Industry Take: Goldman Sachs (NYSE:GS) Beats Estimates but Financials are Losing Ground

First published on Simply Wall St News

The financial sector is reporting earnings this week, and analysts have set their growth estimates at a low 3.5%. For today's analysis, we will compare price valuations for the financial industry and single out The Goldman Sachs Group Inc. (NYSE:GS), as our focus.

Here are the key results from our analysis:

GS beat estimates driven by gains in FICC trading

Financials industry at historically low Median PE based on low future earnings estimates

Consumer financials have the lowest, while diversified financials have the highest earnings forecasts

Financials Sector Overview

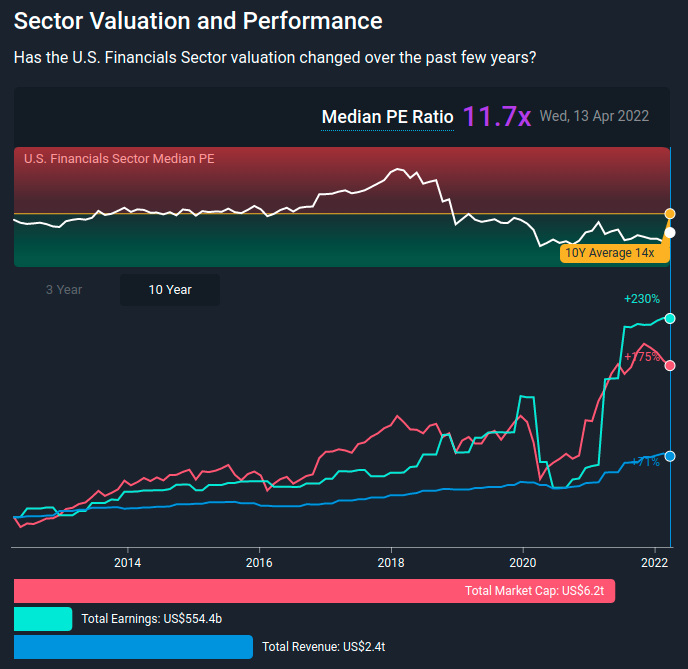

Markets tend to make their best estimates on future profits, hence the relationship between earnings growth and the market cap of stocks in the financial industry.

Analysts are estimating lackluster future industry profit growth of 3.5%, which is why the market cap of stocks within this industry is under pressure during this earnings season.

While stocks that have growth potential are likely to overcome drawdowns in the future, there are a lot of financial institutions that saw a spur of earnings during 2021, which are now reverting to historical levels, or possibly feeling more stress for the stocks that are closely exposed to consumers.

On the other side of analysts, we have investor sentiment.

The median industry PE ratio is 11.7x, which is 16% lower than the 10-Year average of 14x, indicating that investors expect a reduction in overall earnings.

However, not every sub-industry is the same:

Capital Markets have a 37x PE and a forecasted earnings growth of 6.1%, indicating high sentiment or possibly that the industry is somewhat overvalued.

Diversified Financials have the highest expected earnings growth of 23.8%, and a 7.7x PE.

Consumer Finance has both the lowest sentiment of 5.9x and projected forecasts of -2.8%.

Considering that top financial institutions like Goldman Sachs have posted earnings today, we will examine the results and their stock pricing.

Goldman Sachs Pricing

Goldman Sachs earned $3.831b in quarterly net income / $18.271b in the last 12 months. A 13.6% decline from the last quarter trailing twelve months.

Quarterly EPS was $10.76, beating the $8.95 estimates by 20.9%.

Trailing twelve-month diluted EPS is $51.52, down from the $59.36 previous quarter trailing 12 months.

The earnings were driven by Goldman's $4.723b FICC revenue performance - fixed income, currencies and commodities trading. It seems that Goldman's trading department made some good calls in the last quarter, which helped the company beat estimates. Quarterly trading revenue of $7.87b, vs $5.84b, a 34.7% surprise in this segment.

Quarterly net revenue of $12.93b, versus the estimated $11.73b, a 10.2% surprise.

Before today's open, Goldman had a -4% stock return from 12 months ago, and the company was trading at a 5.2x price to earnings ratio despite the high US$21.1 past net income. This is likely because the market expected the company to revert to the previous normalized earnings level with a forward PE of 8.2x.

However, if the company continues to find opportunities in future market volatility, shareholders may experience even more future earnings surprises - positive or negative.

See our latest analysis for Goldman Sachs Group

Keen to find out how analysts think Goldman Sachs Group's future stacks up against the industry? In that case, our free report is a great place to start.

If we review the last year of earnings growth, the company posted a terrific increase of 142%. The strong recent performance means it was also able to grow EPS by 145% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts still show earnings growth heading down by 9.6% per annum over the next three years. That's not great, as investors may prioritize stocks from the rest of the Capital Markets sub-industry, which is expected to grow by 6.1% per year.

Next Steps:

Investors that feel that financial sector stocks like Goldman Sachs are well positioned to capitalize on the possible worldwide financial turbulence, may find the stock attractive and take a deeper dive in the fundamentals of the company.

Conversely, financial sector stocks are expected to post low future growth rates, which can drag down individual stocks along with the sector - this is because there might be a rotating out of financials because of the estimated future volatility. If this happens, a good valuation will help investors find stocks that have the most rebound potential for longer term plays.

You might be able to find a better investment than Goldman Sachs Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

generic

generic