Asos Revives Topshop, Topman for a New, Digital Generation

LONDON — After more than 18 months of ownership, Asos is ready to reveal the latest iteration of British cult clothing labels Topshop and Topman.

On Thursday the company will showcase a new visual identity for the sibling labels that it purchased in early 2021 from Arcadia Group, which filed for bankruptcy during the pandemic.

More from WWD

Inspired by signage from old Topshop and Topman stores, the visual identity will appear as a digital storefront on a stand-alone landing page on Asos.com. This is the first time Asos is dedicating a stand-alone storefront to brands in its portfolio.

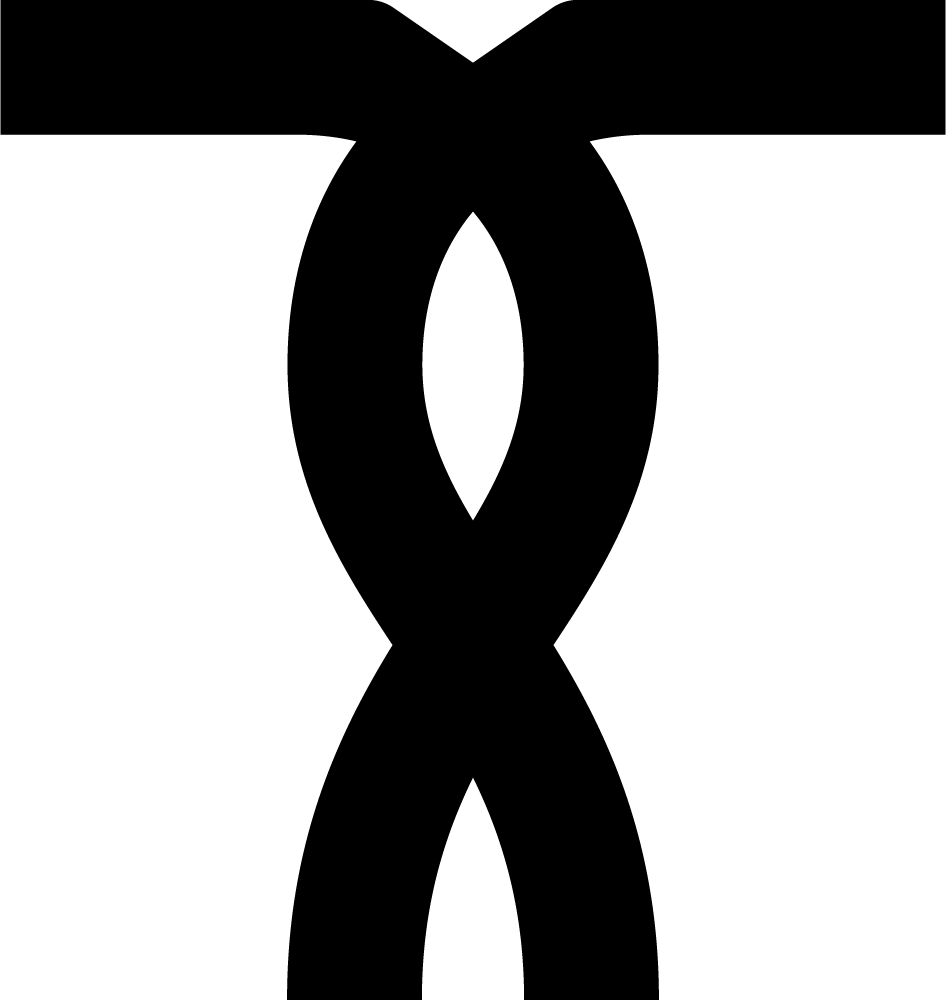

A new monogram features interlocking Ts in a bid to unite the two heritage high-street brands under one banner and aesthetic. While Topshop and Topman had always been related, and shared shop floor space, this is the first time they’ve been marketed under one banner.

In an exclusive interview, Nikki Tattersall, an Asos veteran and the director of Topshop and Topman, said the e-commerce giant is introducing “reinvigorated collections with a laser focus on quality, design, fit and fabric.”

Price points are similar to what they were in the past, although Tattersall did not elaborate. She said Asos was “very much focused on finding the right value” and seeking the best possible fit, quality fabric and pricing.

Topshop and Topman will remain “head-to-toe” brands, offering accessories and product extensions in line with what customers want, Tattersall said.

There is a strategic focus on the brands’ most popular categories, including denim, dresses and tailoring. Tattersall said the design teams remain the same as those who worked under the ownership of Philip Green’s Arcadia.

Tattersall said Asos was keen to “harness the knowledge and expertise” of the creative teams and “reignite their creativity and autonomy. We’re putting the focus right back on fashion, and putting the customers’ needs at the heart of our decisions.”

She added that it was crucial for Asos to highlight the individual aesthetic of Topshop and Topman and ensure they stood apart from the other clothing brands in the Asos portfolio. That’s why they’ll have their own digital storefront and landing page.

