This chart explains why the US will avoid a recession, according to JPMorgan strategists

The US is going to dodge a recession, at least in the near term, according to JPMorgan Asset Management.

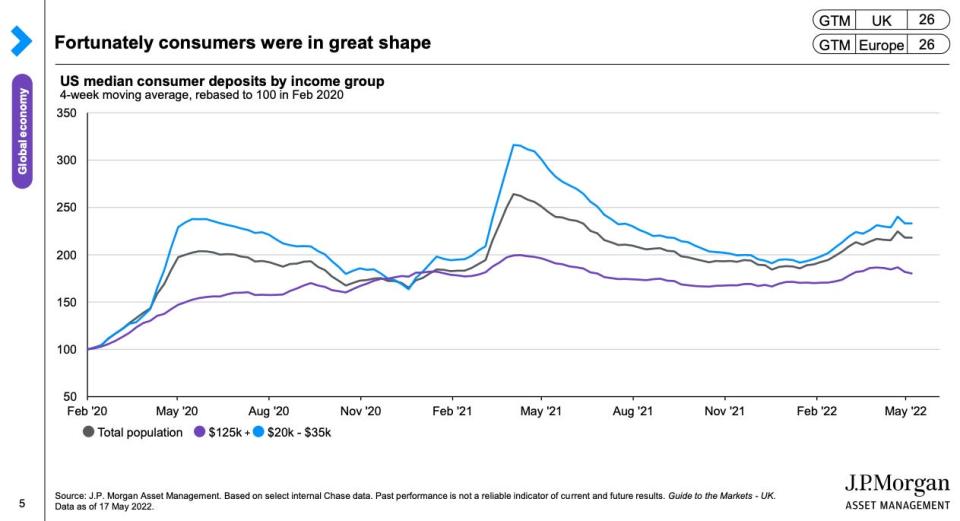

JPMAM strategist Mike Bell said the massive increase in US consumer savings is the key factor that will support the economy.

JPMorgan's internal data shows how Americans have built up a healthy cushion since the pandemic started.

Will the US tumble into a recession? It's the key question hanging over global financial markets right now.

Strategists at JPMorgan Asset Management have staked out their view: the economy will avoid a long-term decline, for now.

"Our base case is not that we get a recession in the US in the near term," Mike Bell, a global market strategist at JPMAM, said at a conference in London on Wednesday.

Bell said the key factor supporting the US economy is the fact that Americans are sitting on large amounts of savings, thanks in large part to the pandemic-era stimulus checks. This buffer will help cushion the blow of high inflation, he said.

To back up his argument, Bell pointed to a chart showing the sharp rise in the deposits of JPMorgan Chase retail banking customers since the start of the pandemic.

"See in the US how much the stimulus checks boosted savings, particularly for the lower income group," Bell said.

"Part of the reason we had a lot of booming economic growth and inflation over the last year was that some of that got spent. But they're still sat, on average, on somewhere like double the amount of savings they had at the beginning of the pandemic."

However, Bell said there's still a chance the Federal Reserve raises interest rates so far it'll trigger a recession — typically defined as two consecutive quarters of falling gross domestic product.

And he said central bankers and finance ministers face a trade-off. If there's no recession, then inflation is likely to stay above central banks' 2% target for a lengthy period.

Read the original article on Business Insider

generic

generic