Target's (TGT) Omnichannel, Digitization Efforts Propel Sales

Target Corporation TGT, one of the widely recognized names in the Retail – Discount Stores industry, has been making tactical changes in its business operations to adapt and stay relevant in the ever-evolving retail landscape. The company has been deploying resources to enhance omni-channel capabilities and adopt strategies to provide a seamless shopping experience through multiple channels.

Well, the strategy to sell quality products at reasonable prices has aided Target to emerge as a favorite destination for shoppers, be it essentials or discretionary purchases. The business model has helped gain consumers’ wallet share and drove top-line growth. Markedly, the Zacks Consensus Estimate for Target’s current financial year sales and EPS suggests growth of 13.9% and 40.1%, respectively, from the year-ago period.

Providing Seamless Shopping Experience

Target has been making constant efforts to improvise shopping methods and techniques, be it in-store or online. It has been making investments to scale up fulfillment services and enhance supply chain capabilities. The company’s delivery services like doorstep delivery, curbside pickup or buy online and pick up at store, has been playing a crucial role in serving consumers better.

During third-quarter fiscal 2021, same-day services (Order Pick Up, Drive Up and Shipt) grew approximately 60%. While sales fulfilled by Shipt were up more than 30% year over year, sales through Drive-Up were up more than 80%. We note that Order Pickup rose more than 30%. Meanwhile, digital comparable sales grew 29% and comparable stores sales rose 9.7% during the quarter.

Target introduced additional features and functionalities to make deliveries and pickups more convenient for consumers during the holiday season. These include ‘Shopping Partner’, increasing the number of Drive-Up spots as well as expanding assortment and personalized store selection for same-day delivery with Shipt. Enhancement to same-day services includes the addition of more than 18,000 assigned spaces for curbside pickup.

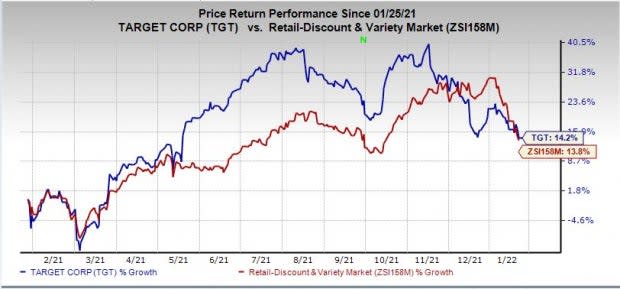

Image Source: Zacks Investment Research

One-Stop Shopping Destination

Thanks to its one-stop shopping destination, consumers have been opting Target for its multi-category assortment of owned and exclusive brands as well as popular national brands. Impressively, the company has been striving to build on its partnerships, especially with popular and high-profile brands like Apple, Ulta Beauty and Levi's.

Well, the retail giant has taken its long-drawn relationship with Apple to the next level. The company is doubling Apple’s footprint across select stores and online. The move is expected to help strengthen Target’s electronics offerings. The highly anticipated Ulta Beauty at Target has been rolled out at more than 100 Target stores and online. This "shop-in-shops" concept is expected to reach a total of 800 Target stores nationwide, in the coming years. The company is also tripling the number of Disney stores at Target locations.

Wrapping Up

Target’s well-chalked assortments, refurbished stores and growing digital capacity are likely to keep it in good stead in the days ahead. Shares of this Zacks Rank #3 (Hold) company have rallied 14.2% in the past year compared with the industry’s growth of 13.8%.

3 Stocks Looking Red Hot

Here are three more favorably ranked stocks — Albertsons Companies ACI, United Natural Foods UNFI and Costco COST.

Albertsons Companies, a leading food and drug retailer in the United States, sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 31.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Albertsons Companies’ current financial year sales suggests growth of 1.6% from the year-ago period. ACI has an expected EPS growth rate of 8% for three-five years.

United Natural Foods, the leading distributor of natural, organic, and specialty food and non-food products in the United States and Canada, flaunts a Zacks Rank #1. UNFI has a trailing four-quarter earnings surprise of 35.4%, on average.

The Zacks Consensus Estimate for United Natural Foods’ current financial year sales and EPS suggests growth of 5.1% and 8.8%, respectively, from the year-ago period.

Costco, which operates membership warehouses, carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 8.3%, on average.

The Zacks Consensus Estimate for Costco’s current financial year sales and EPS suggests growth of 10.9% and 14%, respectively, from the year-ago period. COST has an expected EPS growth rate of 8.8% for three-five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

generic

generic