5 things you should be doing before you invest your money, according to a financial expert

Welcome to #Adulting, the ultimate breakdown for all your grown-up needs. These articles are here to help you feel less alone and answer all your personal, financial, and career questions that weren’t answered in school (no judgement, we get it!). Whether you’re looking to find out how to tackle laundry or you want a deep breakdown on how to make a savings plan—we’ve got you covered. Come back every month to find out what life skills we’re upgrading next and how.

Ah, females and finance. We all know we should be doing certain things to set ourselves up for comfortable futures, but often, we don’t know where to start. Or, better yet, we have an idea, but are overwhelmed by all the specifics. We get it: Words like investment and retirement fund aren’t exactly sexy. In fact, according to a study conducted by Merrill Lynch bank in partnership with Age Wave, 61 percent of women would rather talk about their own death than about money. Seriously?!

We think dealing with your finances is not only sexy, but empowering. While investing is a huge wealth generator, we know not everyone is ready (or has the funds available) to put their money into something that seems scary and even a bit unstable—a.k.a. “the market.”

That’s why we spoke to Lorna Kapusta, head of women investors at Fidelity, to chat about what you should do to set yourself up for that next step, even if you know it’s not right now (which, by the way, is totally okay!).

Finance is also not a one-size-fits-all topic. It’s deeply personal and can trigger all sorts of feelings about stability, our goals, and the idea that we need to provide, not only for ourselves, but our future families. So before we begin, take a deep breath—you’re probably already doing some of these things.

Simple steps to take before you start investing:

1Build yourself an emergency fund.

Before you start investing your money, let’s cover the basics. We all know that it’s generally a good idea to make sure we have some savings in case of an emergency, but how much is *really* necessary?

While there is no specific amount of money you should have saved before you start investing, Kapusta recommends having six months of expenses amassed in an account (specifically for rent, insurance payments and anything else you might pay on a monthly basis) to prepare yourself for the unexpected. You know, like for those times your tires blow out and need to be replaced or when you drop your phone and need the screen fixed ASAP.

“As long as you have three to six months of expenses, you can be in a more comfortable place because you know you have something to tap into,” Kapusta says. “Life happens.”

2Take advantage of those retirement benefits.

Yeah, retirement can seem like a long way away when you’re in your 20s or 30s, but it’s a reality that’s better to think about now than regret not planning for later. “If you can take care of your retirement now, even if it feels far away,” says Kapusta, “that money will grow and really add up by the time you need it.”

She suggests that if your company offers a 401(K) plan (which is just the technical term for a retirement savings plan that’s sponsored by an employer), take advantage of it. Her team typically recommends putting 10-15 percent of your paycheck towards it, but if that sounds like a lot, shoot for the percentage your company matches. Many companies will match (and therefore double) the amount you put aside, which is usually up to six percent. So if you can try and contribute a portion of that, you’re in good shape for that seemingly far-off-future goal.

And for those you who work freelance or own a business, don’t worry! You can still have personal accounts that you control yourself by setting them up through any online broker that work the same way. These are known as Traditional IRA or Roth IRA accounts, depending on the type you need. For this particular plan, invest as much as you feel comfortable doing that’s within your budget. While it’s important to save, it’s important to live, too.

Bottom line: It’s never too early to start thinking about retirement, and if you get your finances in order to save for it now, you’ll find you have more wiggle room to eventually invest (and also not stress) later.

P.S. Enrolling in a retirement fund is technically a form of investment, so you’re already making your money work for you by getting on board with this.

3Write down your financial needs and goals.

Once those two basics are out of the way, you can sit down and think about what exactly you need from your money. Are you saving for your future wedding? A down payment on a house? Finally being able to pay off your student loans?

