2 Fascinating GAMCO 2nd-Quarter Picks

GAMCO Investors was founded by legendary investor Mario Gabelli (Trades, Portfolio). The asset management company uses a strategy which focuses on bottom up stock picking of value stocks which are trading less than intrinsic value estimates. Gabelli aims to spot mispricings in great businesses and then buy with a catalyst on the horizon.

The catalyst is a key part of GAMCOs strategy as it helps to close the gap between share price and value. Often if a stock is undervalued it may stay that way for many years without a catalyst. Let's dive into two of my favorite Gabelli picks from the second quarter and their potential catalysts.

ZenDesk

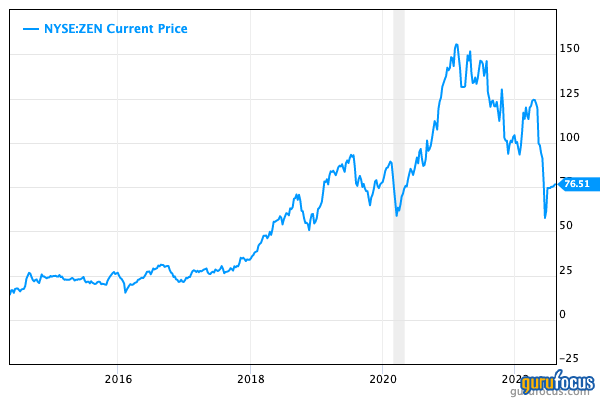

ZenDesk (NYSE:ZEN) is a software as a service (SaaS) company which focuses on transforming customer support. The company was founded in Denmark back in 2007 and IPOd in 2014. Since then, the stock produced fantastic results for investors and increased by over 932% up until February 2021, with the stock price more than doubling from 2020 alone. However, ZenDesk's stock price has corrected by over 52% following the popping of the Covid stock bubble.

GAMCO was buying during a quarter in which the average price was $98.90, which is ~23% higher than where the stock trades at the time of writing. Other Guru Investors such as Jeremy Grantham (Trades, Portfolio) and Ken Fisher (Trades, Portfolio) were also buying stock at similar levels.

The catalyst here was that the company was considered a prime acquisition target. In February 2022, a variety of private equity firms offered to buy ZenDesk for between $127 and $132 per share, which would have meant a significant profit for Gabelli. However, management refused that acquisition and the stock price plummeted further, before the companys board voted to be acquired for just $77.50 per share by an investor group led by Hellman & Friedman and Permira.

This has led some analysts (including myself) to believe management panicked because the stock price had fallen, despite receiving higher offers prior. The stock price popped by over 34% from a $54 per share low to the buyout price of $77 as the price gap closed on the catalyst.

Interestingly the company actually posted strong second quarter revenue which was up a rapid 28% year over year to $407 million. This surpassed analyst consensus estimates by $2.53 million dollars. Non-GAAP gross margin improved by 1% year over year and is at an ultra high 82%. This confirms my belief that management may have sold the company at the low end given prior valuations, which may upset some investors.

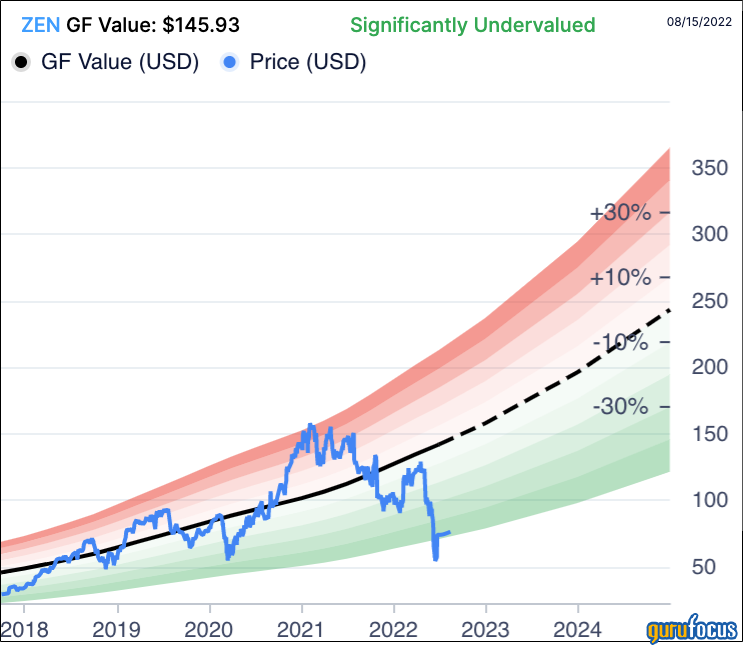

The GF Value calculator also confirms this theory with a fair value of $145 per share, which means the stock is significantly undervalued at the buyout price.

Vertiv Holdings

Vertiv Holdings is an Ohio-based provider of IT and electrical equipment for data centers. Its products include racks, cooling equipment, Uninterruptible Power Supplies (UPS) and even monitoring software. The cloud computing market was worth approximately $430 billion in 2021 and is forecasted to grow at a rapid 15.8% growth rate to a staggering $1 trillion by 2028 according to Facts & Factors. This is driven by the digital transformation of businesses, as they move their on premises IT to the cloud. This enables them to take advantage of flexible pricing models (pay for what computing you use) and reduces the need to manage complex infrastructure.

