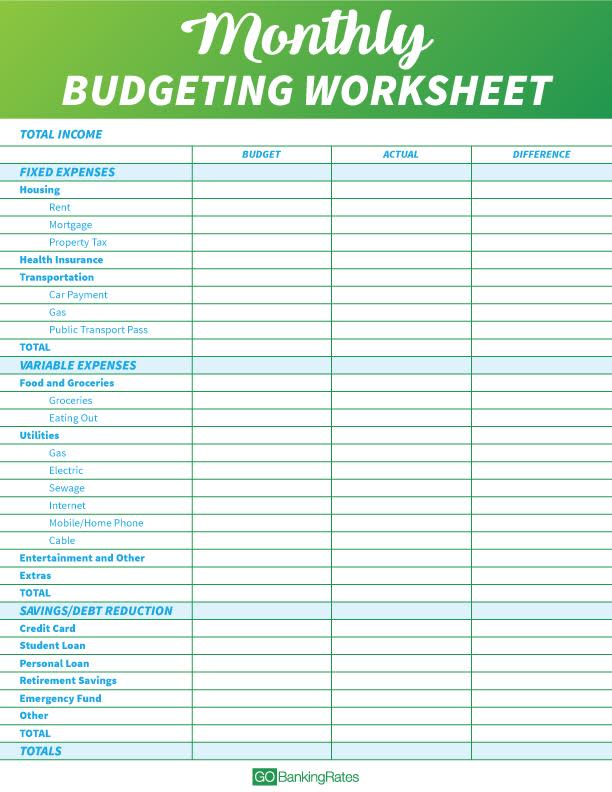

Create Your Perfect Budget With This Worksheet

If you find yourself wondering where your money went at the end of each month, budgeting can help you become more aware of your income and spending. Committing your budget to paper takes the benefits a step further by showing you exactly where your money is going and how much you need to cover your expenses. Once you’ve created your planner, you can breeze through bill payments without breaking a sweat and make sure you’re spending in a way that supports your financial goals instead of working against them. If you’ve never budgeted before — or you haven’t done it for a while — follow this guide.

See Our List: 100 Most Influential Money Experts

Explore: Your Biggest Money Etiquette Questions Answered

How To Create a Budget

Here are the major steps to create your budget:

Identify and calculate your fixed expenses.

Track spending on variable expenses.

Build your savings.

Eliminate debt.

First, learn the details of how to make a monthly budget that fits within your net income, then use this budgeting worksheet to start tracking your money.

Fixed Expenses

When it comes to budgeting, there are two categories of expenses: fixed and variable. Fixed expenses don’t change from month to month, and they’re often non-negotiable. This category includes the absolute necessities — such as housing, health insurance and transportation — and often comprises the largest portion of your budget.

Take Our Poll: Do You Have an Emergency Fund Established?

Housing

The most important part of your monthly budget is the amount you spend on housing, and chances are, it’s also the biggest. Research from the Bureau of Labor Statistics found that American households [i.e., consumer units], spent an average of $22,624 on housing in 2021. That works out to about $1,885 monthly.

If you own your home, you should also include the cost of your property tax, homeowner’s insurance and homeowner’s association fees, if applicable, when budgeting for housing costs.

Health Insurance

Staying healthy isn’t free, so you should include the cost of healthcare in your budget planner. Healthcare costs include your health insurance premiums if you’re not covered through work — or if you’re topping up your coverage using private market insurance — as well as costs for healthcare not covered by insurance and any money you spend on co-pays and deductibles.

How much you spend on healthcare depends on your age, whether you’re taking prescription medication and the cost of your insurance premiums. Americans’ average healthcare spending reached $5,452 per household last year, according to the BLS, with $3,704 of that going to health insurance. Generally speaking, the older you are, the more you’re likely to spend on healthcare.

Transportation

Unless you’re among the lucky few who can bike or walk everywhere you need to go, budgeting for transportation is nearly as essential as budgeting for housing. Depending on your living situation, transportation costs might include a monthly metro pass, ridesharing, car loan or vehicle leasing payment, registration, insurance, fuel and routine maintenance like oil changes.

