Why Etsy's (NASDAQ:ETSY) Growth Should be Taken with some Reserve

First published on Simply Wall St News

Etsy, Inc.'s (NASDAQ:ETSY) share price leapt 22% to US$155 in the week following its full-year results. It seems that investors are impressed with the performance, and today we will inspect the growth rates in order to see if Etsy's performance is reliable.

The last annual report posted revenues of US$2.3b, in-line with what the analysts predicted. However, Etsy surprised by delivering a statutory profit of US$3.4 per share, a notable 11% above expectations.

In order to get a better picture of performance, we will evaluate both the quality of past growth, and future expectations.

See our latest analysis for Etsy

Quality of Growth

"Growth is good", can be a dangerous proposition. Some companies manage to grow successfully, but others eat up their company from the inside in order to deliver growth. That is why it is important to also check the quality of growth for a company like Etsy and make sure they are growing in a way that benefits shareholders.

In the last 5 years, Etsy Inc. has increased its revenue by 538.2%, going from US$365m in December 2016 to US$2.3b in December 2021. This amounts to a CAGR (Compound Annual Growth Rate) of 44.9% over that period. These are very impressive numbers, and it is no surprise that investors who caught the company early were excited about the stock.

Looking at last year, the company's revenues increased by 35%, which is a bit less than the 3-year average growth rate of 63.9%. This might mean that the company has realized a good portion of its market share and is usually the time when investors start valuing the company more stringently and start going down in the income statement from revenue to profitability.

When companies start decelerating organic growth, they must re-invest much more into the company in order to keep growing, this means more cash outflows from investing - including CapEx and acquisitions. Keep this in mind, as the company has already increased (annual report, p. 99) the cash spent on investment, and will likely need to continue doing so in the future.

There are 2 more things we will go through when evaluating the quality of growth. These are scaling and margin adjusted growth.

We look at how growth scales in relation to the costs of producing a product or service. In that regard, we take the last 12-month revenue growth and subtract the growth of costs in the same period.

In the last 12 months, Etsy's costs grew 6% more than revenue growth. This means that the company is now spending relatively more to create the same service.

Another way to look at this is with the gross profit margin, which declined 1.6% from last year. This is not necessarily a bad thing with growing companies, as they are initially focused on growth and tend to optimize profitability later in their development.

While growth vs. costs is one side of the coin, the other is growth vs. business expenses.

Investors want to know if a company is cutting into its margins while growing, or if margins are stable. Some companies spend too much on marketing and other business expenses, while not managing to cover the loss in margins with enough growth.

It seems that the company has an EBIT margin of 20%, which decreased from 24.6% in the last 12 months. This means investors should take a deeper dive at the justification for expenses, as they seem to enable growth, but at the cost of profitability.

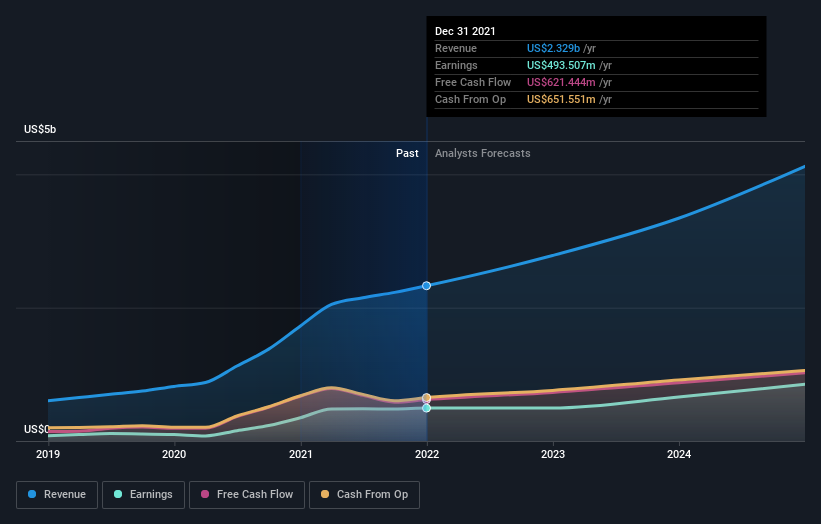

Now we will look at what analysts expect to see for Etsy in the future and estimate where the stock might move. In the chart below, we paired the past growth with future forecasts, so that we can get a better picture for the development of the company.

Future Estimates

Taking into account the latest annual results, the most recent consensus for Etsy from 17 analysts is for revenues of US$2.78b in 2022 which, if met, would be a decent 19% future growth. On the other hand, EPS is forecast to sink 14% to US$3.34 in the same period.

Unfortunately, this has likely led to the decline of the average price target by 8.5% to US$217.

These estimates are interesting, but it can be useful to compare Etsy's past performance to peers in the same industry.

The other companies in this industry with analyst coverage are forecast to grow their revenue at 14% annually. Even after the forecast slowdown in growth, it seems obvious that Etsy is also expected to grow faster than the wider industry.

Key Takeaways

Etsy is growing but not scaling too well, at least not yet. The company is still young and the nature of their business may allow for better profit optimization after the growth phase. Currently, the company is sacrificing both the gross and operating margin in order to drive growth - while investors cut growing companies some slack in this regard, it is something to keep track of in the long term.

The stock jumped on a positive earnings result, and seems to be in-line with the future forecasts for the company.

While the price target declined, the stock still has a good 40% upside according to analysts.

Also, be aware that Etsy is showing 2 warning signs in our investment analysis, which you may want to check.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

generic

generic