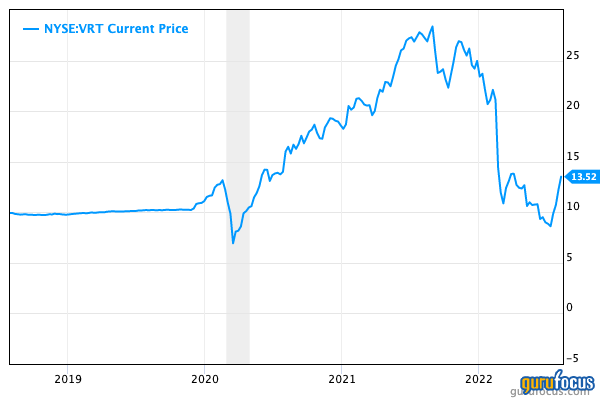

Despite this tailwind, the companys share price has been butchered since November 2021, sliding 71%, which I think is unfair given the long-term prospects. However, since July the stock price has popped by 63% on strong earnings results and order backlog.

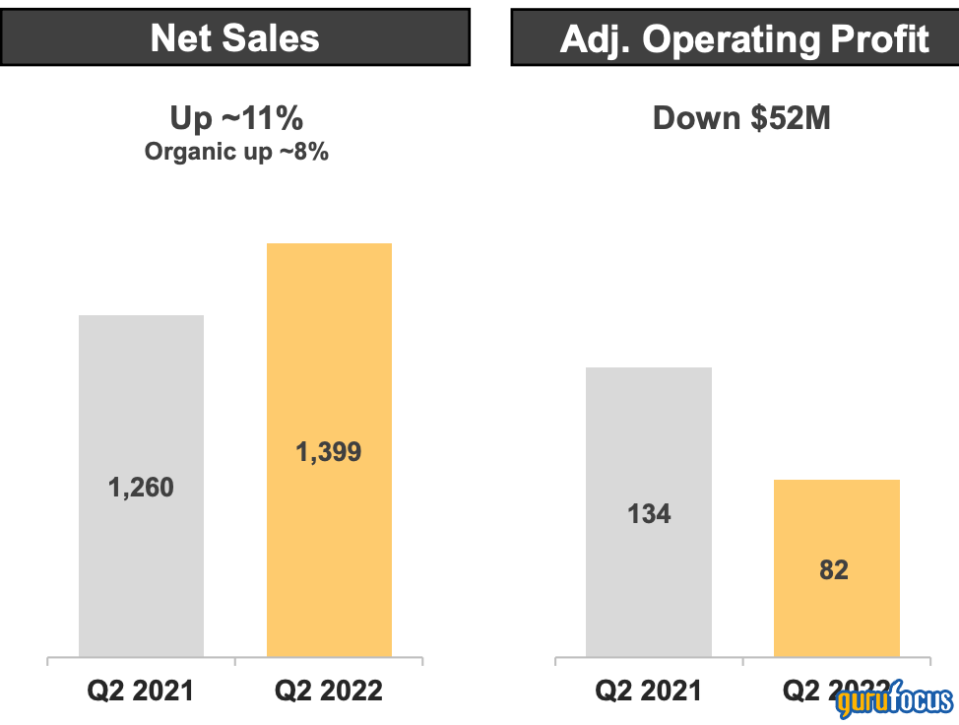

For the second quarter of 2022, Vertiv generated revenue of $1.4 billion, which beat analyst consensus estimates by ~$75 million and increased by ~10% year over year. This was driven by higher pricing but was slightly offset by foreign currency exchange headwinds. The company showed strength in the cloud and colocation markets and had a record backlog of $4.4 billion as of the end of June, which was up a substantial 39% year over year.

Management noted that supply chain challenges are expected to continue into the first half of 2023, but they have made progress in finding alternative fan suppliers.

The company has demonstrated pricing power, and its larger investments into research and development make it an attractive supplier for the growing data center industry.

Therefore, management has increased its fourth quarter revenue and adjusted profit guidance, despite the supply chain headwinds.

During the second quarter, the stock traded for an average price of $11.36 per share, and the stock price has popped by ~19% from those levels at the time of writing.

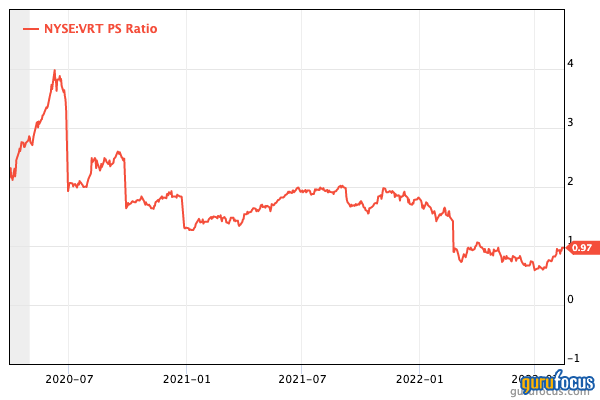

The stock is trading at a price-sales ratio of 0.92, which is slightly lower than historic levels.

This article first appeared on GuruFocus.