Why Accenture Could Continue to See Accelerated Growth

Accenture PLC (NYSE:ACN) recently announced quarterly earnings results that were superior to what Wall Street analysts had anticipated. Growth was robust throughout its business and guidance for the year was raised.

Lets take a closer look at Accenture's recent quarter to see why I believe the momentum in this business can continue.

Earnings highlights

Accenture reported results for its first quarter of fiscal year 2022 on Dec. 16. Revenue improved 27.2% to just under $15 billion, beating estimates by $746.5 million. Earnings per share of $2.78 compared very favorably to $2.17 per share in the prior year. Excluding a 15 cent gain on investments, earnings per share were higher by 28% year-over-year.

Consulting revenue grew 33% to $8.4 billion while Outsourcing revenue was up 21% to $6.6 billion. All industry groups had at least high double-digit growth as the company saw heightened demand nearly across the board. Products, which is the largest customer group for the company, grew 34%. Communications, Media and Technology, Financial Services, Health and Public Service and Resources grew revenue by 32%, 24%, 23% and 17%, respectively.

Each region that the company operates in performed exceptionally well. North America, Europe and Growth Markets (which includes countries in the regions of Asia Pacific, Latin America and the Middle East) had sales growth of 26%, 28% and 30%, respectively.

Accenture saw a company record amount of new bookings of almost $17 billion in the quarter, 30% higher than the prior year. Breaking it down by business, new bookings for Consulting were $9.4 billion and bookings for Outsourcing were $7.4 billion. The book-to-bill ratio was a solid 1.1.

As a result of the companywide strength, the operating margin expanded 20 basis points to 16.3%.

Accenture also provided revised guidance for fiscal year 2022. Revenue is now predicted to grow 19% to 22%, up from the previous 12% to 15% guidance. Earnings per share of is expected in a range of $10.32 to $10.60. The midpoint of guidance represents a 14.2% increase from fiscal year 2021. For context, Accentures earnings per share have a compound annual growth rate of 9.7% over the last decade, according to Value Line.

Takeaways

Not only did revenue and earnings per share grow significantly from the prior year, they also topped analysts estimates by a wide margin. This type of performance happens when all areas of a company are seeing high demand.

The year-over-year growth across client groups and regions shows that Accenture's digital, cloud and security offerings are what clients want for their businesses. Leadership estimates that revenue grew five times the market average, further entrenching Accentures leading position in the consulting business.

There doesnt appear to be much slowdown in the cards either, as net bookings speak volumes regarding the expected increase in demand for the companys offerings. Bookings were a new record by a wide margin.

Quarterly gains arent coming off a weak period either. Accenture proved its might during calendar year 2020 when many other businesses were reeling from the Covid-19 pandemic. The companys two worst performing quarters of this time were the third and fourth quarters of its fiscal year 2020, where revenue fell just 1% and 2%, respectively. Earnings per share were down low single-digits as well. The next year, both the top and bottom lines improved by at least a low 20% figure, meaning that Accentures business barely slowed two years ago and is now much better positioned than any other time in its recent history.

This is due to the companys focus on IT services and consulting. In fact, Accenture was pretty well positioned to perform well under the pandemic circumstances as the company enables clients to transform their digital business and operations to run more efficiently. With much of the world transitioning to an online environment for work, Accenture provided the tools to move to the cloud and leverage data to remain in business during an extremely difficult period of time. Now that companies have made this transition, many dont appear to in a hurry to return to the previous way of operating given the level of bookings seen in the most recent quarter.

Accenture has been so successful at providing a needed service that 98 of the top 100 clients have been with the company for at least a decade. In addition, nearly 90% of the Fortune 100 and three-quarters of the Fortune 500 are counted among the companys client base.

Accenture remains a very shareholder friendly company. The company has increased its dividend for 11 consecutive years and the dividend has a compound annual growth rate of 11% over the last decade. This includes the most recent raise, which was 10.2% for the Nov. 15 payment.

The company also repurchased 2.4 million shares of stock during the quarter at an average price of $352. With the stock trading close to $415, Accenture appears to have gotten good value for its use of capital. The company expects free cash flow of $7.7 to $8.2 billion in fiscal year 2022, which will likely be used to increase dividends and share repurchases.

Valuation analysis

Unfortunately, the market is well aware of Accentures business performance and the positives working in the companys favor. As a result, shares are far from cheap. Shares of Accenture gained nearly 59% in 2021, more than double the return of the S&P 500 Index.

The stock has often traded with a premium multiple, given the average price-earnings ratio of close to 25 over the last five years and 21 over the last decade. With the stock trading at almost 40 times the midpoint of expected earnings for this fiscal year, Accentures valuation is almost twice that of its long-term average.

Given the strength of the companys business and its recent valuation average, a price-earnings ratio of 25 to 28 appears to be fair for Accenture in my opinion. Still, this would mean as much as a 37% decline from the current price of $414.55 if the stock were to trade within this range.

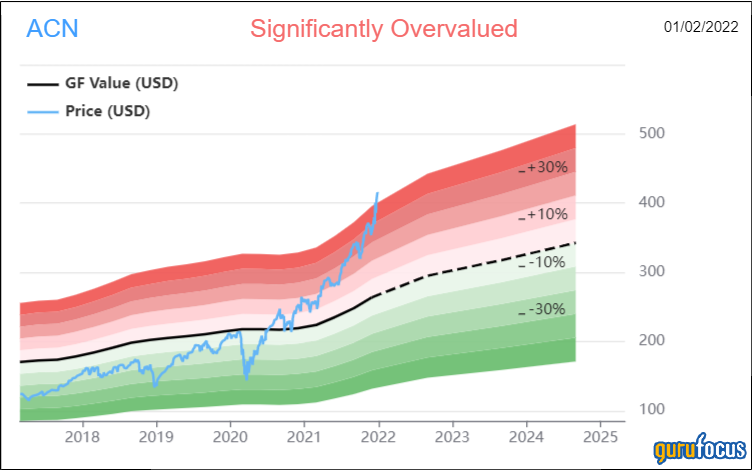

Accenture also looks overvalued using the GF Value chart.

With a GF Value of $267.68, Accenture has a price-to-GF-Value ratio of 1.55. Reaching the GF Value would mean a 35% decline in the stock price.

Final thoughts

Accenture had a stellar quarter, with signs that its businesses are firing on all cylinders. With a strong order of new bookings and a firmly established leadership position in its industry, it is highly likely that Accenture will continue to produce results that please the market.

That said, the stock is well ahead of its own valuation averages and is rated as significantly overvalued by GuruFocus. Value orientated investors will likely not see a discounted valuation in the name given its history, but this does suggest that investors looking to own the name might want to wait for a better entry point.

This article first appeared on GuruFocus.

generic

generic