Student loan forgiveness is in limbo. What does this mean for borrowers?

A series of legal twists and turns regarding President Joe Biden's student loan forgiveness plan has left millions of borrowers in a deepening limbo — and likely without a final answer on debt relief for weeks.

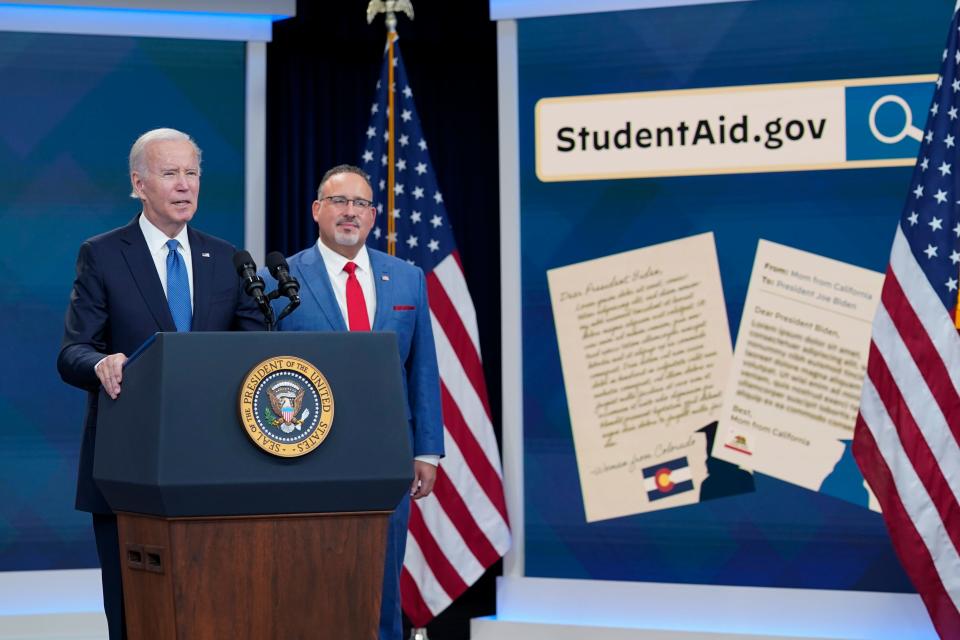

Biden announced in a video Tuesday that the administration would extend the student loan payment forbearance another six months while legal proceedings play out in court until June 30, 2023, or until 60 days after litigation is resolved. The U.S. Department of Education had begun notifying some 16 million Americans that their student loan forgiveness applications were approved before the latest legal roadblock.

"I'm confident that our student debt relief plan is legal. But it’s on hold because Republican officials want to block it," Biden said.

Student loan debt relief: Where things stand

In an email to borrowers sent a few days earlier, Secretary of Education Miguel A. Cardona said a number of lawsuits challenging the program have blocked the department's ability to forgive any debt at the moment.

"We believe strongly that the lawsuits are meritless, and the Department of Justice has appealed on our behalf," he wrote to approved borrowers. "Your application is complete and approved, and we will discharge your approved debt if and when we prevail in court."

Since Biden announced his plan to forgive up to $20,000 in student debt back in late August, opponents have sought to quash it. A handful of lawsuits filed in federal courts across the country attempted to overturn the debt cancellation program, and two of those cases have put the plan on pause.

In late October, the 8th U.S. Circuit Court of Appeals issued a stay prohibiting the administration from discharging any loan forgiveness until it ruled on an emergency request by six Republican states. A three-judge panel of that court, based in St. Louis and covering Arkansas, Iowa, Minnesota, Missouri, Nebraska, North Dakota and South Dakota, issued an injunction Nov. 14 temporarily barring the program, ruling the U.S. Department of Education overstepped its authority.

Then in a more direct blow on Nov. 10, a U.S. District Court in Texas blocked the program, calling it a "complete usurpation" of congressional authority by the executive branch. U.S. District Judge Mark Pittman, who was appointed by President Donald Trump, called Biden's plan "unlawful" on the grounds that the administration didn't have the authority to forgive student debt under the Health and Economic Recovery Omnibus Emergency Solutions Act, or Heroes Act, which provided COVID-19 stimulus funds.

