The Best Pet Insurance Plans and Options, & What to Make Sure Your Plan Has, According to Experts

If you purchase an independently reviewed product or service through a link on our website, SheKnows may receive an affiliate commission.

Responsible pet owners know all too well the cost of properly caring for an animal. Aside from day-to-day care and grooming, there are the constantly mounting costs of wellness checks, emergency vet visits, pet medications and everything else it takes to keep your furry friend healthy and happy.

More from SheKnows

Today's Top Deals

Fortunately, the availability of pet insurance eases some of the financial burdens of pet care. Unfortunately, choosing the best from among all the options available to you can be overwhelming. Get started by determining precisely which insurance benefits are most important to you, and go from there.

Pet insurance is typically utilized for emergencies and illnesses, while pay for your pet’s wellness checks and routine healthcare out of your own pocket. You can often add preventive care if you’d like, but, of course, your premiums will go up. So first decide what your needs are when it comes to keeping your furry friend healthy. Then dig around for a pet insurance plan that offers the best coverage and reimbursement. Let’s sniff out the top contenders.

Best Pet Insurance Plans at a Glance

Best for Fast Reimbursements: Lemonade

Best for Emergencies: Paw Protect

Best for Senior Dogs: Fetch

Best Customized: Careplus by Chewy

Best for Unlimited Payouts: Trupanion

What to Look for in Pet Insurance, According to an Expert

SheKnows turned to Alex Stone, CEO of Petted, the leading pet insurance comparison site in the U.S., to find out exactly what to consider when choosing a pet insurance policy:

Annual coverage

Stone says annual coverage, or “the amount that you can select or amount you can use for covered vet bills each year,” is the first thing to look out for. Depending on the insurer, this can be anywhere from $5,000 a year to unlimited, with a common middle ground being about $250,000. “You really want to make sure that you have enough annual coverage so that if your pet gets really sick, the insurance will pay for it,” clarifies Stone, whose own golden retriever racked up $20,000 in cancer treatment bills in the last year of his life. “If we’d had a plan that only had $2,500 or $5,000 of coverage, then really it wouldn’t have helped him.”

Types of coverage

You’ll want to research exactly what each company covers. For instance, some pet insurers pay only for emergencies and illnesses, while others include preventive care. Others even offer dental coverage, as Stone notes, as well as add-ons like boarding and acupuncture.

Wait times

Pet insurance companies will often require wait times before providing coverage for certain treatments, but every company is different. “Some insurers have longer waiting times than others before knee conditions are covered, for example, or some hip conditions,” says Stone.

Reimbursement model

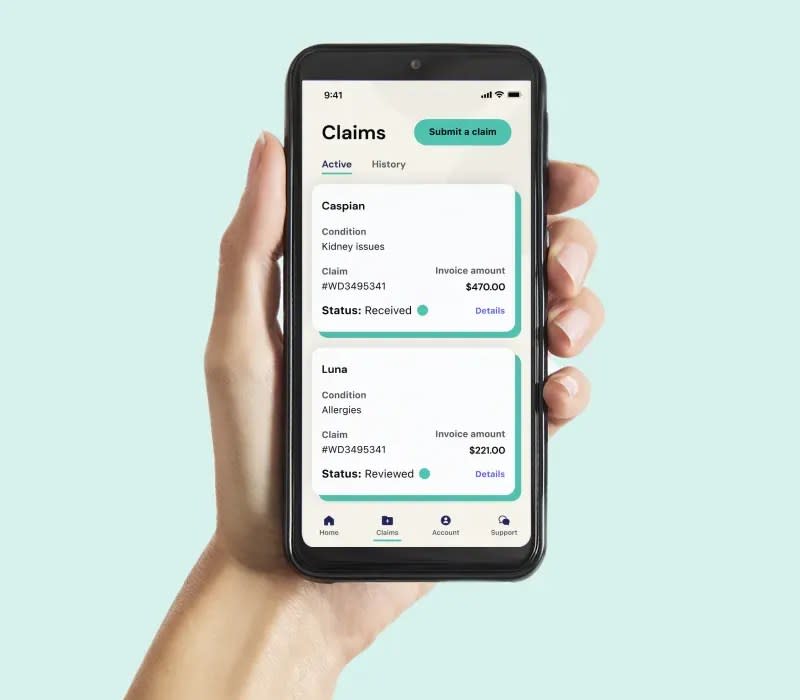

“Pet insurance is usually a reimbursement model. What that means is you have to pay the vet bill first and then get the money back,” says Stone, who points out that some companies take a while to pay claims, so you might want to investigate this beforehand. A few pet insurers will pay the vet directly — something else to consider if that’s important to you.