When budgeting for transportation, keep in mind that some components of this category, such as car payments, are considered fixed, whereas others, like gas, vary.

Overall, transportation costs American households an average of $10,961 per year — the equivalent of about $913 each month.

Variable Expenses

Unlike fixed expenses, the variable components of your budget will change from month to month depending on your lifestyle. Some variable expenses, such as grocery costs, are necessary, whereas others, like entertainment, count as discretionary spending. Creating a budget will keep you from overspending on discretionary expenses so that you have enough money for necessities.

Food and Groceries

No spending tracker is complete without a category for food costs. Accounting for groceries is a pivotal part of the budgeting process, and it should also include delivery, take-out and restaurant visits as well as monthly subscription fees for delivery services you’ve joined. And don’t forget about those food expenses that slip by you — like the latte you paid for in cash.

These expenses can work out to a sizable amount of spending over the course of a year. American households spend an average of $8,289 per year on food, with about $5,200 going to food eaten at home and the remainder paying for food eaten away from home.

Utilities

Though some utilities — like your phone and internet — are fixed, many shift from month to month depending on the season. Gas and electric bills, for instance, will fluctuate as you crank your air conditioner in the summer or heater in the winter. Other utility costs to consider include water/sewer and trash services.

Taken together, they really add up. For example, energy bills for an average single-family home run $2,060 per year, according to Energy Star. The Broadband Pricing Index Report from USTelecom revealed that the most popular tier of internet service costs about $580 per year. The cell bill for one user averages $840 per year, according to JD Power.

Entertainment and Other Extras

Living on a budget doesn’t mean you’re not allowed to enjoy yourself, so include entertainment expenses in your budget template so you can maintain balanced spending habits. American households’ average entertainment expenditures are about $3,600 each year, which works out to $300 per month. Your discretionary expenses can include hobbies, streaming services and other subscriptions, cable, movies, amusement parks, concerts or other activities you spend money on purely for enjoyment.

Additional expenses that will likely work their way into your budget include personal care expenses, like hair care and clothing. On average, personal care products and services cost American households $771 per year, and clothing adds about $1,750 more. Although you might not spend the same amount each month, setting aside a personal care allowance ensures that you’ll have the funds you need when you do go to make a purchase.

You should also make room in your budget for fitness, even if it’s a discount gym membership or streaming workouts, because staying healthy can save you money over time.

Building Savings and Eliminating Debt

One of the biggest benefits of money management is gaining overall financial health because you’re planning your spending to align with your financial goals. With that in mind, saving for the future to become financially secure is key for any budget.

In terms of retirement, start setting goals and saving as soon as you can. Investment brokerage Fidelity says you’ll need 50% to 80% of your pre-retirement income to maintain your current lifestyle[x]. To reach that goal, it advises that you try to save 15% of your pre-tax income, including matching funds from your employer, for retirement.

The easiest way to put money away is to contribute to a 401(k) or individual retirement account. In your monthly budget, deduct this money from your monthly income right away so that you’re not tempted to spend it instead. Consider automating your savings as part of your plan to build better money habits.

It’s also prudent to prioritize establishing an emergency fund for unexpected expenses such as a major home repair, or to cover your expenses in the event you lose your job. As a general rule, try to stash away at least three to six months’ living expenses — use your completed worksheet as a guide.

Another budget priority is debt reduction and eventual elimination. Whereas a mortgage and auto loan are “good” debts because they help you build wealth and maintain a comfortable lifestyle, bad debit like credit card balances can be expensive and burdensome. Set aside a percentage of your income as soon as you get your paycheck to put toward eliminating any debt you might have, starting with bad debt.

Leftover funds can go into general savings you can use for vacations and other luxury purchases.

More From GOBankingRates

Sylvie Tremblay contributed to the reporting for this article.

This article originally appeared on GOBankingRates.com: Create Your Perfect Budget With This Worksheet

Yahoo Home

Yahoo Home