That case was brought by the Job Creators Network Foundation, which describes itself as "a nonpartisan organization founded by entrepreneurs who believe the best defense against bad government policies is a well-informed public." However, the group is actually conservative-leaning, founded by former Home Depot CEO Bernard Marcus to advocate for free enterprise and was a proponent of the Tax Cut and Jobs Act of 2017.

Have student loans? Here's what you need to do to prepare for when payments restart

Mark Kantrowitz, a Chicago-based higher education expert who specializes in how students save and pay for college, said there's a lot of uncertainty surrounding student loan forgiveness because of these lawsuits. But not all hope is lost, he said.

The Biden administration filed an appeal with the 5th U.S. Circuit Court of Appeals, based in New Orleans and covering Texas, Louisiana and Mississippi, seeking to overturn the Texas court ruling. They also filed an emergency appeal at the Supreme Court asking the justices to intervene in the 8th Circuit Court of Appeals injunction.

Kantrowitz said the Biden administration has a fair shot at overturning at least one of the lawsuits, but an answer before the pause of student loan repayments is unlikely.

If payments do indeed resume in July as currently scheduled (or whenever the pause is officially over) Kantrowitz said there are a few things that borrowers can do now to prepare for repayments.

Start saving now

Kantrowitz said the best thing you can do to prepare to begin making student loan payments again is to assume that repayment will start back up soon.

Take a look at your budget and consider where you've been spending the money that you used to use pay your student loans. Spending more than you earn? It's time to reassess, cut back and stop relying on credit cards or other loans to make ends meet.

Then start shelling away your typical monthly payment now as if you were paying off your loan. Kantrowitz recommends putting it in a high-yield savings account to earn some interest. Whenever the payment pause ends, you'll already some money set aside that you can use to chip away at your balance.

"If it doesn't restart, you'll have savings," Kantrowitz said, "and when it does restart, you can make a lump-sum payment."

Make sure you're up to date

Kantrowitz also said borrowers should make sure borrowers' contact information is up to date in both the profile of their loan servicer’s website and their StudentAid.gov profile.

He also suggests signing up for automatic loan payments to take out any of the confusion or amnesia that has come from not making payments for nearly three years. Plus, borrowers who use auto pay get a 0.25 percentage point reduction in their interest rate.

How do I know what my monthly student loan payment will be?

Borrowers who were making payments before the student loan payment pause took place in March 2020 likely won't see a change in their monthly payment. But for those who graduated during the pause and have never made a student loan payment before, borrowers might be wondering what they owe.

Kantrowitz said to contact your loan servicer to get the exact amount of your minimum payment. Monthly loan calculators can be helpful, he said, and a good rule of thumb is to pay 1% of your total 10-year loan balance.

Once the payment pause end date is confirmed, borrowers will receive a billing statement or other notice at least 21 days before payment is due, according to the Department of Education. This notice will include your payment amount.

What if I can't afford my monthly student loan payment?

A lot can change in six months, but with so much economic instability and worry of an impending recession, some borrowers are worried they won't be able to make payments once the pause is lifted.

Kantrowitz said borrowers have several options to avoid missing payments or going into default: economic hardship deferment, unemployment deferment and student loan forbearance. Each program is a little different, and interest may still accrue during while you aren't making payments, but some deferment plans can last up to three years.

Borrowers can also switch to an income-driven repayment plans. Income-driven repayment plans base a borrower's monthly payments on income and family size. In some cases, that payment could total $0 per month.

Kantrowitz said borrowers should contact their student loan servicer immediately if they are ever having trouble making payments.

Should you start repaying your loan even if the pause is extended?

It might be tempting to start making payments on your student loan balance knowing that the pause will end soon, but Kantrowitz advises against it.

"The payment pause comes with an interest waiver, so there's really no difference," he said. "I don't recommend making payments if you don't have to."

Instead, he said, just keep putting what you would be paying in a saving account and you'll be set once the reprieve officially ends.

Sheridan Hendrix is a higher education reporter for The Columbus Dispatch. Sign up for her Mobile Newsroom newsletter here and Extra Credit, her education newsletter, here.

shendrix@dispatch.com

@sheridan120

This article originally appeared on The Columbus Dispatch: Student loan forgiveness: The latest on what borrowers need to know

generic

generic