Beauty Rolodex: European Investors

Europe-based beauty investors continue to multiply in the beauty arena as a host of new brands increasingly come to market. Following are some key players — venture capital, private equity and strategics’ investment arms — on the Continent and in the U.K., listed in alphabetical order.

More from WWD

360 Capital

Headquarters: Paris and Milan

Current Beauty Investment: 900.care

Deal Size: In pre-seed and seed, it invests initial ticket ranging from 150,000 euros to 2 million euros. In series A, it invests between 2 million euros and 6 million euros.

Key Player: Emanuele Levi, general partner

Active Partners

Headquarters: London

Current Beauty Investments: Facetheory and Vieve

Deal Size: Invest 200,000 pounds to 750,000 pounds in seed rounds and 5 million pounds to 15 million pounds in growth rounds.

Key Player: Jason Mahendran, partner

Alven Capital Partners

Headquarters: Paris

Current Beauty Investments: Joone, Planity, Typology

Deal Size: Invests between 1 million euros and 10 million euros, mainly in seed and series A1 rounds.

Key Player: Guillaume Aubin, managing partner, and François Meteyer, partner

Auréa Group

Headquarters: Paris, London and New York

Current Beauty Investment: Dcypher

Deal Size: Invests in companies with sales of between 2 million euros and 20 million euros.

Key Player: Karim Abbas, founding partner

Balderton Capital

Headquarters: London

Current Beauty Investment: Beauty Pie, THG

Deal Size: Dedicated early stage and growth funds — writing checks from $1 million to $60 million per round.

Key Player: Laura McGinnis, associate

BlueGem Capital Partners

Headquarters: London

Current Beauty Investments: QMS Medicosmetics, Iconic London, BeautyNova Group, Dr. Vranjes Firenze, Ecooking

Deal Size: Invests 30 million euros to 70 million euros

Key Players: Mathieu Develay, partner, and Constantin Rojahn, investment director

BOLD (Business Opportunities for L’Oréal Development)

Headquarters: Clichy, France

Current Beauty Investments: Documents, Functionalab Group, Sparty, Prinker, Salon Interactive, Digital Village, Replika Software, Gjosa, Microphyt, Carbios, Global Bioenergies

Deal Size: Stage-agnostic, with focus on series A and B, flexible deal size

Key Players: Samantha Etienne and Presca Ahn, investors

Citizen Capital

Headquarters: Paris

Current Beauty-Related Investments: Hub.Cycle, What Matters

Deal Size: Invests between 1 million euros and 18 million euros.

Key Player: Diane Roujou de Bonbée, investment director

Eurazeo Brands

Headquarters: New York and Paris

Current Beauty Investments: Nest New York, Beekman 1802, Gisou, Pangaea

Deal Size: Invests 15 million euros to 100 million euros, minority and majority stakes.

Key Players: Jill Granoff, chief executive officer (N.Y.); Adrianne Shapira, head of North America (N.Y.), Laurent Droin, head of EMEA (Paris)

Eutopia

Headquarters: Paris, New York, Madrid and Amsterdam

Current Beauty Investments: Oh My Cream!, Laboté, Même Cosmetics, Merci Handy

Deal Size: Invests in seed and series A stage in rounds from 1 million euros to 8 million euros.

Key Player: Camille Kriebitzsch, partner and cofounder

Experienced Capital

Headquarters: Paris

Current Beauty Investments: L:a Bruket, Oh My Cream!

Deal Size: Invests in brands with enterprise value between 10 million euros and 100 million euros, and equity tickets between 10 million euros and 30 million euros.

Key Player: Alban Gérard, partner

Fable Investments (Natura & Co.’s VC fund)

Headquarters: Luxembourg

Current Beauty Investments: Perfumer H, Maude, Stratia, Loli Beauty

Deal Size: Invests from 2 million euros to 10 million euros.

Key Player: Thomas Buisson, managing director

Famille C Participations (Courtin family holding company)

Headquarters: Paris

Current Beauty Investments: Ilia, Pai Skincare, Ceremonia

Deal Size: Invests without constraint of company size, investment phase or exit horizon, in majority or minority.

Key Player: Prisca Courtin, chief executive officer

Firstminute Capital

Headquarters: London

Current Beauty Investments: Typology, Asystem, Kyra

Deal Size: Equity tickets run between $1 million and $5 million.

