Beauty Is About to Re-Enter Its Dupe Era

Amid rampant inflation and economic uncertainty, experts say dupes, "premiumization" and emotional purchasing will carry the industry through.

If it seems like beauty products are getting pricier these days, it's because they are.

Inflation isn't just hitting grocery items and rent; it's also impacting beauty products, which are undergoing major cost increases — as much as 11% over the past year, according to Nielsen IQ. And it seems no segment of the category is immune: Generic shampoo is seeing price hikes, while luxury products' costs are also trending upward.

"On the mass market side, you have a greater diversity of income levels, and therefore you're feeling a little bit more of the pinch," says Larissa Jensen, the vice president beauty industry advisor at Circana. "Basically what's happening is you have these higher income consumers that are more engaged and also spending more than they did prior to the pandemic, like almost double what they were spending... they are also the least likely to feel some of those inflationary pressures, so they're able to treat themselves."

The "Premiumization" of Beauty Essentials

Beyond inflation hitting the beauty aisles, there's also a relatively new pricing method that's gaining widespread traction. Anna Mayo, the vice president of beauty at Nielsen, calls it the "premiumization" of beauty, or when beauty essentials get a makeover, followed by a markup. Deodorant is one example of a product that's gotten the premiumization treatment of late.

"You're not expanding consumption of deodorant, right? You're not getting people to use more deodorant. But the category has grown," Mayo explains. "In 2022, it's up almost 15%, and that's all a premiumization story. Shoppers are switching over to these more natural deodorants, which can be like three or four times the price of a conventional deodorant."

In other words, beauty brands are finding new ways to market their products that then allows them to also increase prices. In some ways, that's a tale as old as time, but it's also having a very real impact at the moment. One Speed Stick costs about $3 at Walgreens, versus Native's aluminum-free version, which is priced at $13.

"It's a really interesting value story: The industry has proven to people why they should make the switch and why it's 'better' for them. Consumers are kind of happy to do it because they find a personal benefit in switching to something with 'cleaner' and more natural ingredients in it. That's kind of a great story about how a category can premium-ize," says Mayo.

Price changes are, predictably, having drastically different impacts on different customer sectors. Those with incomes of more than $100,000/year tend not to change their shopping behavior in times of high inflation, but many others can't afford today's higher beauty prices, especially when that can include numbers more than triple the norm. It's getting more challenging for folks to afford their typical beauty routines, and as a result, the beauty market is poised for a shift.

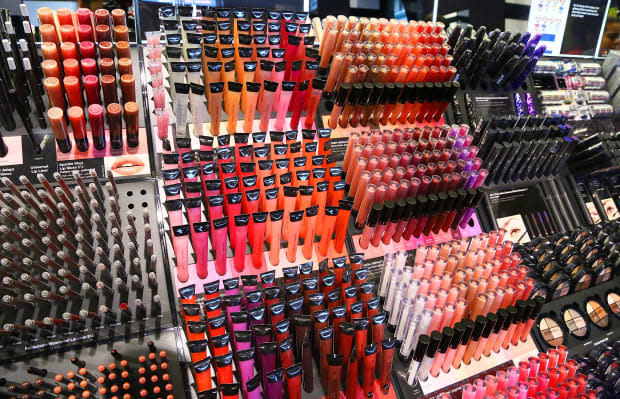

Photo: Charley Gallay for Stringer/Getty Images

A Return to Dupe-Focused Beauty Brands

"Dollar sales for beauty have been really healthy," Mayo says. "But it's not the same story with units. People are spending more: They're continuing to purchase even though prices are going up. But they are cutting back a little bit in some ways," like reducing the frequency of purchasing an item, she notes.

It's paving the way for the rise of an anti-premiumization kind of beauty business. Enter: dupe companies, or brands that make less expensive versions of pricey products.

Dossier, for instance, is a fragrance brand that draws "inspiration" from designer scents, offering its own riffs on them, often for less than half the price. If the $300 price tag on Maison Francis Kurkdjian's viral Baccarat Rouge 540 is out of your budget, Dossier offers its $49 "Ambery Saffron" as a substitute. Meanwhile, companies like The Ordinary and Beauty Pie focus on popular ingredients in skin care and offer formulas spotlighting them, often at fractions of the costs of others. While none of these companies are new — and beauty dupes have been popular for years — this category of the market offers unique potential at the moment, and it's seeing a bit of a resurgence in piquing consumer attention.

"What's really exciting is the innovation in this industry and how entrepreneurs really rise to meet the challenge and meet the moment that we're in," she says. These dupe brands are offering what Mayo calls a "democratization of price points."

What's more, understanding the current state of beauty is not as simple as matching customer incomes to product prices. Thanks to the myriad of categories within beauty, Jensen says there's more nuance to it than assuming that customers are only buying the products that match their take-home pay.

"Don't underestimate the 'treat [yourself]' mindset. Yes, the higher-income consumer makes up the majority of the buyer for total beauty, but... there's this big growth that we're seeing in fragrances. The drivers of that are actually lower income and more ethnically diverse consumers. It's almost like, yes, you could make the blanket statement, but you have to recognize that there are differences within categories," notes Jensen. "There's a lot more happening underneath the layers, so I don't believe a blanket statement is necessarily accurate, because anyone can treat themselves."

Photo: Astrid Stawiarz/Getty Images for Sephora

Re-Thinking the "Lipstick Index" for 2023

History doesn't always repeat itself, and relying on an understanding of what happened in beauty during previous recessions may not be entirely helpful in analyzing the current landscape, or where it's headed in the immediate future.

The so-called "Lipstick Effect" — coined by Estée Lauder executive Leonard Lauder in 2001 — has been a popular temperature check for consumer sentiment in the beauty market. It posits that consumers spend more on lipstick and similar little luxuries during recessions and times of economic downturn. In other words, when lipstick purchases go up, it signals economic stress.

While Forbes reported that the effect indeed kicked in last summer, Mayo is cautious about its reliability in today's market. "It's hard to tie one product to consumer sentiment. It's a nice idea. I think some people cut certain data points and then make it work, but we're looking at the full market of beauty: So, $90 billion in sales in the U.S.," she says. Essentially, with the beauty industry the size it is now, there are many alternatives to lipstick when it comes to small luxuries.

For examples, "With lipstick being an impractical treat for yourself [during the pandemic], fragrance stepped in to take its place, and fragrance sales skyrocketed," explains Jensen. Despite fragrance typically being more expensive than lipstick, Jensen attributes the behavior to an emphasis on mental wellness in today's beauty culture. Many beauty purchases will likely continue to be driven by emotions or wellness goals.

"When you think about beauty as an industry, there are very few industries that are better positioned to meet consumers' emotional needs," she explains. "In many ways, this is also a part of what is driving performance."

Want the latest fashion industry news first? Sign up for our daily newsletter.