PayPal (PYPL) Q4 Earnings Miss Estimates, Revenues Rise Y/Y

PayPal Holdings, Inc. PYPL reported non-GAAP earnings of $1.11 per share in fourth-quarter 2021, which missed the Zacks Consensus Estimate by 0.9%. Further, the figure improved 2.8% on a year-over-year basis, while coming in line with the prior-quarter figure.

Net revenues of $6.92 billion exhibited year-over-year growth of 13% on a FX-neutral basis and a reported basis. Further, the figure surpassed the Zacks Consensus Estimate of $6.88 billion and rose 11.9% sequentially.

Growing transaction and other value-added services’ revenues drove year-over-year revenues growth in the reported quarter. Also, accelerating U.S. revenues contributed well.

The strong performance by Venmo remained another positive. The growing total payment volume (“TPV”), courtesy of increasing net new active accounts, drove the results.

However, declining international revenues were concerning.

Notably, shares of the company plunged 16.6% in the pre-market trading due to less-than-expected fourth-quarter 2021 earnings and weak guidance for first-quarter 2022 earnings.

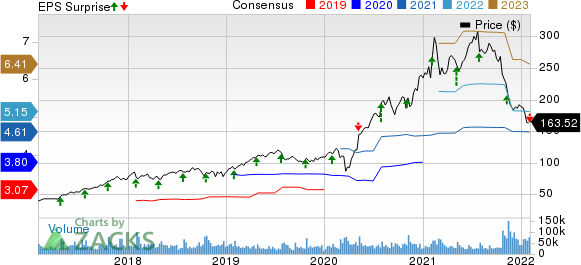

PayPal Holdings, Inc. Price, Consensus and EPS Surprise

PayPal Holdings, Inc. price-consensus-eps-surprise-chart | PayPal Holdings, Inc. Quote

Top Line in Detail

By Type: Transaction revenues amounted to $6.4 billion (92% of net revenues), up 12% from the year-ago quarter. Other value-added services generated revenues of $541 million (accounting for 8% of net revenues), up 25% year over year.

By Geography: Revenues from the United States totaled $3.9 billion (56% of net revenues), up 27% on a year-over-year basis. International revenues were $3.02 billion (44% of revenues), down 1% from the prior-year quarter.

Key Metrics to Consider

PayPal witnessed year-over-year growth of 13% in total active accounts, with 9.8 million net new active accounts in the reported quarter. The total number of active accounts was 426 million in the quarter under review.

The total number of payment transactions was 5.3 billion, up 21% on a year-over-year basis.

The company’s payment transactions per active account were 45.4 million, which improved 11% from the year-ago quarter.

TPV amounted to $339.5 billion for the reported quarter, reflecting year-over-year growth of 23% on both spot rate and currency-neutral basis.

Notably, year-over-year growth in TPV was primarily driven by robust Venmo, which accounted for $230.1 billion of TPV, rising 44% on a year-over-year basis.

Operating Details

PayPal’s operating expenses were $5.9 billion in the fourth quarter, up 13.9% from the prior-year quarter. As a percentage of net revenues, the figure expanded 60 basis points (bps) on a year-over-year basis.

Non-GAAP operating margin was at 21.8%, contracting 290 bps from the year-ago quarter.

Balance Sheet & Cash Flow

As of Dec 31, 2021, cash equivalents and investments were $9.5 billion, down from $13.3 billion as of Sep 30, 2021.

PayPal had a long-term debt balance of $8.05 billion at the end of the fourth quarter compared with $7.9 billion at the end of the third quarter.

The company generated $1.8 billion of cash from operations, up from $1.5 billion in the previous quarter.

Free cash flow was $1.6 billion in the reported quarter compared with $1.3 billion in the prior quarter.

The company returned $1.5 billion to shareholders by repurchasing 8 million shares.

Guidance

For first-quarter 2022, PayPal expects year-over-year revenues growth of 6% on a current spot rate and a currency-neutral basis. The Zacks Consensus Estimate for revenues is pegged at $6.67 billion.

Non-GAAP earnings are expected to be 87 cents per share, including a benefit of 6 cents from credit loss reserve releases. The Zacks Consensus Estimate for earnings is pegged at $1.12 per share.

For 2022, PayPal anticipates year-over-year revenues growth of 15-17% at current spot rates as well as on a currency-neutral basis. The Zacks Consensus Estimate for 2022 revenues is pegged at $25.33 billion.

Non-GAAP earnings for 2021 are anticipated to be $4.60-$4.75 per share, which includes a benefit of 21 cents from credit loss reserve releases. The Zacks Consensus Estimate for the same is pegged at $4.61 per share.

TPV for 2021 is likely to exhibit 19-22% growth on a spot rate basis. On a FX-neutral basis, TPV is expected to grow 21-23%.

Zacks Rank and Stocks to Consider

Currently, PayPal carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Broadcom AVGO, AMETEK AME and Advanced Micro Devices AMD, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Broadcom has gained 27.4% over a year. The long-term earnings growth rate for AVGO is currently projected at 14.52%.

AMETEK has gained 17.6% over a year. The long-term earnings growth rate for AME is currently projected at 10.42%.

Advanced Micro Devices has gained 31.5% over a year. The long-term earnings growth rate for AMD is currently projected at 46.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

generic

generic