Goldman Sachs is even more bullish on the power of a COVID-19 vaccine

With most consumers having a stockpile of cash saved up after a year of going nowhere during the COVID-19 pandemic — and vaccination in plain view — the number crunchers at Goldman Sachs are even more bullish on the path for the U.S. economy.

On Monday, Goldman Sachs Chief Economist Jan Hatzius lifted his 2021 GDP estimate to 5.3% from 5%. Hatzius thinks 2021 will come out of the gate somewhat solid due to vaccine distribution, leading to 3% GDP growth in the first quarter. Previously, Hatzius estimated 1% growth for the U.S. economy in the first quarter.

Hatzius’ call is rooted in an upbeat outlook for consumer spending.

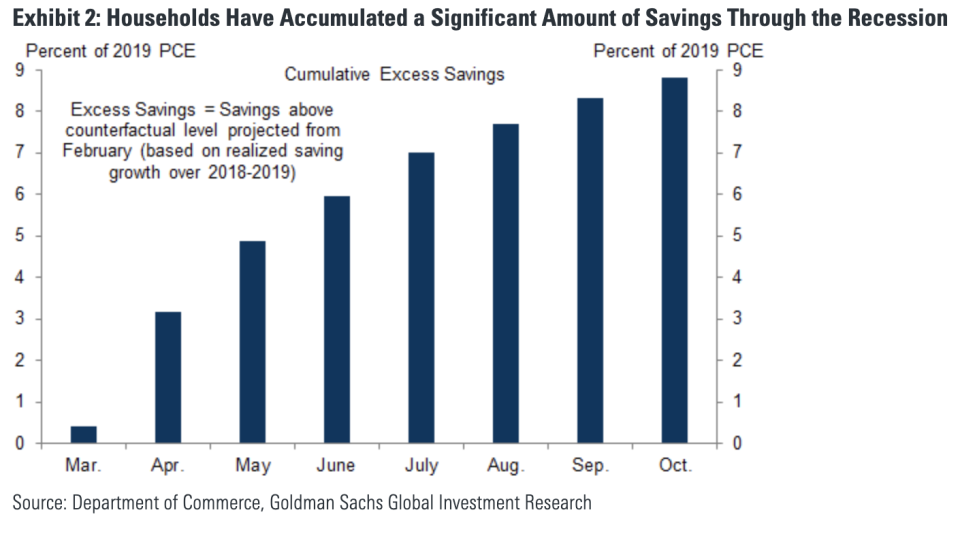

“The growth outlook remains very uncertain, with rising new virus cases and fatalities, warnings of further state and local restrictions to come, and signs of an increasing drag on virus-sensitive industries, but overall a very resilient consumer in the midst of the virus resurgence,” said Hatzius. “We estimate the vaccine boost based on the assumption of a sharp bounce-back in the most virus-sensitive industries, with reopening of businesses, reduced risks, pent-up demand for services, and a significant amount of accumulated excess savings all providing a tailwind.”

The economist says that assuming 50% of excess consumer savings is spent over the next two years, there will be 0.5% average boost to consumption each quarter following the arrival of a vaccine.

Such a pent up demand theory put forward by Hatzius isn’t totally far-fetched. For some retailers, it’s already playing out this holiday season.

Ulta Beauty CEO Mary Dillon is seeing promising trends in the personal care retailer’s business after months of consumer spending more cautiously on non-essential goods.

“What I would say is that beauty as a gift giving category at Ulta Beauty for the season we think is more relevant than ever, and we are seeing that in how the early start [to the shopping season] looks,” Dillon told Yahoo Finance Live.

Even still, meeting Hatzius’ bullish GDP call for next year won’t be easy given the state of the U.S. labor market — which has been ravaged by the pandemic.

S&P Global Chief Economist Beth Ann Bovino points out that permanent job losers accounted for a “chilling” 34.9% of the 10.7 million people unemployed in November.

So while many consumers may have money socked away, they could decide to keep on saving in 2021 due to job market uncertainty. That could undercut Hatzius’ call (and others like it on the Street right now) and perhaps unwind some of the bullishness evident in asset markets currently in large part on vaccine hopes.

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

What’s hot from Sozzi:

Watch Yahoo Finance’s live programming on Verizon FIOS channel 604, Apple TV, Amazon Fire TV, Roku, Samsung TV, Pluto TV, and YouTube. Online catch Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, and reddit.

generic

generic