Live Nation's (LYV) Q3 Earnings & Revenues Surpass Estimates

Live Nation Entertainment, Inc. LYV reported third-quarter 2022 results, wherein earnings and revenues beat the Zacks Consensus Estimate. Both metrics improved year over year.

The company has been benefiting from the pent-up demand for live events and robust ticket sales. It continues to benefit from the robust performance of Ticketmaster and the increase in fan spending.

For concerts, the company said that it has already sold more than 115 million tickets this year, up 37% from the same period in 2019. The company is highly optimistic about its growth opportunities in 2023. For shows in 2023, the company is witnessing even stronger ticket sales. In 2023, the company expects to add more venues to its operated portfolio. In terms of tickets, the company is likely to benefit from the market pricing trend.

Earnings & Revenues

In third-quarter 2022, the company reported adjusted earnings per share of $1.39, beating the Zacks Consensus Estimate of $1.08. In the prior-year quarter, the company had reported adjusted earnings per share of 19 cents.

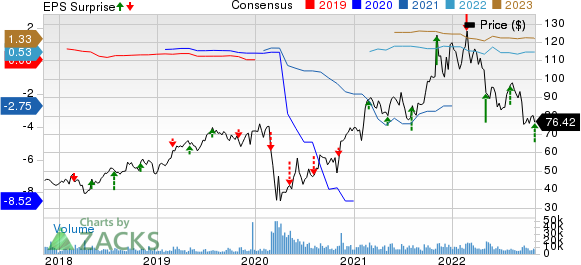

Live Nation Entertainment, Inc. Price, Consensus and EPS Surprise

Live Nation Entertainment, Inc. price-consensus-eps-surprise-chart | Live Nation Entertainment, Inc. Quote

The company’s revenues amounted to $6,153.5 million, beating the Zacks Consensus Estimate of $4,972 million. In the prior-year quarter, the company had reported revenues of $2,698.7 million.

Segmental Discussion

Concerts: The segment’s revenues totaled $5,292.6 million, up from the prior-year quarter’s $2,151.6 million. Moreover, adjusted operating income came in at $280.8 million compared to a loss of $59.6 million in the year-ago quarter. Total estimated events increased to 11,219 in the third quarter, up from the prior-year quarter’s 5,579 events.

Ticketing: The segment’s revenues amounted to $531.6 million, up from the prior-year quarter’s $374.2 million. Adjusted operating income decreased to $163.2 million from $171.8 million reported in the prior-year quarter. Total estimated tickets sold rose to 135,367,000.

Sponsorship & Advertising: The segment’s revenues were $343 million, up 96.7% from the prior-year quarter. Moreover, adjusted operating income rose to $226.2 million from $111.2 million reported in the prior-year quarter.

Other Financial Information

Cash and cash equivalents as of Sep 30, 2022, totaled $4,951.2 million compared with $4,884.7 million as of Dec 31, 2021. Goodwill in the third quarter was $2,548.5 million compared with $2,590.9 million at 2021-end. Total long-term debt, net increased to $5,120.2 million compared with $5,145.5 million as of Dec 31, 2021.

Net cash provided by operating activities was $928.4 million compared with $1,024.7 million reported in the prior-year quarter.

Zacks Rank & Key Picks

Live Nation currently carries a Zacks Rank #3 (Hold).

Some top-ranked stocks in the Zacks Consumer Discretionary sector are Marriott International, Inc. MAR, Crocs, Inc. CROX and Caesars Entertainment, Inc. CZR.

Marriott currently carries a Zacks Rank #2 (Buy). MAR has a trailing four-quarter earnings surprise of 18.6%, on average. The MAR stock has declined 12.6% in the past year. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for MAR’s current financial year sales and EPS indicates a surge of 46.8% and 104.1%, respectively, from the year-ago period’s reported levels.

Crocs has a Zacks Rank #2 at present. CROX has a long-term earnings growth rate of 15%. Shares of Crocs have plunged 57.7% in the past year.

The Zacks Consensus Estimate for CROX’s 2022 sales and EPS indicates a rise of 49.6% and 20.7%, respectively, from the year-ago levels.

Caesars Entertainment carries a Zacks Rank #2. The stock has declined 59.6% in the past year.

The Zacks Consensus Estimate for CZR’s current financial year sales and EPS indicates growth of 14.1% and 25.9%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Caesars Entertainment, Inc. (CZR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

generic

generic