Should You Keep Investing at All-Time Highs?

This article was originally published on The Best Interest Blog and has been republished here with permission.

A note from a dedicated reader inspired today's article. It's a question about the stock market and investing at all-time highs. It reads:

Hey Jesse. So, back in March you said that you were going to keep on investing despite the major crash. Fair enough, good call!

Note: here and here are the two articles that likely inspired this comment

But now that the market has recovered and is in an obvious bubble (right?), are you still dumping money into the market?

You might have heard "buy low, sell high." That's how you make money when investing. So, if the prices are at all-time highs, you aren't exactly "buying low," right?

You could address this question in three different ways.

General ideas about investing

Back-testing historical data

Identifying and timing a bubble

Long story short: yes, you can still technically "dump" money into the stock market despite all-time highs. But no, it's not 100% right.

General Ideas about Investing

We all know that investing markets ebb and flow. They go up and down. But, importantly, the stock market has historically gone up more than it has gone down.

Why does this matter? Say you're implementing an investing plan that is going to take decades to fulfill. Over those decades, the average–the trend–will present itself. That average goes up. So, you're not betting on individual days, weeks, or months. You're betting on decades.

It feels bad to invest right before the market crashes. But the worry isn't about the value of my investments one month from now, but rather where they'll be in 20+ years.

Allowing short-term emotions—e.g. fear of an impending crash—to cloud long-term, math-based thinking is the nadir of result-oriented thinking. Don't do it.

Here's a fun idea. Google the term "should I invest at all-time highs?"

People have been asking this question for quite a while. All-time highs have happened before, and they beg the question of whether it's smart to invest. Here's the S&P 500 data from 2016 to today.

S&P 500 – Past five years. Punctuation my own addition.

So should you have invested in 2016? In 2017? In 2018? While those markets were at or near all-time highs, the resounding answer is YES! Investing in those all-time high markets was a smart thing to do.

Let's go further back. Here's the Dow Jones going back to the early 1980s. Was investing at all-time highs back then a good idea?

The results would be convincing no matter what historic window you chose. Investing at all-time highs is still a smart thing to do if you have a long-term plan.

Investing at all-time highs isn't that hard when you have a long outlook.

But let's look at some hard data and see how the numbers fall out.

Historical Backtest for Investing at All-Time Highs

There's a well-written article at Of Dollars and Data that models what I'm about to do: Even God Couldn't Beat Dollar-Cost Averaging.

But if you don't have the time to crunch all that data, here are the results of a simple investing back-test below.

First, we're looking at the dollar-cost averager. This is someone who contributes a steady investment at a steady frequency, regardless of whether the market is at an all-time high. It might be how you invest via your 401(k). The example is from someone who invests $100 every week.

Then, there's the "all-time high avoider." This is someone who refuses to buy stocks at all-time highs, saving their cash for a time when the stock market dips. They'll take $100 each week and make a decision: if the market is at an all-time high, they'll save the money for later. If the market isn't at an all-time high, they'll invest all their saved money.

Thearticle from Of Dollars and Data goes one step further, if you're interested. It presents an omniscient investor who has perfect timing, only investing at the lowest points between two market highs. This person, author Nick Maggiulli comments, invests like God would–they have perfect knowledge of prior and future market values. If they realize that the market will be lower in the future, they save their money for that point in time.

What are the results?

The dollar-cost averager outperformed the all-time high avoider in 82% of all possible 30-year investing periods between 1928 and today. And the dollar-cost averager outperformed "God" in ~70% of the scenarios that Maggiulli analyzed.

How can the dollar-cost averager beat God, since God knows if there will be a better buying opportunity in the future? Simple answer: dividends and compounding returns. Unless you have impeccable–perhaps supernatural–timing, leaving your money on the sidelines is a poor choice.

Investing at all-time highs is where the smart money plays.

Identifying and Timing a Bubble

One popular piece of finance jargon is the "permabear." It's a portmanteau of permanent and bear, as in "this person is always claiming that the market is overvalued and that a bubble is coming."

Being a permabear has one huge benefit. When a bubble bursts–and they always do, eventually–the permabear feels righteous justification. See?! I called it! Best Interest reader Craig Gingerich jokingly knows bears who have "predicted 16 of the last 3 recessions."

