What Happened to $100M Box Office Openers?

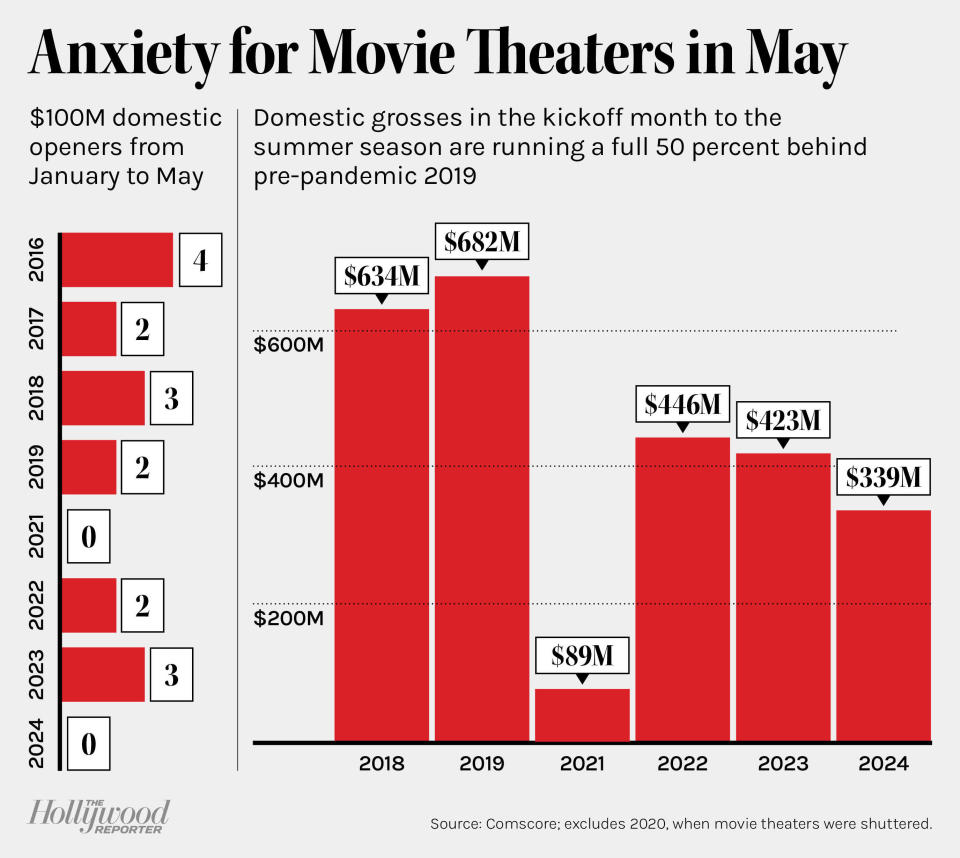

No one could blame the box office for needing an imaginary friend right now. For the first time in more than a decade — excluding the worst period of the COVID-19 crisis — no movie opening during the first six months of the year has come close to hitting the $100 million mark in its domestic launch.

In 2023, for example, three films had accomplished this feat by the time Memorial Day rolled around, including The Super Mario Bros. Movie, which debuted to $146.3 million in April on its way to earning $1.36 billion worldwide. To date, the top opening of the year belongs to March tentpole Dune: Part Two, which started off with $82.5 million, followed by $80 million for Godzilla x Kong: The New Empire. In fact, it’s nearing the one-year anniversary of the last film to open to $100 million or more — Barbie, which sunnily smiled its way to a $162 million debut in the latter half of July. It ultimately became the year’s top-grossing film, with $1.45 billion.

More from The Hollywood Reporter

Box Office: 'Deadpool & Wolverine' First-Day Ticket Sales Set R-Rated Record, Climb to $8M-$9M

'Super/Man: The Christopher Reeve Story' to Get Special September 2024 Release in Theaters

Box Office: John Krasinski's Ryan Reynolds Starrer 'IF' Improves to $35M Opening for No. 1 Finish

With the 2024 summer box office now nearly one month in, the vanishing $100 million opener is especially problematic because moviegoing begets moviegoing. There’s no more crucial season than the months when younger kids, teenagers and college students are sprung from school.