Comparison sites like Petted help you skip the monotony of going from one insurance site to another to compare. They lay out all your options in detail so you can make your own informed decision.

How to Pick a Pet Insurance Plan Based on Your Needs, According to an Expert

Once you’ve zeroed in on the pet insurers you prefer, check to make sure they’re available in your state. Then consider:

Your pet’s age

“Puppies and younger pets are usually healthier than senior pets, just like in the human world,” says Stone. “Coverage is never going to change If you sign up when your pet is younger, but if you try and sign up when they’re older, sometimes there’s going to be longer wait period. And there are certain coverages or deductibles or copays that just won’t be available from certain insurers. Sometimes insurers won’t insure pets at all if the pet is over, say age five.” Stone says it’s best to sign your pet up as a puppy, but if that’s not an option, find a pet insurer that has provisions for older pets (although Stone points out that pre-existing conditions are almost never covered).

Deductibles and copays

The deductible is the amount of covered vet bills you’re responsible to pay for each year before insurance kicks in, and it resets each year. The copay is the amount or percentage you have to pay out of pocket for each visit. These two factors usually have an inverse relationship with each other. If your pet is generally healthy and you don’t expect too many vet visits, a high deductible might be right for you versus higher copays.

Reimbursement percentages

“This is what percentage you get back for each claim, whereas a copay would be the percentage that you pay towards each claim,” says Stone. A reimbursement percentage is broken down like this: “Typically the options are 70, 80 or 90 percent reimbursement. So what that means is you are either going to pay 30, 20, or 10 percent towards each covered condition,” Stone explains. The higher your monthly premium, the more you’ll get reimbursed for each incident. Stone says most people would rather pay a higher monthly premium than put a lot of money into each service — especially if they don’t have a lot in savings to pay for 10 to 30 percent of an emergency vet bill. But this is entirely up to you.

Here’s an overview of the best pet insurance companies on the market.

Our mission at SheKnows is to empower and inspire women, and we only feature products we think you’ll love as much as we do. Lemonade is a SheKnows sponsor, however, all products in this article were independently selected by our editors. Please note that if you purchase something by clicking on a link within this story, we may receive a small commission of the sale.

Lemonade

BUY NOW:

Price: $”” $””

Buy Now

rgwc=1&utm_source=sheknows_pet_us&utm_medium=partners_online” asin=”” button_layout=”price_inside” version=”2″]

This insurance company has a base pet plan that covers accidents and illnesses — specifically, the diagnostics, procedures and medications involved, whether your dog or cat breaks a bone, swallows a Lego or develops hip dysplasia — after various waiting periods that range from two days to six months. Lemonade also offers add-on options and preventive packages that kick off immediately. The company prides itself on reimbursing claims quickly (up to 90 percent), depositing funds directly into your bank account. Plans start at $10 a month, and deductibles and copays may apply.

Age restrictions: Eight weeks to 14 years

Plans available: Accident and Illness, Preventive Care and Preventive Care+ with dental cleaning

Deductible options: $100 to $500 per year

Reimbursement options: 70%, 80% or 90%

Coverage limits: $5,000 to $100,000

Pros: Claims can be approved and paid instantly by Lemonade’s AI-powered platforms; payments can be made directly to the vet; preventive care options are available.

Cons: Claims can only be filed through the app, and you cannot interact with a human representative.