Key Player: Brent Hoberman and Spencer Crawley, cofounders and managing partners

Founders Future

Headquarters: Paris

Current Beauty Investments: Epycure, Dr. Elsa Jungman, Jho

Deal Size: Invests in seed and series A rounds

Key Player: Thomas Bajas, principal

Grazia Equity

Headquarters: Stuttgart, Germany

Current Beauty Investment: Gitti Conscious Beauty

Deal Size: Investment usually starts at around 1 million euros and ranges from 5 million euros to 10 million euros during a company’s lifecycle

Key Player: Jochen Klüeppel, partner

Impala

Headquarters: Paris

Current Beauty Investments: Augustinus Bader, Laboratoire Native (including Roger & Gallet, Lierac, Phyto and Jowaé), P&B Group

Deal Size: Has taken stakes upward of 20 percent.

Key Player: Vincent Revol, associate director

Index Ventures

Headquarters: London, New York and San Francisco

Current Beauty Investments: Glossier, Beauty Pie, Josh Wood Colour, Beautystack, Boulevard

Deal Size: Invests from seed to growth rounds through to IPO, with check sizes ranging from hundreds of thousands of dollars to $80 million. Seven out of 10 of Index’s initial investments are seed or series A.

Key Player: Danny Rimer, partner

IRIS Ventures

Headquarters: Barcelona and London

Current Beauty Investment: Olistic

Deal Size: Leads or co-leads series A investments and co-investments in later-stage rounds

Key Player: Montse Suárez, founder and managing partner

Karot Capital

Headquarters: Paris

Current Beauty Investments: Sevessence, WAAM

Deal Size: Invests first 300,000 euros to 2 million euros as a minority shareholder

Key Player: Charles-Antoine Morand, partner

L Catterton Europe

Headquarters: London, Paris and Milan

Current Beauty Investment: Pibiplast

Deal Size: Invests in middle-market growth companies in Western Europe between 30 million euros and 100 million euros.

Key Player: Jean-Philippe Barade, partner

LBO France

Headquarters: Paris

Current Beauty Investment: Payot

Deal Size: Primary or secondary LBO with an equity ticket of between 10 million euros and 25 million euros for companies with an enterprise value of 25 million euros to 100 million euros.

Key Player: Emmanuel Fiorentino, investment director LBO Small Cap

Made in Italy Fund

Headquarters: Luxembourg

Current Beauty Investment: Rougj

Deal Size: Invests in companies with sales mainly ranging from 10 million euros to 50 million euros.

Key Players: Alessandro Binello and Walter Ricciotti, founders and chief executive officers of parent company Quadrivio Group

