Afterpay to Offer Monthly Payment Solution

Just in time for the holiday season, Afterpay is introducing a new monthly payment option to its roster of buy now, pay later solutions.

According to Afterpay’s Next Generation Index, since 2020, U.S. consumers spending using BNPL has increased 660 percent, equaling more than five times the rate of growth for debit card spending (43 percent) and credit card spending (8 percent).

More from WWD

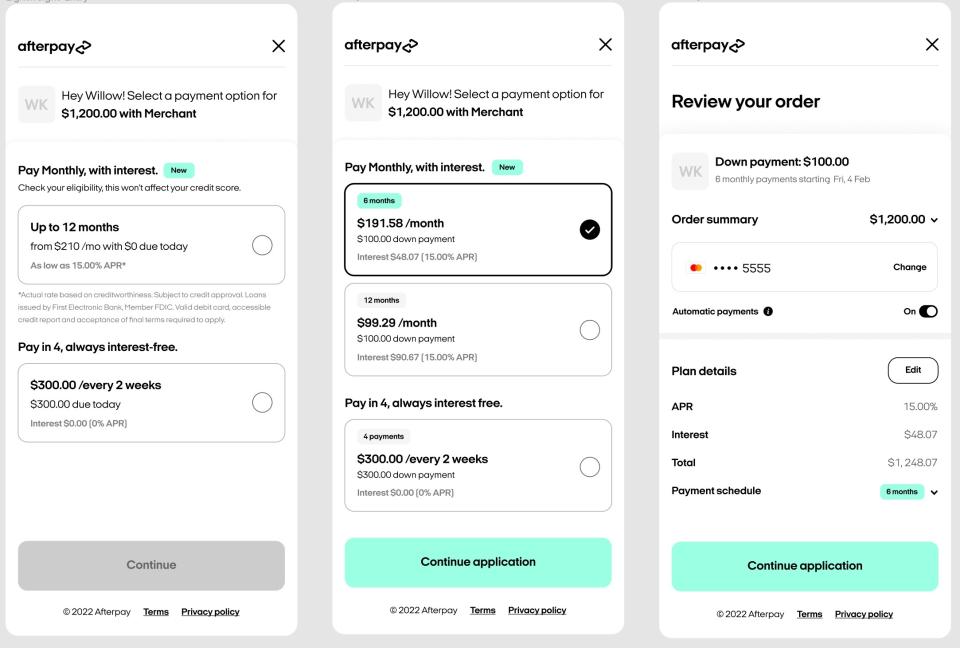

Now, by offering more time to pay through a monthly payment option, the company aims to give consumers even more choice and flexibility. The option allows consumers to budget payments over six- or 12-month periods and will be offered for purchases between $400 and $4,000.

The monthly payment option also includes Afterpay’s consumer-friendly payment terms including: no late fees, no compounding interest with a cap on total interest owed and transparent view of what is owed at the time of purchase.

“Our new offering is a natural extension of the Afterpay experience — giving customers a new way to take more control and have more choice in the way they pay,” said Lee Hatton, head of Cash App Asia Pacific. “We look forward to supporting customers with yet another smart budgeting tool.”

For merchants, Afterpay said, the new solution will allow for more items in more categories to be included in the payment plan without paying additional transaction fees or integration costs. Afterpay also expects merchants will benefit from new customer growth, increased sales and higher average order values.

Afterpay’s monthly payment solution will be available initially online, with plans to offer it for in-person purchases in 2023.