Paw Protect

There’s something very unique about Paw Protect: in addition to accidents, illnesses and preventive care, they provide members with an interest-free $2,000 line of credit to use in the event of a vet bill you can’t afford. They also offer 10% if you take out an additional pet policy, and they’ll reduce your deductible by $50 for each year you don’t make a claim. You’ll also get back $25 a year if you opt for a wellness plan.

Age restrictions: Up to 14 years for accidents and illnesses; 15 years and older for accident-only.

Plans available: Accident and illness, Accident-only and Wellness (as an add-on)

Deductible options: $100 to $500

Reimbursement options: 70% to 90%

Coverage limits: $5,000 to unlimited

Pros: Interest-free line of credit; some coverage for senior dogs; preventive care; incentives for covering more than one pet; 24/7 telehealth line.

Cons: Illnesses not covered for senior dogs; $25 enrollment fee.

Careplus by Chewy

The beloved pet supply brand offers both wellness and emergency/illness insurance plan options that make your life as a pet parent easier. They pay the vet directly — any vet in the U.S. offer unlimited lifetime coverage and cover prescriptions 100 percent. Chewy even offers telehealth services. Waiting periods are up to two weeks at the most.

Age restrictions: Two months to unlimited.

Plans available: Accident only, Value, Essential, Essential Plus and Complete

Deductible options: $250

Reimbursement options: 70%, 80% and 90%

Coverage limits: Unlimited

Pros: Direct payment to vets; telehealth access seven days a week; full reimbursement; a lot of plan tiers, some including preventive care.

Cons: Up to a month waiting period; Premiums on the higher side.

Trupanion

Trupanion will reimburse the vet directly up to 90 percent, offers unlimited annual coverage and flexible deductible options, and their customer service agents are there for you 24/7. They cover accidents, illnesses — even those developed through breeding — and add-ons such as boarding and third-party property damage. However, Trupanion doesn’t offer preventive care. Trupanion places no limits on claims or incidents per year or lifetime payouts — a particular benefit for someone who has an unlucky pet or one with lifelong health conditions. Once your pet has been approved for insurance coverage, Trupanion will work with you to adjust your deductible as needed.

Age restrictions: 0 to 14 years

Plans available: Accident and illness plan (plus add-ons)

Deductible options: $0 to $1,000

Reimbursement options: 90%

Coverage limits: Unlimited

Pros: No annual caps; rates won’t increase as your pet ages; payment directly to vets; offers pet owner assistance add-ons.

Cons: Preventive care is not covered; vet exams not covered.

Fetch

Fetch (formerly PetPlan) is the only insurance option that offers the option of 100 percent reimbursement to all veterinarians in the U.S. and Canada. Other reimbursement amounts are available for pet owners looking to control their premiums. And Fetch covers all accidents and illnesses with no restrictions for hereditary or congenital conditions. They even cover acupuncture!

Age restrictions: 6 weeks and up

Plans available: Accident and illness plan

Deductible options: $200, $350 or $500

Reimbursement options: 70%, 80% and 90%

Coverage limits: $5,000 to $15,000

Pros: No maximum age limit; covers up to $1,000 in telehealth visits; offers some dental coverage.

Cons: Does not pay the vet directly; no preventive care.

Healthy Paws

Not only does this insurance cover your sick or injured pet, it also provides first-rate coverage for animals with chronic (but not pre-existing) conditions. Healthy Paws offers unlimited lifetime benefits, and there is no cap or limit on individual claims. Your deductible is annual and not per incident, so it’s a money-saver for anyone whose pet spends a lot of time at the vet. And you can customize your deductible based on what you’re willing and able to afford out-of-pocket.

Age restrictions: 8 weeks to 14 years

Plans available: Accident and illness

Deductible options: $100 to $500

Reimbursement options: 70% to 90%

Coverage limits: Unlimited

Pros: No annual caps; cancer treatment is covered (not as an add-on).

Cons: Dental care is not included; routine care is not included.

More Top Deals from SheKnows

Best of SheKnows

25 Under-$20, Miracle-Working Nail Care Products That'll Heal Your Dry, Cracked Nails

Become Your Own Interior Designer With One of These Online Classes

67 Costco Products That Have Gained a Cult Following for a Good Reason

Sign up for SheKnows' Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.