Amazon Luxury Stores Is Heading to Europe

LONDON — Amazon Luxury Stores is preparing to debut in Europe later this year, according to industry sources, although the competition for brands — and fashion customers’ wallets — will be more ferocious than ever.

Amazon is said to be readying a rollout for November, although the lineup of brands set to join remains in flux. Both Dundas and Elie Saab, which already sell on the U.S. Luxury Stores site, plan to join the European platform.

More from WWD

Amazon Prime Day 2020: Fashion and Beauty Deals to Check Out

A Look Back at The Battle of Versailles Fashion Show in 1973

An Amazon spokeswoman said the company cannot comment on rumors or speculation. The brands declined to comment.

Luxury Stores rolled out a year ago in the U.S. as a by-invitation-only platform for Prime members located inside the Amazon app.

Although it was originally aimed at those Prime customers, it is now available to a wider U.S. audience on desktop, mobile and tablet browsers, in addition to the Amazon app.

Luxury Stores also boasts a growing roster of international names including Oscar de la Renta, Mark Cross, Christopher Kane, La Perla, Deveaux, Mira Mikati and Boglioli. It has added beauty brands including Clé de Peau Beauté and RéVive Skincare.

Amazon is understood to be happy with the interest it has drawn both from emerging and well-known brands, and from the fashion-loving segment of its consumer base.

It has also been hard at work promoting the platform with a “Smile! It’s Summer” campaign featuring Paloma Elsesser, Georgia May Jagger and Luka Sabbat, and a springtime initiative supporting Red Carpet Advocacy and its charities.

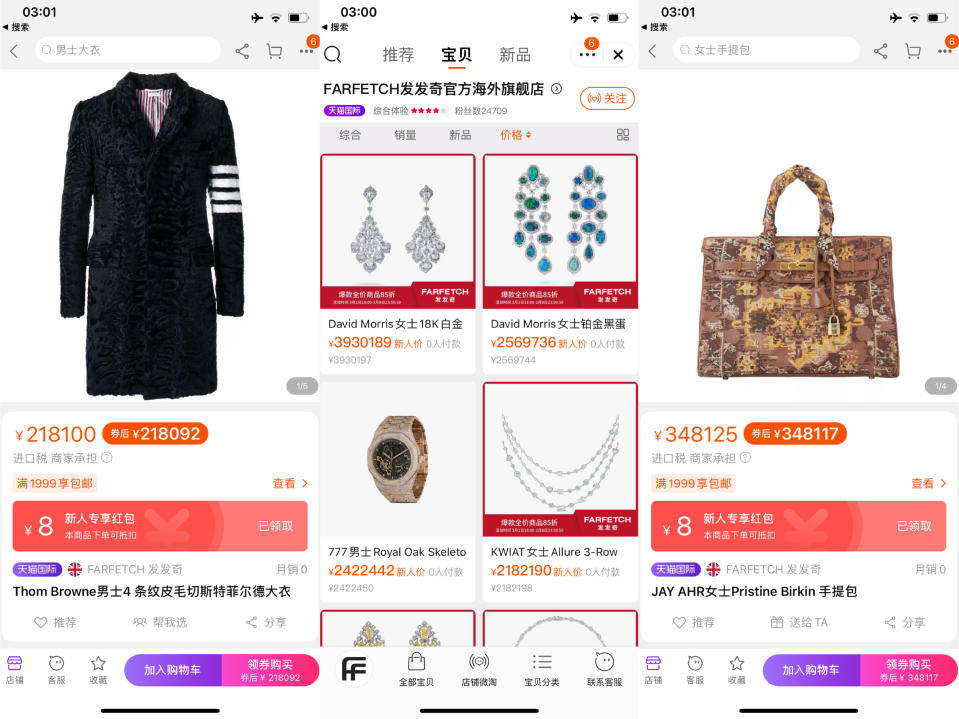

Screenshots/WWD

Some of the brands on the platform have been reporting robust sales, and remain transfixed by the potential of reaching even a fraction of Amazon’s customers. But there are those who believe the momentum might not transfer to Europe given all the homegrown, multibrand fashion and luxury sites such as Zalando, Farfetch, Mytheresa, Net-a-porter, Matchesfashion and the LVMH Moët Hennessy Louis Vuitton-owned 24 Sèvres.

