ConocoPhillips (COP) Beats Q3 Earnings Estimates, Ups Dividend

ConocoPhillips COP has reported third-quarter 2022 adjusted earnings per share of $3.60, beating the Zacks Consensus Estimate of $3.41. The bottom line surged from the prior-year quarter’s $1.77 per share.

One of the world’s largest independent oil and gas producers based in Houston, TX, ConocoPhillips’ quarterly revenues of $21,614 million increased from third-quarter 2021 sales of $11,616 million. Also, the top line beat the Zacks Consensus Estimate of $17,052 million.

The strong quarterly results have been aided by higher oil-equivalent production volumes and realized commodity prices.

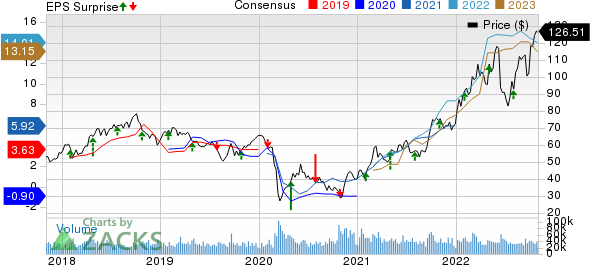

ConocoPhillips Price, Consensus and EPS Surprise

ConocoPhillips price-consensus-eps-surprise-chart | ConocoPhillips Quote

Dividend Hike & Share Repurchases

ConocoPhillips has announced a quarterly ordinary dividend of 51 cents per share, indicating a 10.9% increase from the last paid 46 cents. The dividend is payable on Dec 1, 2022, to stockholders of record at the close of business on Nov 15, 2022. Additionally, COP announced a variable return of cash payment of 70 cents per share.

The company’s board of directors approved a $20-billion increase in the existing share repurchase program to $45 billion.

Production

Total production averaged 1,754 thousand barrels of oil equivalent per day (MBoe/d), up from the year-ago quarter’s 1,544 MBoe/d. Of the total output, 51% was crude oil. Overall production was higher than the year-ago period primarily due to the significantly increased production in the Lower 48.

ConocoPhillips’ crude oil production was 895 thousand barrels per day (MBbls/d), higher than the year-ago quarter’s 815 MBbls/d. Production of natural gas liquids totaled 271 MBbls/d, higher than the year-ago period’s 130 MBbls/d. Bitumen production for the quarter was 69 MBbls/d, unchanged from the year-ago quarter. However, the company’s natural gas output was 3,113 million cubic feet per day (MMcf/d), lower than the year-ago level of 3,177 MMcf/d.

Realized Prices

Average realized oil equivalent prices rose to $83.07 per barrel from the year-ago level of $56.92.

The average realized crude oil price for the third quarter was $97.56 per barrel, reflecting a significant increase from the year-ago figure of $70.43. Realized natural gas liquids price was $35.47 per barrel, higher than the year-ago quarter’s $34.79. The average realized natural gas price for third-quarter 2022 was $13.04 per thousand cubic feet, up from the year-ago period’s $5.94. The average realized bitumen price was $49.77 per barrel, reflecting an increase from the year-ago level of $41.19.

Total Expenses

ConocoPhillips’ third-quarter total expenses rose to $14,174 million from $8,034 million in the corresponding period of 2021.

Production and operating expenses rose to $1,799 million for the reported quarter from $1,389 million a year ago. Similarly, the cost of purchased commodities rose to $9,251 million for the quarter from $4,179 million a year ago. Exploration costs increased to $89 million for the September-end quarter of 2022 from $65 million in the comparable period of 2021.

Balance Sheet & Capital Spending

As of Sept 30, 2022, ConocoPhillips had $8,010 million in cash and cash equivalents. The company had a total long-term debt of $16,297 million. It had a debt-to-capitalization ratio of 0.257. At the third-quarter end, the company had short-term debt of $664 million.

Capital expenditure and investments totaled $2,497 million, and dividend payments grossed $1,484 million. Net cash provided by operating activities was $8,740 million.

Guidance

For 2022, ConocoPhillips reiterated its production guidance of 1.74 million barrels of oil equivalent per day (MMBoe/d). For the fourth quarter, ConocoPhillips expects production between 1.74 MMBoe/d and 1.80 MMBoe/d.

Zacks Rank & Stocks to Consider

ConocoPhillips currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RPC Inc. RES reported adjusted earnings of 32 cents per share in the third quarter, beating the Zacks Consensus Estimate of 25 cents. The strong quarterly results were backed by higher activity levels in all the service lines and improved pricing.

With no debt load, RPC had cash and cash equivalents of $35.9 million at the third-quarter end. This reflects the company’s strong balance sheet that provides it with massive financial flexibility. It allows RPC to remain afloat during tough times.

Oceaneering OII reported a third-quarter 2022 adjusted profit of 23 cents per share, beating the Zacks Consensus Estimate of a profit of 13 cents. The outperformance was largely due to robust results in certain segments.

For 2022, Oceaneering projects consolidated EBITDA of $215-$240 million and continued significant free cash flow generation of $25-$75 million.

Halliburton Company HAL reported a third-quarter 2022 adjusted net income per share of 60 cents, surpassing the Zacks Consensus Estimate of 56 cents. The outperformance reflected stronger-than-expected profit from its divisions.

Halliburton expects international activity to gain momentum throughout the globe. The company’s state-of-the-art portfolio, selective contract wins and balanced geographic mix will help it maximize profit from the upcycle. As far as North America is concerned, HAL sees continued revenue growth in a tight market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

generic

generic