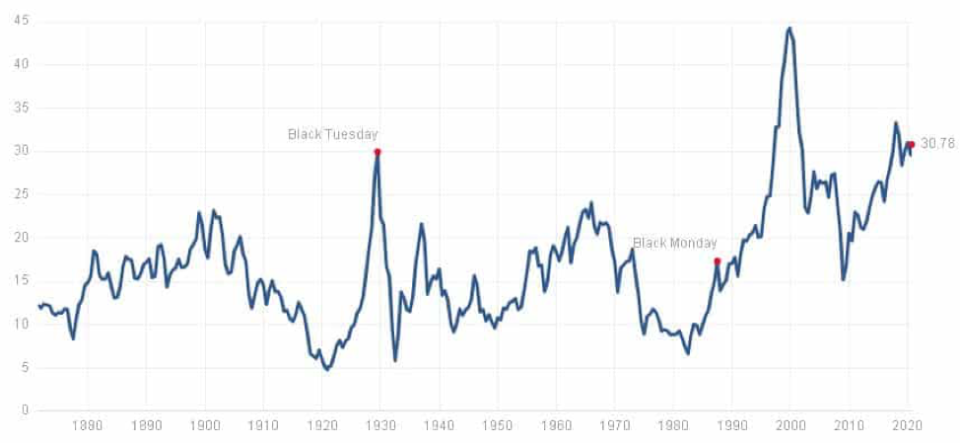

Source: advisorperspectives.com

Suffice to say, it's common to look at the financial tea leaves and see portents of calamity. But it's a lot harder to be correct, and be correct right now. Timing the market is hard.

"Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves."

– Peter Lynch

Predicting market recessions falls somewhere between the Farmers' Almanac weather forecast and foreseeing the end of the world. It takes neither skill nor accuracy but instead requires a general sense of pattern recognition.

It's difficult to find the skill nor inclination to identify a market bubble or to predict when it'll burst. And if someone convinces you they do have that skill, you have two options. They might be skilled. Or they're interested in your bank account. Use Occam's Razor.

Just remember: some permabears were screaming "SELL!" in late March 2020. You'll always hear "buy low, sell high." But maybe selling your portfolio at the absolute market bottom is the new secret technique?

"But…just look at the market"

It feels like something funny is going on.

The stock market is higher than it was a year ago. It's higher than it was before the COVID crash. How is this possible? How can we be in a better place mid-pandemic than before the pandemic?

One explanation: the U.S. Federal Reserve has dropped their interest rates to, essentially, zero. Lower interest rates make it easier to borrow money, and borrowing money is what keeps businesses alive. It's economic life support.

Of course, a side effect of cheap interest rates is that some investors will dump their cheap money into the stock market. The increasing demand for stocks will push the price higher. So, despite no increase (and perhaps even a decrease) in the intrinsic value of the underlying publicly-traded companies, the stock market rises.

Is that a bubble? Quite possibly. But I'm not smart enough to be sure.

The CAPE ratio–also called the Shiller P/E ratio–is another sign of a possible bubble. CAPE stands for cyclically-adjusted price-to-earnings. It measures a stock's price against that company's earnings over the previous 10-years (i.e. it's adjusted for multiple business cycles).

Earnings help measure a company's true value. When the CAPE is high, it's because a stock's price is much greater than its earnings. In other words, the price is too high compared to the company's true value.

Buying when the CAPE is high it's like paying $60K for a Honda Civic. It doesn't mean that a Civic is a bad car. It's just that you shouldn't pay $60,000 for it.

Similarly, nobody is saying that Apple is a bad company, but its current CAPE is 52. Try to find a CAPE of 52 on the chart above. You won't find it.

So, does it make sense to buy total market index funds when the total market is at a CAPE of 31? That's pretty high, and comparable to historical pre-bubble periods. Is a high CAPE representative of solid fundamentals? Probably not, but it's not a sure thing.

My Shoeshine Story

There's an apocryphal tale of New York City shoeshines giving stock-picking advice to their customers…who happened to be stockbrokers. Those stockbrokers took this as a sign of an oncoming financial apocalypse.

The thought process was: if the market was so popular that shoe shines were giving advice, then the market was overbought. The smart money, therefore, should sell.

I recently heard a co-worker talking about his 12-year old son. The kid uses Robin Hood—a smartphone app that boasts free trades to its users. Access to the stock market has never been easier.

According to his dad, the kid bought about $100 worth of Advanced Micro Devices (ticker = AMD). When asked what AMD produces, the kid said, "I don't know. I just know they're up 60%!"

This, an expert might opine, is not indicative of market fundamentals.

But then I thought some more. Is this how I invest? What does your index fund hold, Jesse? Well…a lot of companies I've never heard of. I just know it averages ~10% gains every year! My answer is eerily similar.

I'd like to believe that I buy index funds based on fundamentals that have been justified by historical precedent. But, what if the entire market's fundamentals are out of whack? I'm buying a little bit of everything, sure. But what if everything is upside down?

Closing Thoughts

Have you ever seen an index zealot transmogrify into a permabear?

Not yet. Not today.

It's understandable why some warn of a bubble. But there's no certainty or confidence to act on it. It's like John Bogle said in the face of market volatility:

"Don't do something. Just stand there."

– John Bogle

Markets go up and down. The U.S. stock market might crash tomorrow, next week, or next year. Amidst it all, it might be best to keep on investing. Steady amounts, steady frequency.

History says investing at all-time highs is still a smart thing. Current events seem crazy, but crazy has happened before. Stay the course.

generic

generic