Hilton (HLT) Q1 Earnings & Revenues Top Estimates, Rise Y/Y

Hilton Worldwide Holdings Inc. HLT delivered impressive first-quarter 2022 results, with earnings and revenues beating the Zacks Consensus Estimate and rising year over year. While the bottom line beat the consensus estimate for the second straight quarter, the top line surpassed the same for the fourth consecutive time.

Christopher J. Nassetta, president & CEO of Hilton, stated, "We are happy to report solid first quarter results, with all segments driving better than expected top line performance in March. Our results in the quarter, coupled with our confidence in continued recovery throughout the year, enabled us to begin returning capital to shareholders earlier than we had anticipated.”

Q1 in Detail

Hilton reported adjusted earnings per share (EPS) of 71 cents, beating the Zacks Consensus Estimate of 59 cents. In the prior-year quarter, the company reported an adjusted EPS of 2 cents.

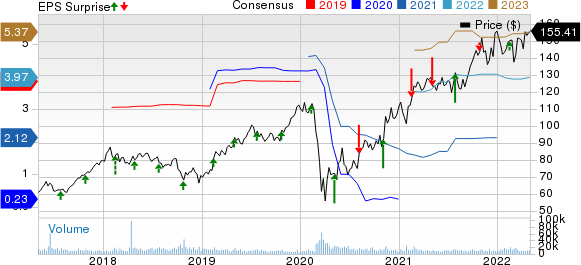

Hilton Worldwide Holdings Inc. Price, Consensus and EPS Surprise

Hilton Worldwide Holdings Inc. price-consensus-eps-surprise-chart | Hilton Worldwide Holdings Inc. Quote

Quarterly revenues of $1,721 million surpassed the consensus mark of $1,586 million. Moreover, the top line surged 96.9% from the year-ago quarter’s levels.

RevPAR and Adjusted EBITDA

In the quarter under review, system-wide comparable revenue per available room (RevPAR) increased 80.5% year over year (on a currency-neutral basis), owing to an increase in occupancy and average daily rate (ADR). However, RevPAR is down 17% compared with 2019 levels.

During the quarter, fee revenues increased 79% year over year. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) during the third quarter was $448 million compared with $198 million reported in the prior-year quarter.

Balance Sheet

As of Mar 31, 2022, cash and cash equivalent balance (inclusive of restricted cash) amounted to $1,510 million compared with $1,512 million in the previous quarter. The company reported long-term debt outstanding of $8.8 billion (compared with $8.9 billion in the previous quarter), excluding deferred financing costs and discounts, with a weighted average interest rate of approximately 4%.

During the quarter, the company resumed its share repurchase activity. Quarter to date (through Apr 29, 2022), the company repurchased 1.8 million shares of its common stock worth approximately $265 million.

Meanwhile, the company declared a quarterly cash dividend of 15 cents per share. The dividend will be payable on Jun 24, 2022, to shareholders of record as of May 27, 2022.

Business Updates

During first-quarter 2022, Hilton opened 76 new hotels. It also achieved net unit growth of nearly 7,800 rooms. During the quarter, the company opened the 500th hotel under its Homewood Suites in the United States. HLT also announced the opening of Hilton Singapore Orchard (in the Asia Pacific region) and two new lifestyle hotels, including the Canopy by Hilton Boston Downtown and the Canopy by Hilton New Orleans Downtown.

As of Mar 31, 2021, Hilton's development pipeline comprised nearly 2,730 hotels, with nearly 410,000 rooms across 113 countries and territories — including 27 countries and territories where it currently does not have any running hotels. Moreover, 245,000 rooms in the development pipeline were located outside the United States and 200,000 rooms were under construction. The company boosted its development pipeline with two international deals under its Curio Collection (by Hilton brand), including the Royal Palm Galapagos (in Ecuador) and the Palacio Bellas Artes San Sebastian (Spain). For 2022, the company expects net unit growth to be nearly 5%.

Outlook

For second-quarter 2022, the company anticipates net income in the range of $250-$264 million. Adjusted EBITDA is expected to be between $590 million and $610 million. The company expects second-quarter diluted EPS (adjusted for special items) to be between 98 cents and $1.03.

For the second quarter, the company anticipates system-wide RevPAR to increase between 45- 50% on a year-over-year basis. However, the metric is expected to decline 5-10% from 2019 levels.

For 2022, the company anticipates net income in the range of $1,001-$1,071million. General and administrative expenses for 2022 are projected to be between $410 million and $430 million. Adjusted EBITDA is expected to be between $2,250 million and $2,350 million. The company expects 2022 diluted EPS (adjusted for special items) in the range of $3.77-$4.02. Full-year capital return is projected to be between $1.4 billion and $1.8 billion.

The company anticipates system-wide 2022 RevPAR to increase between 32-38% on a year-over-year basis. However, the metric is expected to decline 5-9% from 2019 levels.

Zacks Rank & Key Picks

Hilton currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Consumer Discretionary sector are Funko, Inc. FNKO, Clarus Corporation CLAR and Bluegreen Vacations Holding Corporation BVH.

Funko sports a Zacks Rank #1 at present. FNKO has a trailing four-quarter earnings surprise of 96.2%, on average. Shares of the company have declined 20.6% in the past year.

The Zacks Consensus Estimate for Funko’s current financial year sales and EPS suggests growth of 22.6% and 26.8%, respectively, from the year-ago period’s reported levels.

Clarus sports a Zacks Rank #1 at present. The company has a trailing four-quarter earnings surprise of 12.3%, on average. Shares of the company have increased 20.5% in the past year.

The Zacks Consensus Estimate for CLAR’s 2022 sales and EPS suggests growth of 25.3% and 23.1%, respectively, from the year-ago period’s levels.

Bluegreen Vacations carries a Zacks Rank #2 (Buy). BVH has a trailing four-quarter earnings surprise of 425.1%, on average. The stock has increased 41.6% in the past year.

The Zacks Consensus Estimate for BVH’s current financial year sales and EPS indicates growth of 8.3% and 20.8%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Clarus Corporation (CLAR) : Free Stock Analysis Report

Funko, Inc. (FNKO) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

generic

generic