Add the Tmall and JD.com dynamics to the punchbowl, and it makes for one potent cocktail of competition.

In the 12 months since Amazon Luxury Stores launched — and with online sales rocketing due to the pandemic — those European sites have been forging new, international alliances, raising money on the public markets and making further inroads in luxury.

According to one luxury chief executive officer, who requested anonymity, Zalando is fast becoming a formidable force in the fashion tech space and “putting luxury at the front of the agenda. They have become Europe’s version of Amazon luxury in what is now a very competitive market.”

Zalando, Europe’s largest online fashion platform which works with 4,500 international brands, already carries luxury names such as Roksanda, Victoria Beckham, Christopher Kane, Paul Smith, Bally and Moschino, some of which have stand-alone shops on the site.

Zalando also grants third parties access to its logistics network, enabling brands to sell their own inventory through the fashion store, and operates the Zalon style advice service, connecting freelance stylists with customers.

Courtesy of Sephora

Those customers keep coming back for more: In August, the German e-commerce giant said that in the first six months of its fiscal year, it saw massive growth during the COVID-19 pandemic and the ensuing lockdown: revenues totaled 4.97 billion euros, an increase of 39.7 percent on the previous year.

Like Amazon, Zalando has also been embracing luxury beauty. In June, the German giant inked a long-term strategic partnership with Sephora to create a prestige beauty experience online. It will start in Germany in the fourth quarter of this year.

Principals of both companies have said their goal is to create a matchless customer experience for Zalando’s 42 million active customers, with “hyper-personalization” one of their priorities.

Zalando isn’t the only threat to Amazon Luxury’s ambitions in Europe.

Late last year, Farfetch signed a global strategic partnership that saw Compagnie Financière Richemont, its Chinese ally Alibaba and Artemis Group — owned by the Pinault family that owns Kering — pour hundreds of millions of dollars into Farfetch Ltd., and into a new joint venture called Farfetch China.

As part of the deal, Farfetch launched on Alibaba’s luxury platforms in China, and added thousands of fashion and luxury brands to the Chinese site.

In addition, Farfetch has been positioning itself as an environmentally aware destination, releasing its first Conscious Luxury Trends Report, and promoting circular fashion through its Second Life retail service. Separately, it has added fine jewelry to the mix and has partnered with Wishi to bring new product suggestions and styling tips to shoppers.

The retailer 24S may not have as big or broad as its European competitors, but it has LVMH muscle behind it, and has also been raising its luxury profile.

Earlier this month, it tapped Charles de Vilmorin, the French fashion scene’s hottest up-and-comer, the new creative director of Rochas and a finalist for this year’s edition of the LVMH Prize for Young Designers, for an exclusive unisex capsule collection set to launch online on Sept. 9.

While Amazon may tower over Europe’s (and China’s) fashion platforms in terms of revenue and customer reach — according to a Kantar report, more than 50 percent of British households are Prime members, while worldwide, Amazon Prime counts 200 million members — Luxury Stores remains a work in progress.

Some brand managers interviewed for this story said they were disappointed both that Amazon had opened Luxury Stores to a broader audience (no longer restricting it to top Prime customers) and that the big-name luxury brands never arrived while in many cases they do sell on the likes of Net-a-porter, Mytheresa or Farfetch.

“There are no adjacencies to elevate the smaller brands that are already on the site,” said one manager who asked not to be named. Another one added: “We were expecting them to come up with the heavy hitting brands, but they haven’t so far.”

Another company chief who asked not to be named said it was unlikely their brand would make the leap to Amazon’s new European site. The person said it made more sense to be on Luxury Stores in the U.S. as the wholesale market is smaller with the recent closure of so many department stores in the region.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.