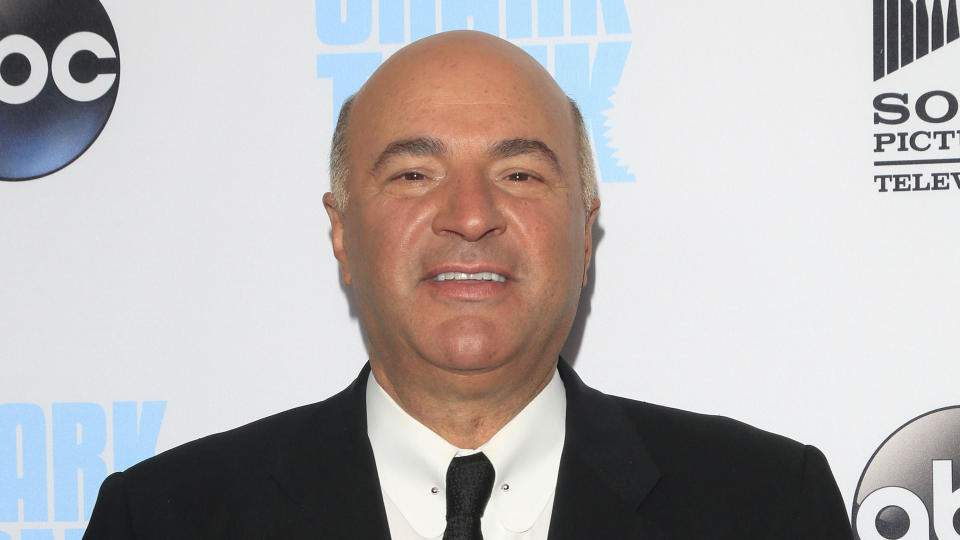

Here’s Why Kevin O’Leary Sees the Uncertain Financial Environment as ‘a Time of Opportunity’

Kevin O’Leary co-founded the educational software company SoftKey Software Products, Inc. in 1986 and sold it (as The Learning Company) to Mattel in 1999 for more than $3.5 billion. In 2008, he set up a mutual fund called O’Leary Funds, which he sold in 2016. He is now a Shark on “Shark Tank” and a StartEngine strategic advisor.

Recognized by GOBankingRates as one of Money’s Most Influential, here he shares a unique way for retail investors to diversify their portfolios.

How should Americans invest in today’s market?

An uncertain financial environment can be intimidating for investors, but it’s also a time of opportunity for those who are savvy enough to know where to look for growth. After years of almost unlimited money flowing, the venture capital spigot is finally slowing down.

Check Out: The Top 100 Financial Experts of 2022

The Most Influential Money Experts: Where We Get Our Money Advice

That means that startups will be looking for new sources of capital and may turn increasingly to non-traditional funding. Equity crowdfunding platforms like StartEngine, which allow anyone to invest in early-growth companies, could be a great opportunity for retail investors looking to diversify their portfolios.

Jaime Catmull contributed to the reporting for this article.

More From GOBankingRates

Social Security: Women Get $354 Per Month Less Than Men - Here's Why

Ending Soon! Nominate Your Favorite Small Biz by July 25 for the 2022 Small Business Spotlight

Looking To Diversify in a Bear Market? Consider These Alternative Investments

This article originally appeared on GOBankingRates.com: Here’s Why Kevin O’Leary Sees the Uncertain Financial Environment as ‘a Time of Opportunity’

generic

generic