$191,000 Fine for New England Trio’s False Made in USA Claims

A group of New England fashion companies is under fire for branding their leather footwear and belts and other goods with deceptive Made in America claims, according to the Federal Trade Commission.

The agency, better known as the FTC, ordered Massachusetts- and New Hampshire-based companies owned by Thomas Bates to fork over nearly $200,000 for marketing that doesn’t pass muster with its Made in USA standards.

More from Sourcing Journal

“’Made in the USA’ means what it says,” Samuel Levin, director of the FTC’s bureau of consumer protection, said. “Falsely labeling products as ‘Made in the USA’ hurts consumers and competition, and the FTC will continue to aggressively enforce the law to stop deceptive claims and hold violators accountable.”

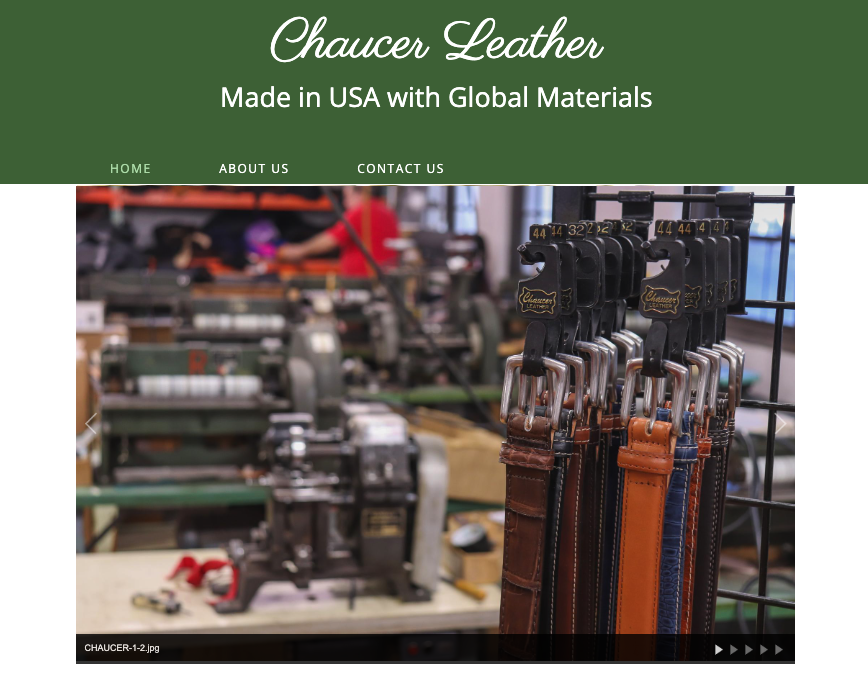

According to the FTC complaint published Tuesday, Chaucer Accessories, also known as Chaucer Leather; Bates Accessories, also operating as Thomas Bates, TB Phelps, David Spencer Shoes and Custom Brand Footwear; and Bates Retail Group ran afoul of the requirements for labeling products as American-made. All three companies are alleged to frequently advertise their products as “Made in the USA” or “Hand Crafted in the USA” in their marketing and sales materials. The companies also sold belts labeled “Made in the USA from Global Materials,” per the FTC complaint.

But FTC claims the companies have violated the Federal Trade Commission Act, and said that the firms sold certain products that were imported outright or incorporated “significant” materials sourced offshore. The complaint said the belts “made from global materials” consisted of belt straps imported from Taiwan with buckles attached in the States.

“Chaucer Leather is one of the oldest remaining leather accessories factory [sic] in the USA,” states Maker’s Row, a website that serves as a database of U.S. manufacturers across various industries. “Chaucer is proud to be Made in the USA.”

But Chaucer, whose factory is in a former leather tannery in the Massachusetts town of Haverhill, a onetime footwear manufacturing powerhouse 35 miles north of Boston near the New Hampshire border, gets a bit murky. On Maker’s Row, it states that it can “produce finished or semi-finished products in Asia through trusted partner factories.” Its website further says it sources raw materials worldwide, producing various leather products in China, India, Indonesia, Japan and Korea for over 25 years.

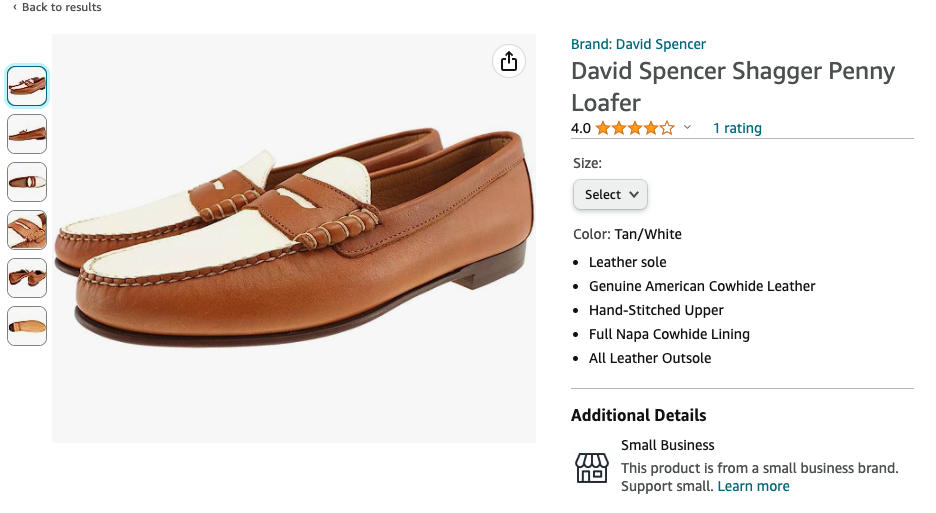

Similarly, Thomas Bates’ website states that its products are made in the United States with materials sourced overseas. David Spencer’s Amazon storefront states that its penny loafers, for example, are made with genuine American cowhide leather, though no other details are provided. T.B. Phelps’ website says the company celebrates classic American style and suggests—though never explicitly says—that its products are made on U.S. soil. It does, however, state that T.B. Phelps “supports both American made and global production . . . utilizing as much American materials and workmanship as possible.”

The FTC’s order against the trio and Bates—which the respondents have agreed to—includes several requirements about the claims they make. First, the companies and Bates are prohibited from making unqualified U.S.-origin claims for any product unless they can show that the product’s final assembly or processing, as well as all significant processing, takes place in the U.S. and that all or virtually all components of the product are made and sourced in the States.

They are also required to include, in any qualified “Made in USA” claims, a “clear and conspicuous” disclosure about the extent to which the product contains foreign parts, components or processing. Third, the companies and Bates must also ensure that, when claiming a product is assembled in the United States, it’s substantially transformed in the U.S., its principal assembly takes place in the U.S., and U.S. assembly operations are substantial. The FTC also ordered Bates et al. to pay it $191,481.

As part of their settlement, the companies are required to notify customers that the agency has sued them for making false claims.

Bates and his three companies did not respond to Sourcing Journal’s request for comment by press time.