The trio that saved America is this week's Champ — Putin's the chump

This week’s champ is the three-headed, America-saving monster — Hank Paulson, Ben Bernanke, and Timothy Geithner. Yes, the band got back together this week to talk about that time they saved America 10 years ago. They gathered in Washington for a seminar this week, looking back on their response to the financial crisis.

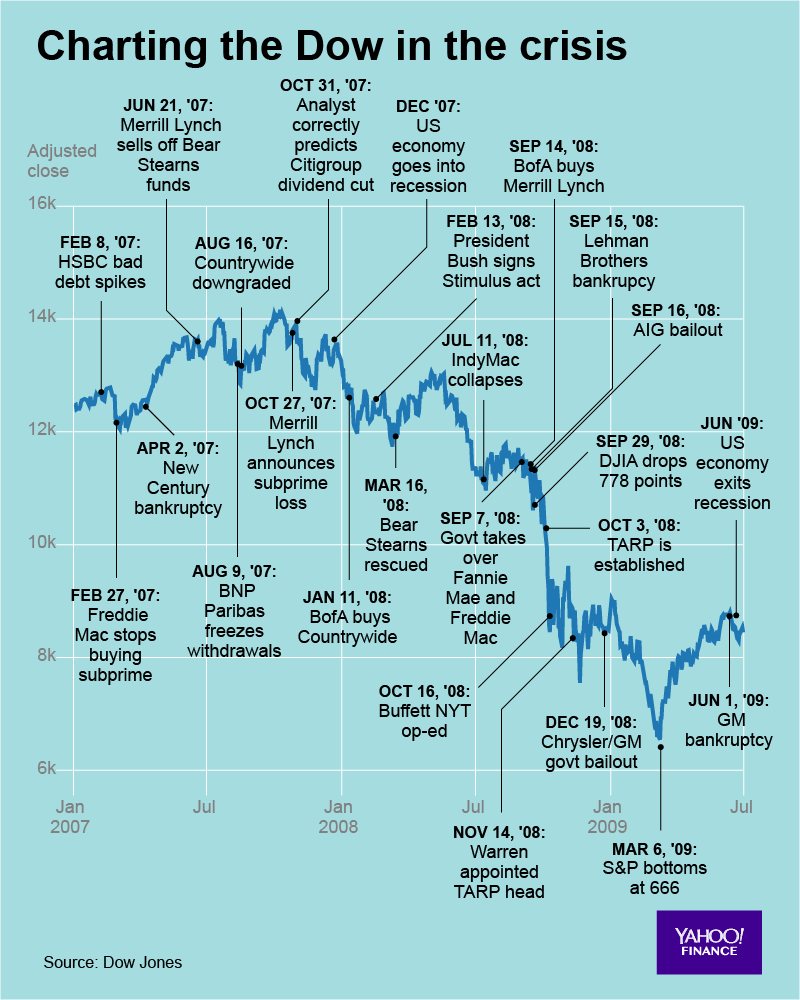

They rescued the economy by basically handing Wall Street a blank check in the midst of a catastrophic meltdown. Most people think of the $700 billion dollars the government paid for the Troubled Asset Relief Program — or TARP. But actually, that was just the tip of a very, very deep iceberg: More recently, Forbes put the price tag at $16.8 trillion dollars.

The was a problem: They rescued Wall Street and the financial system, but they didn’t do all that much to help ordinary working people. When the Federal Reserve, led by Bernanke, pushed US interest rates to zero and started printing money it made a lot of CEOs, money managers, lawyers and lobbyists lots and lots of money.

But it left regular people who didn’t own stocks — new research shows that nearly half of America is missing out on the historic bull run — and were left to deal with lost jobs and lost homes and a whole lot of questions. But hey, the financial system got saved, right?

In any case, the trio of Paulson, Bernanke and Geithner are this week’s champs!

This week’s chump is none other than Russian President Vladimir Putin. Putin had a tough week: First, the U.S. added more sanctions to their existing sanctions on Russia for interfering in the 2016 elections. Then they added a new round of sanctions for Russia’s role in a nerve gas attack in the UK on a Russian spy.

Then Britain added its own sanctions for the nerve gas attack. And then the European Union added sanctions of their own for the nerve gas attack. And now the U.S. is considering what’s being called the “Sanctions Bill from Hell.” This all occurs as the emerging market crisis looks to be creeping into Russia.

It’s looking like a cold winter for Vladimir Putin. this week’s chump.

—

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

See also:

Wall Street managers have cost Americans more than $600 billion over the past decade

It’s the end of the world as we know it, and investors feel bullish

The dollar’s status as the world’s funding currency is in question

Why Trump’s trade war hasn’t tanked the market or the economy yet

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.