While Asos has preserved so much of both brands’ DNA, it has also made changes. Asos has been working with the design teams on a “digital-first” approach. In the past, Topshop and Topman sold mainly through physical stores, although they did have an e-commerce element.

Tattersall said the two distribution channels were very different, and Asos has been working closely with teams on issues such as “phasing, timing, color options and styling” of the merchandise to ensure that the collections appeal to a customer who is buying online rather than browsing a shop floor.

Even in the darkest days of Arcadia’s financial woes, and last year’s transition to new ownership, Topshop and Topman continued to perform well on the shop floor.

Topshop and Topman sell through 100 Nordstrom stores in North America, and Tattersall said business in the region is booming.

“Our Nordstrom partnership is particularly exciting,” she said, adding that she made a recent visit to Los Angeles to lay out the new branding and strategy for the North American teams.

Jennifer Gross, senior director of Strategic Brand Partnerships, Nordstrom, said the retailer is “energized and excited about the next chapter for Topshop and Topman. Their team has put a ton of effort into understanding the brands’ historical fashion strengths, and we look forward to seeing that same spirit continue in the next chapter.

“We’re impressed by the attention to detail in the new collections as well as the level of investment from a fashion perspective. There is a strong London essence in the collections, and we think Nordstrom customers are going to respond well. We’re proud to be the exclusive physical retailer for Topshop and Topman in North America and we think our customers and team members are super eager for this next chapter of Topshop Topman history.”

Tattersall declined to say whether the revamped Topshop and Topman would have a physical presence outside of North America.

Under Asos, Topshop and Topman will have a wider reach globally and be delivered to 230 territories.

For the first time, Topshop and Topman will introduce “truly inclusive sizing” through the new Curve range, which covers sizes 18 to 28. That also applies to Topshop’s bestselling denim range, including the popular Jamie and Joni styles.

Asos has invested further in Topshop’s maternity, tall and petite collections, too. Tattersall said that inclusivity in terms of sizing, diversity of offer and audience appeal was “non-negotiable” for Asos.

For fall 2022, Asos will introduce a series of limited-edition pieces that it describes as “the purest expression” of the brands’ new vision. She said the limited-edition pieces have a more elevated, directional aesthetic, with key designs manufactured in the U.K., many of them at factories and workshops in London.

Tattersall said “taking stewardship of such a beloved institution has been a privilege. Over the last 18 months, we have done some incredible work, learning from the past, and from each other, to create something exciting and relevant for the future.”

Going forward, more collaborations — with music, pop culture, art and other creative industries — could be in the cards, Tattersall added. “We want to cement the brands’ place in fashion and culture, and partner with talent from various different avenues,” she said.

Until late 2020 Topshop was a multibrand emporium selling makeup, accessories, jewelry and even cupcakes from its buzzy ground-floor space on Oxford Street and its other U.K. stores.

Both Topshop and Topman have been around since the ’60s and have long been synonymous with youth culture in Britain. Many fashion designers, editors, PRs and buyers in the U.K. worked Saturday jobs at the two brands, or spent their weekends shopping in the stores.

It was under brand director Jane Shepherdson, who left in 2006, that Topshop became an internationally recognized retailer — and a destination on the London retail circuit. On her watch Topshop looked beyond the runways, and to the burgeoning street-style scene, for inspiration. She also tapped London fashion brands from Zandra Rhodes to JW Anderson to create capsule collections for the retailer.

Under former owner Green, Topshop would go on to broker celebrity deals with Kate Moss, Beyoncé, and Kendall and Kylie Jenner for clothing, lingerie and makeup. Topshop was also a headline sponsor of London Fashion Week, bankrolling its own, large-scale venue during shows and supporting designers including Shrimps, Molly Goddard and Charlotte Knowles.

As reported last year, Asos won the bidding race for Topshop, Topman, Miss Selfridge and HIIT, the flagships in now-defunct Arcadia.

The price of the deal was 330 million pounds, minus the store portfolio, and some argued at the time that Asos picked up a bargain.

The online giant bought the brands, intellectual property and inventory in a deal that mirrors Boohoo’s acquisition of Debenhams last year.

Asos has since integrated the brands into its platform and their revenues and profits will be consolidated within the larger group.

Asos, which was already selling Topshop on its multibrand platform, said last year the overlap between its own customer base and that of Topshop was part of the attractiveness of the deal, as was the fashion retailer’s established presence in international markets, including the U.S. and Germany.

“The acquisition will help accelerate our multibrand platform strategy,” said Nick Beighton, then chief executive officer of Asos, who has since taken up the CEO role of Matchesfashion.

According to Euromonitor, the acquisition secured Asos’ place among the top five online players in the apparel and footwear e-commerce space, and allowed it to offer a “better balanced” product assortment between the Asos brand and third-party labels.

Last year’s sale also came with store closures and job losses.

While up to 300 employees working across the labels’ design, retail partnerships and buying departments moved over to Asos, thousands of jobs at the brands’ 70 or so physical stores across the U.K. were lost.