How Charlie Munger pulled Warren Buffett away from 'cigar butt' investing

The way Warren Buffett thinks about investment opportunities has evolved, and he can thank his right-hand man Charlie Munger for affecting some of this change.

The biggest change has been Buffett’s shift away from betting on what appeared to be the unusually cheap stocks of companies that didn’t necessarily have great business prospects. Buffett has called this “cigar butt” investing (and he gave a hilarious example of it at the 2019 Berkshire Hathaway (BRK-A, BRK-B) Annual Shareholders Meeting).

Here’s Buffett explaining the approach in his 1989 letter to Berkshire Hathaway shareholders: “If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible. I call this the ‘cigar butt’ approach to investing. A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the ‘bargain purchase’ will make that puff all profit.”

[Read More: Charlie Munger: Of course, I would fly in a Boeing 737 MAX]

In his first interview since Berkshire Hathaway’s Annual Shareholders Meeting, Munger was asked by Yahoo Finance Editor-in-Chief Andy Serwer how he convinced Buffett to focus less on “cigar butts” and more on “better businesses.”

“Well, it was perfectly obvious that he'd made so much money in the other technique that it was hard for him to leave something that had worked so well,” Munger said. “But it was not going to scale.”

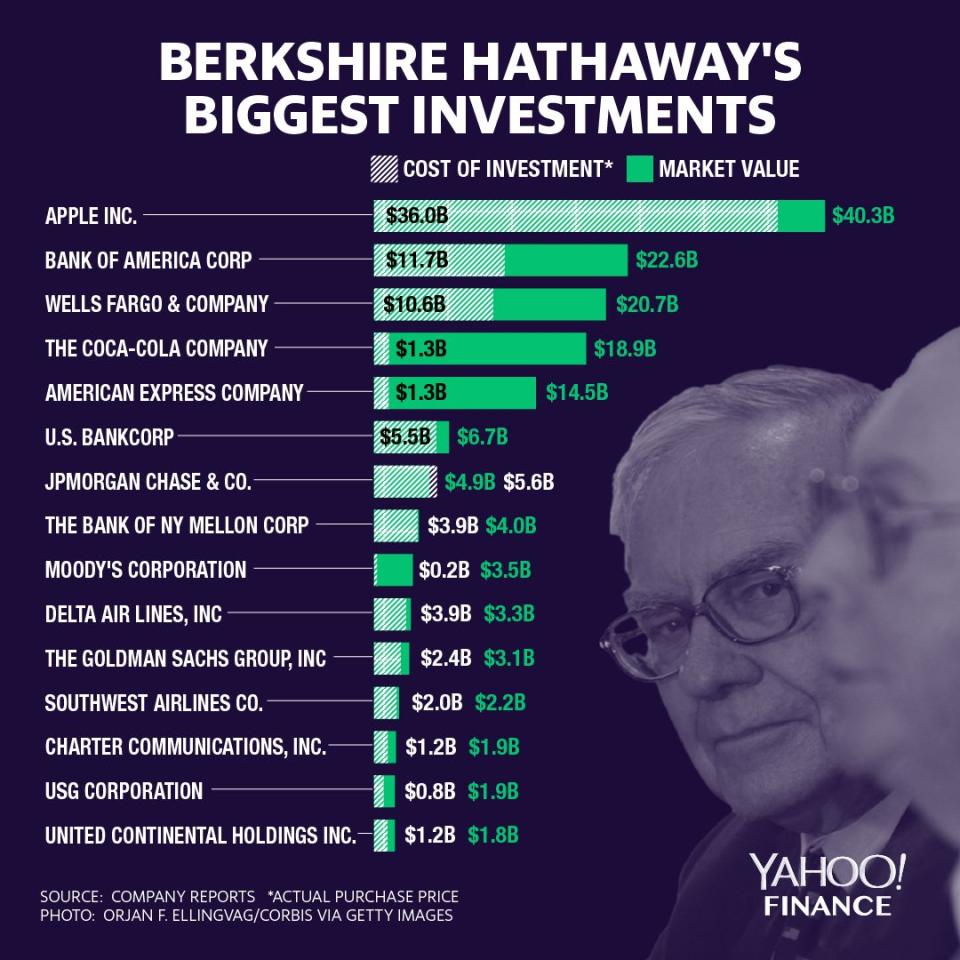

In other words, these “cigar butt” opportunities were not going to have a meaningful impact on Berkshire Hathaway considering how large it has become. According to a recent filing, Berkshire’s stock portfolio was worth $191.8 billion. This is why we’ve seen the company making massive bets on trillion-dollar companies like Amazon (AMZN) and Apple (AAPL).

“So when he started looking for investment values in great businesses that were temporarily under pressure, it changed everything for the better,” Munger said. “Now we could scale up to the big time.”

Munger made the remarks to Editor-in-Chief Andy Serwer in a conversation that will air on May 9, 2019 on Yahoo Finance in an episode of “Influencers with Andy Serwer,” a weekly interview series with leaders in business, politics, and entertainment.

—

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

Highlights from the 2019 Berkshire Hathaway Shareholders Meeting

Warren Buffett decries accounting rule change that has made a mess of Berkshire's earnings

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

generic

generic