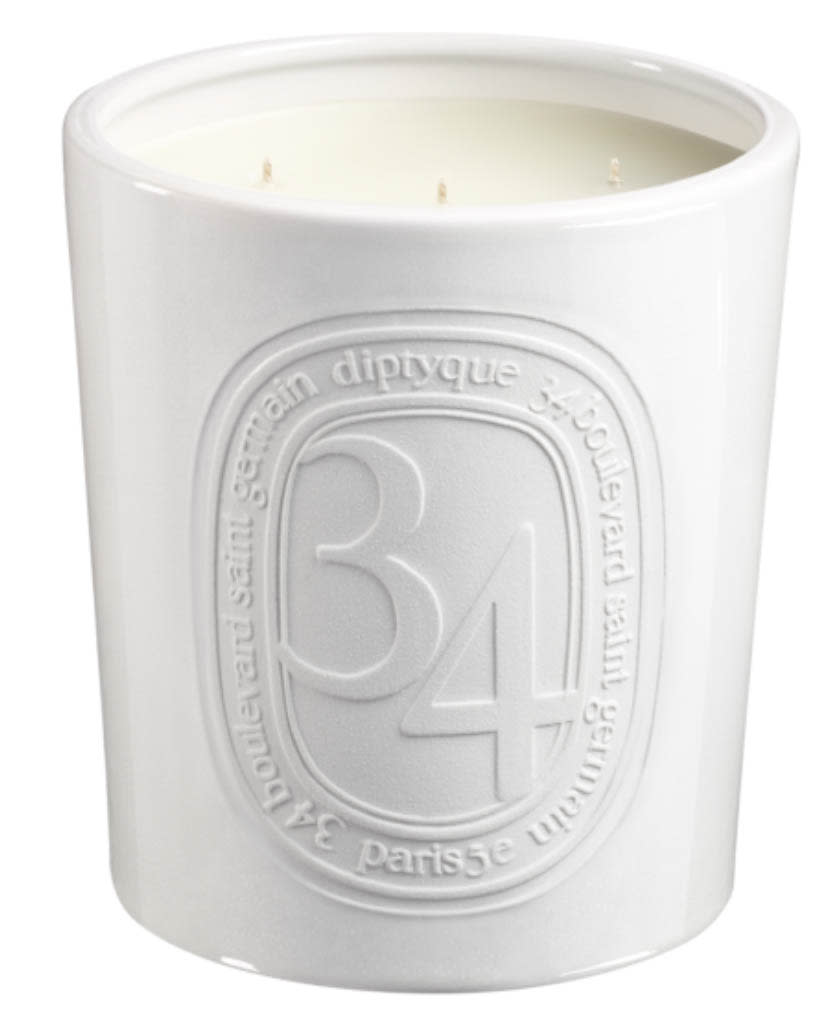

Manzanita Capital

Headquarters: London

Current Beauty Investments: Diptyque, Malin + Goetz, SpaceNK, Susanne Kaufmann, Glossier, Unbound, A-Frame, SuperOrdinary, Sam McKnight, Byredo

Deal Size: It makes acquisitions, while its venture portfolio makes early-stage investments, typically in the first or second round of fundraising. Manzanita can lead, co-lead or co-invest in companies.

Key Player: Harry Richards, investment director

NEO Investment Partners

Headquarters: London

Current Beauty Investments: Miller Harris, Victoria Beckham Beauty

Deal Size: Invests between 10 million euros and 30 million euros in companies with sales of 20 million euros to 40 million euros

Key Player: David Belhassen, founder and managing partner

Octopus Ventures

Headquarters: London

Current Beauty Investments: Elvie, Skin & Me

Deal Size: Invests in pre-seed rounds of about 100,000 pounds from the pan-European fund, and seed to series B rounds, starting at investments of 1 million pounds.

Key Players: Kirsten Connell and Maria Rotilu, investors

Ohana & Co. (Incubator)

Headquarters: Paris, New York and Los Angeles

Current Beauty Investments: Fré, WhatMatters, Face D, Respire, Kos Paris, Angela Caglia, My Lubie

Deal Size: Invests in early-stage companies between 500,000 euros and 5 million euros

Key Player: Karine Ohana, managing partner

Obratori (L’Occitane Group’s corporate VC fund)

Headquarters: Marseille, France

Current Beauty Investments: Le Rouge Français, Eclo, Abyssea, InHairCare, Medene, Paper Cosmetics

Deal Size: Invests solo or in co-investments with tickets between 100,000 euros to 300,000 euros. Invests in early-stage start-ups with a PoC, MVP and 1st market traction. Invests in minority stakes between 5 percent and 20 percent. It does not reinvest in subsequent rounds.

Key Player: Delphine Oung, investment manager, and Arthur Vachelard, VC analyst

Piper Private Equity

Headquarters: London

Current Beauty Investments: Neom, Wild Nutrition

Deal Size: Invests 5 million pounds to 25 million pounds in brands with at least 5 million pounds in sales

Key Player: Dan Stern, partner

Raise Investissement

Headquarters: Paris

Current Beauty Investments: Blissim, Clinique des Champs-Elysées

Deal Size: Invests minority stakes of 10 million euros and 50 million euros in French companies with sales of 50 to 500 million euros

Key Player: Alexandre Dupont, co-head

Silverwood Brands

Headquarters: London

Current Beauty Investments: Balmonds, Nailberry, Steamcream, Cigarro

Deal Size: 2 million pounds to 500 million pounds

Key Players: Paul Hodgins, non-executive director, and Andrew Tone, executive director

Unilever Ventures

Headquarters: London and Mumbai

Current Beauty Investments: Be For Beauty (The Inkey List), Beauty Bakery, BYBI, Exponent Beauty, ESQA, Frank Body, Kopari, Live Tinted, Minimalist, Pangaea, Perelel, Plant People, Plum, Rael, Sachajuan, Saie, Sentials, The Nue Co., Thesis, Thryve, Trinny London, True Botanicals, UOMA, Volition, Straand, Womaness, Youvit

Deal Size: It offers flexible capital, investing from $500,000 to $15 million, seed to series B rounds.

Key Player: Olivier Garel, managing partner, and partners Rachel Harris, Pawan Chaturvedi, Anna Ohlsson-Baskerville and Stephen Willson

Vaultier7

Headquarters: London

Current Beauty Investments: Gisou, Joone, 111Skin

Deal Size: Invests 2 million pounds to 10 million pounds in companies with sales of 3 million pounds to 15 million pounds

Key Player: Anna Sweeting, founder

White Star Capital

Headquarters: London

Current Beauty Investment: 900.care

Deal Size: Series A to series B

Key Player: Matthieu Lattes, general partner

Best of WWD