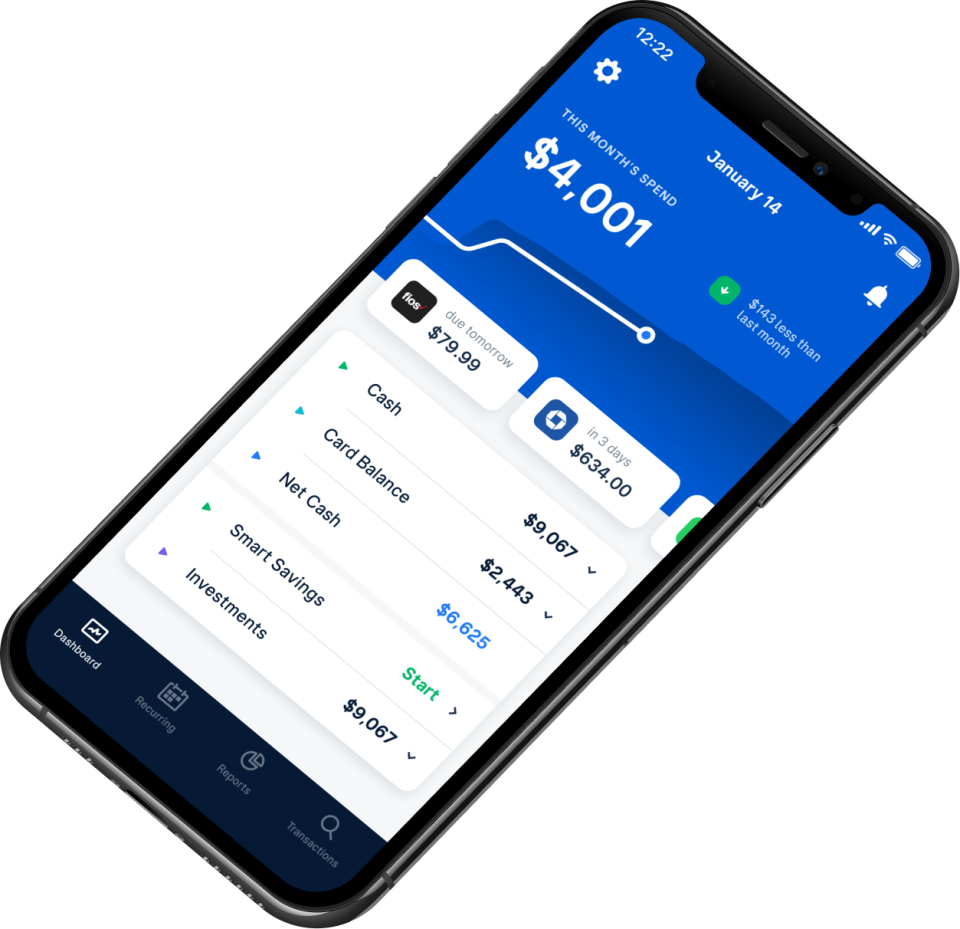

2. TrueBill

ALSO CONSIDER

Like Trim, TrueBill connects with your financial instruction to let you track spending and manage subscription services. Though it’s free upfront, TrueBill charges for its premium features that are more labor-intensive. Its Bill Negotiation service, for example, scans your payments and looks for savings opportunities. TrueBill takes a 40% cut of any successful bill negotiation savings in the first year, meaning if their service saves you $100 bucks, they’ll take $40. If you want to access its other premium features, like TrueBill’s Cancellation Congerige — which cancels unwanted subscriptions for you — you’ll need to pay for Premium. This costs between $3-$12 per month, as TrueBill lets you choose your own price. TrueBill is available on desktop and mobile.

3. TrackMySubs

SIMPLEST SOLUTION

True to its name, TrackMySubs doubles down on its ability to help users consolidate all of their subscriptions. Its pricing tiers correspond with the number of subscriptions you need to track — free for the first 10, then $5/month, $10/month and $15/month for 20, 50 and unlimited tracked subscriptions, respectively. However, TrackMySubs doesn’t offer a secure sync with your bank, meaning you have to enter your subscriptionsand categorize them manually in order to keep track of them. You can set up reminders for incoming subscription payment dates and concluding free trials, but that’s about it. TrackMySubs might work for someone who wants a simple subscription consolidation tool, but honestly, it pales in comparison to some of the other apps on this list, and isn’t much easier than the manual process we outlined above.