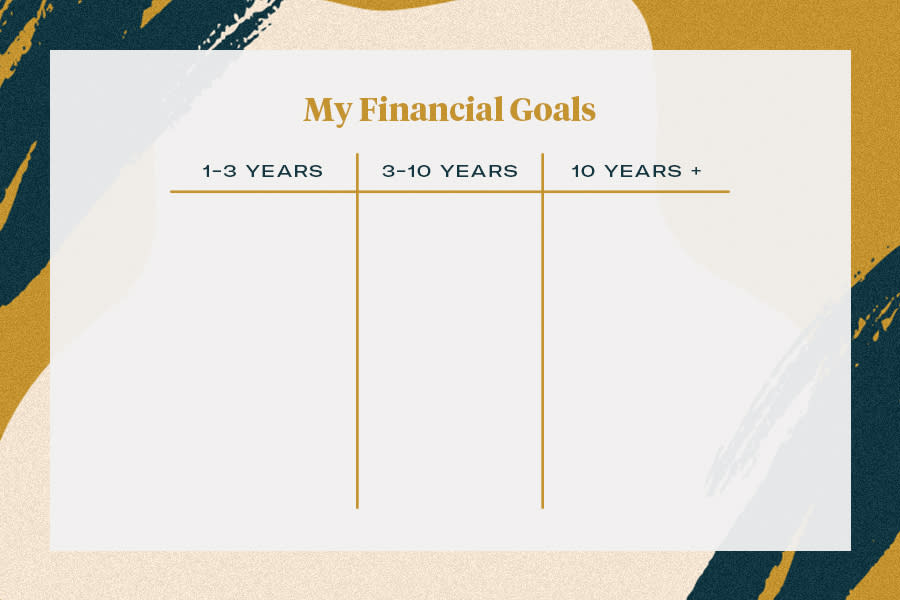

Taking a look at your big financial picture will give you the clarity you need to feel on top of your financial game, instead of being overwhelmed by it. Kapusta recommends to look at your financial goals in three “buckets”: one to three years, three to 10 years, and 10 years plus.

If it helps, try making a T-chart and splitting it up into three columns, one for each of the money buckets.

Download the printable financial chart here.

One example Kapusta gives is her frequent bridesmaid status in her late 20s. Knowing that she needed an extra bit of cash in her budget in that one to three year bucket, she factored that in to her savings for that time period. Visualizing what she needed to have available in each timeframe helped her prioritize those funds.

While these goal-oriented savings should be separate from your emergency savings (you can even open separate savings accounts and title them based on your goals), Kapusta stresses that most normal bank accounts aren’t earning you enough interest on that money.

“The most important thing–and you should even do this for you emergency savings—is making sure you’re putting your money in a place where you’re earning interest on it,” she says. Look into high-yield savings accounts that will earn you one percent or more on your money. That way, it’s not loosing its value by sitting in a bank. After all, you worked hard for it.

“It’s important to start early because of the power of compounding,” Kapusta explains. “The reality is, your money grows and makes money. Even small amounts make such a big difference.”

4Create a flexible budget.

Rigid budgets don’t work. They’re clunky and put pressure on you to cut out on things that make you happy (like those brunch plans or a weekend trip with the girls). That’s why Kapusta and her team have a flexible budget breakdown in place. It’s more about being mindful about where your hard earned money is going instead of the old grin-and-bear-it mantra where you wince every time you check your bank account—we’ve been there.

Instead, she says to strive for: 50 percent of your income towards essential expenses, 15 percent towards retirement, and five percent towards savings. That way, you’re left with 30 percent of your paycheck to save or spend as you need. That can go towards paying down you loans, adding to your goal-oriented savings accounts, or, let’s face it, in a big city, towards your rent (hello, New York). This way, there’s some breathing room tailored to your personal needs and lifestyle.

5Give yourself some grace.

Perhaps Kapusta’s best advice is what she would have liked to tell her younger self:

undefined

Things change, and while your salary and goals for the next 10 years are bound to fluctuate over time, the most important thing is feeling confident and informed about where your money is coming from, and where it’s going.

After taking care of these simple steps, anything extra you make can go towards investing—and you can feel better about it, knowing your bases are covered. Happy adulting!