Alphabet revenue beats expectations as Google ad sales climb

Alphabet (GOOG, GOOGL), the parent company for search giant Google, reported quarterly sales results that beat consensus expectations, rebounding after posting soft top-line results during the quarter prior.

Here were the key numbers from the report, versus estimates based on Bloomberg-compiled data:

Revenue ex-TAC: $31.71 billion vs. $30.84 billion expected

Adj. earnings: $14.21 vs. $13.97 per share expected

TAC, or traffic acquisition costs, refer to payments Internet search companies pay to affiliates to direct traffic to their websites.

In the second-quarter report, Alphabet also announced its board had authorized a $25.0 billion repurchase of its Class C common stock.

Ahead of results, investors were laser-focused on Google’s ad business, which posted weaker-than-expected sales during the first quarter. Alphabet derives most of its company-wide sales from Google’s advertising business.

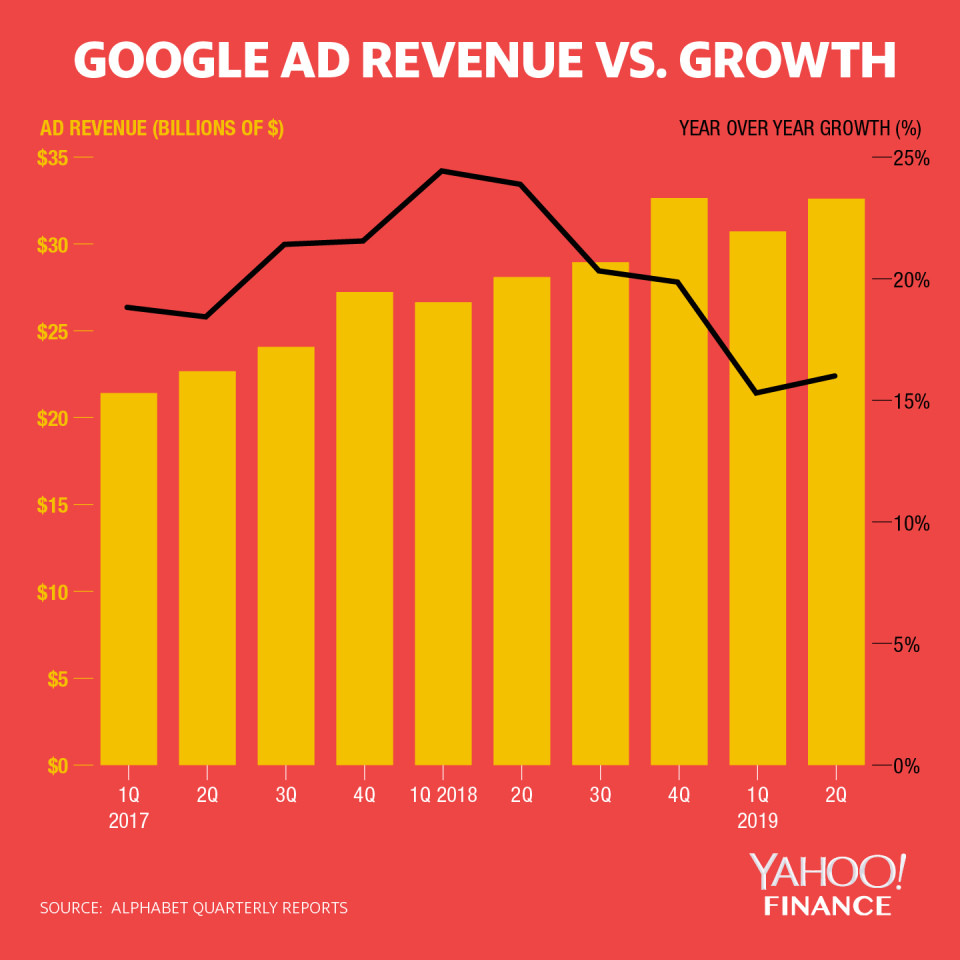

Google’s ad sales for the second quarter totaled $32.6 billion, an increase of 16% over last year and slightly ahead of consensus expectations for $32.58 billion, based on Bloomberg-compiled estimates.

The acceleration in Google’s ad sales growth helped allay worries of a persistent slowdown in Alphabet’s core business. Prior to Thursday’s results, Google’s ad revenue had decelerated on a year-over-year basis in each quarter since the second quarter of 2018.

Meanwhile, Alphabet saw more of its revenue flow to its bottom line, with traffic acquisition costs comprising a smaller portion of Google advertising revenue than during the year-ago period. Alphabet overall company operating margins improved to 24%, from 18% the quarter prior, and came in ahead of expectations for 22.6%.

“From improvements in core information products such as Search, Maps, and the Google Assistant, to new breakthroughs in AI and our growing Cloud and Hardware offerings, I’m incredibly excited by the momentum across Google’s businesses and the innovation that is fueling our growth,” CEO Sundar Pichai said in a statement.

Shares of Alphabet rose 7.41% as of 4:12 p.m. ET.

Google’s management, during last quarter’s earnings call, attributed its first-quarter ad sales growth slowdown to product changes in ads in the past year. Over the past couple months, Google announced new monetization methods for its Discover Feed through new Discovery Ad formats and revamped Showcase Shopping Ads.

Alphabet shares had fallen about 11.5% through Thursday’s close since the company last reported quarterly results in April.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Netflix’s 2Q global paid subscriber additions miss expectations

Tech companies like Lyft want your money – not ‘your opinion’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read the latest financial and business news from Yahoo Finance