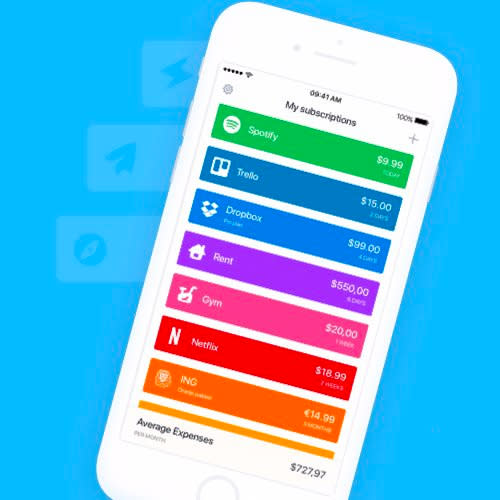

4. Bobby

BEST DESIGN

Bobby is a simple and effective, mobile-only subscription tracking app. Like TrackMySubs, it lacks the bank integration, leaving you to input subscriptions yourself. Bobby does, however, make things a bit easier by giving you a list of popular subscriptions to choose from, along with the common costs for each of them. This significantly streamlines the process. You can set reminders, customize the frequency of payment and add notes to accompany your subscriptions. The major selling point here is the clean, colorful design, which presents an elegant, organized window into your various subscriptions. The mobile app is free and allows up to five subscriptions. For an extra $1.99, users unlock the full version with unlimited subscriptions, iCloud sync and other customization features.

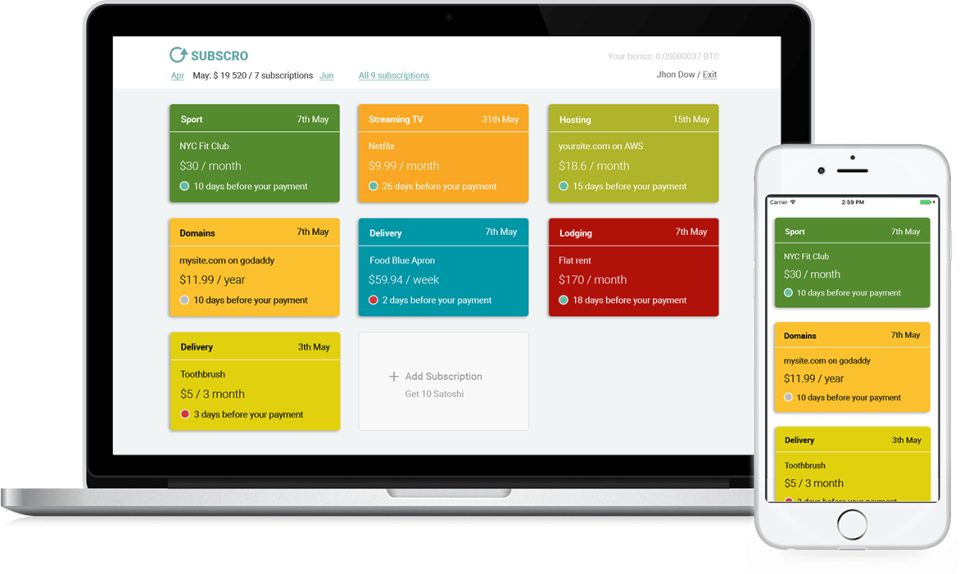

5. Subscro

BEST INCENTIVE

SUBSCRO rounds out the group of manual subscription trackers, letting users input the name, amount and frequency, then color-coding them based on their cost — yellow being cheapest and red being most expensive. It’s clean and simple, but the big perk is the sign-up bonus — you get free Bitcoins for adding new subscriptions.

More Top Deals from SPY

Best of SPY