Genetic editing is this week's champ — Fed's Powell is the chump

This week’s champ is Clustered Regularly Interspaced Short Palindromic Repeats or CRISPR.

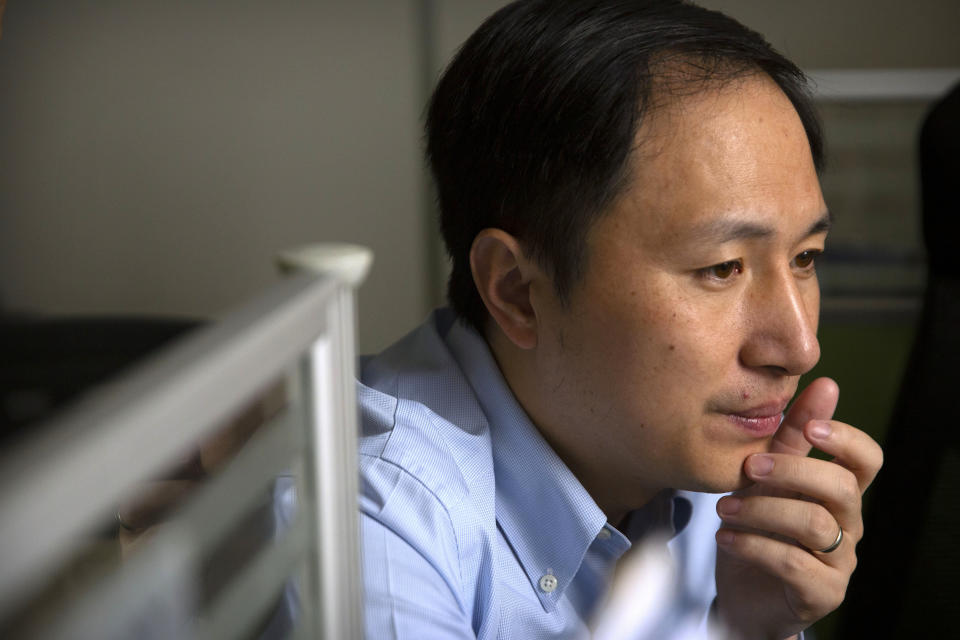

Chinese scientist He Jiankui claimed this week that he was able to successfully modify the DNA of an unborn baby to cure it of HIV. Not only that, he says the mother of the genetically edited baby is now pregnant again and has also gone through the same genetic editing to be free of HIV. The tool he used – CRISPR (CRSP).

This could mean the end of genetic and hereditary disease – no more Alzheimers, no more HIV, no more cystic fibrosis passed from parents to their children. But it could also mean designer babies – parents choosing to give their children different skin tones or eye colors or even giving them increased athletic ability or brain power. It sounds kinda cool, except it hasn’t been studied and could lead to some really gruesome and dangerous side effects. Not to mention the whole playing God thing. That’s why it’s basically banned around the world.

Jiankui, the scientist who performed the genetic editing, said he paid for and conducted the research all by himself and may face some serious consequences. But you know who won’t face consequences? CRISPR. The market doesn’t care if your tech is good or evil, whether it helps the world or hurts. All the market wants to know is does it work and can it make us some money. The answer when it comes to CRISPR appears to be yes.

CRISPR. This week’s champ.

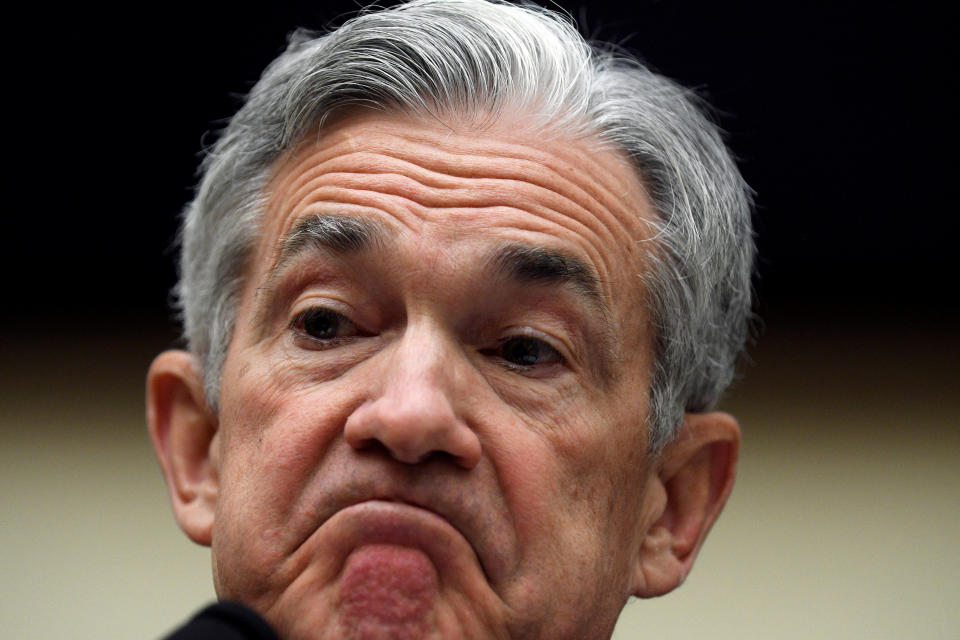

This week’s chump is Federal Reserve Chair Jerome Powell.

It seems like just last month – because it was – that Powell was talking confidently about raising interest rates. When it came to whether the Fed was going to keep on raising rates the man said, “We may go past neutral, but we’re a long way from neutral at this point.”

Then yesterday he changed his tune to say, interest rates remain “just below” what would be neutral for the economy. How can they be just below if we’re a long way from neutral?

Stock traders got to celebrate Christmas early after those comments, with the Dow rising 617 points, the S&P jumping 2.3 percent and the Nasdaq rising a scorching 2.95 percent. And just like that the Fed put was back in play.

And the truth is, there’s not much to what Powell said. But what matters is Powell had a chance to stand tall, to say that this Fed, his Fed, wasn’t going to be held hostage by the whims of the stock market or the White House, that they were going to raise interest rates because as Jay Powell said himself a month and a half ago:”The really extremely accommodative low interest rates that we needed when the economy was quite weak, we don’t need those anymore. They’re not appropriate anymore.”

Jerome Powell. This week’s chump.

—

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

See also:

Wall Street managers have cost Americans more than $600 billion over the past decade

It’s the end of the world as we know it, and investors feel bullish

The dollar’s status as the world’s funding currency is in question

The stock market is at ‘a crossroads’ and on course for a ‘reckoning’ in 2019, investors say

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.