This year, the high season started off with a groan of pain when Universal’s The Fall Guy opened on the low end of expectations despite headlining two of the stars who were part of the Barbenheimer phenomenon, Barbie’s Ryan Gosling — who enjoyed career-high attention and was nominated for an Oscar for his performance as Ken — and Oppenheimer’s Emily Blunt, also nominated for an Oscar. No one expected the action comedy to reach $100 million in its launch, but $27.7 million? It has currently grossed $65.8 million against a net budget of $130 million.

The film’s disappointing results prompted Universal to to make the title available to rent in the home via premium video on-demand for $19.99 on May 21, a mere three weekends after it launched in theaters. Fall Guy will still play in cinemas, but the move underscores the movie’s failure to catch on in a significant way theatrically. Early PVOD has been a boon for Universal. The studio insists it doesn’t cannibalize theatrical, and that a movie hitting PVOD can actually improve box office grosses. Still, original plans were for a longer window, one exhibition source says, but Universal changed course. The studio has been a pioneer in the early PVOD space, which has become a moneymaker for all of the studios, although many wait at least 31 to 32 days, as does Universal if a film opens to $50 million or more.

Then came John Krasinki’s IF, Paramount’s original live-action/CGI imaginary friend family pic starring Ryan Reynolds opposite a voice cast that includes just about every big name in town. IF, which was expected to bow with at least $40 million, debuted with $33.7 million.

For years, Marvel Studios has provided a spark to summer by opening a superhero pic the first weekend of May. (Last year, Guardians of the Galaxy Vol. 3 kicked off May with a gross north of $118 million.) But this year’s calendar was dramatically rearranged between the production and postproduction delays stemming from the labor strikes and even the pandemic. At one point, Marvel’s Captain America: Brave New World was scheduled to open the first weekend of May. Other big movies that moved out of summer 2024 include the next Mission: Impossible and Spider-Verse installments.

“Hollywood is sucking wind right now. The strike wreaked havoc,” says Wall Street analyst Eric Handler of MKM Partners. “For the first time in years, we started off summer with an unproven, character-driven film,” he adds, referring to The Fall Guy. “I’m not worried because there are big movies coming, but it does put pressure on the rest of the summer and year.”

A big guessing game in Hollywood right now is which of the three big summer franchise installments might be able to reverse the curse and open with at least $100 million — Pixar’s Inside Out 2 (June 14), Universal and Illumination’s Despicable Me 4 (July 3) or Marvel’s Deadpool & Wolverine (July 26). New data, however, has changed the conversation regarding Inside Out 2. The Pixar sequel came on tracking May 23, and leading services show the movie starting off with anywhere from $75 million to $85 million (one service is providing a range of $77 million to $93 million). Disney is going with $80 million-plus, which would make it one of the biggest openings of the year and potentially the biggest if it passes up Dune: Part Two. The first Inside Out opened to $90.4 million and, despite tracking, some believe the sequel still has a shot at the century mark. If not, the $100 million problem continues.

Memorial Day weekend boasts two solid titles — The Garfield Movie and George Miller’s Furiosa — but neither is expected to come near $100 million (think more in the mid-$30 million to mid-$50 million range).

May has been brutal in terms of moviegoing. For the May 1-19 corridor, domestic box office revenue is off nearly 20 percent from last year and 50 percent behind 2019. Year-to-date revenue is likewise hovering roughly 20 percent behind 2023. “We knew it was going to be bad, but not this bad,” says a top studio executive of post-strike estimates predicting summer box office losses exceeding half a million dollars. “There was no alarm bell going off this year telling people the summer box office had started.”

Comscore chief box office analyst Paul Dergarabedian has another theory: The industry has over the years backed itself into a corner with a fixation on the $100 million opening weekend as both a key benchmark for success and as a revenue-based marketing hook that, if not achieved, knocks great films on their heels and deems them financial failures, often unfairly. Studios are now placed in the position of defending their marketing and distribution strategies that, unable to power their big-budget releases, are scrutinized for not achieving this lofty goal.

“In today’s modern theatrical marketplace, the emphasis should shift from the short-term gain to the long-term playability, since this is now a game of yards instead of inches,” Dergarabedian says. “And the analysis of what constitutes a hit or a flop must be reevaluated.”

May 23, 11:15 a.m.: Updated with Inside Out 2 tracking data.

A version of this story first appeared in the May 22 issue of The Hollywood Reporter magazine. Click here to subscribe.

Best of The Hollywood Reporter