Apple Q4 Preview: Another EPS Beat Inbound?

The Zacks Computer and Technology Sector has tumbled in 2022 amid a hawkish pivot from the Federal Reserve, down more than 30% and widely underperforming the general market.

Image Source: Zacks Investment Research

A behemoth in the sector, Apple AAPL, is on deck to unveil quarterly earnings on October 27th, after the market close.

Currently, the legendary tech titan carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a B.

How does everything else stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, Apple shares have held up relatively well, down 14% vs. the general market’s decline of roughly 20%.

Image Source: Zacks Investment Research

Over the last three months, Apple shares have continued to display relative strength, up a marginal 0.4% and outperforming the general market once again.

Image Source: Zacks Investment Research

The relative strength shows that market participants have respected Apple shares much higher than most, undoubtedly a positive in a historically-volatile 2022.

AAPL’s valuation multiples have pulled back by a fair margin; the company’s 22.9X forward earnings multiple is just a tick below its five-year median and nowhere near 2021 highs of 35.6X.

The company carries a Value Style Score of a C.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have primarily been bullish regarding their earnings outlook, with three positive earnings estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $1.26 suggests Y/Y earnings growth of a modest 1.6%.

Image Source: Zacks Investment Research

Apple’s top-line looks to improve as well; the Zacks Consensus Sales Estimate of $88.5 billion suggests revenue growth of 6% from year-ago quarterly sales of $83.4 billion.

Quarterly Performance & Market Reactions

The tech titan has an impressive earnings track record, exceeding revenue and earnings estimates in nine of its last ten quarters. Just in its latest print, Apple registered a 5.3% EPS beat and a 1.2% revenue beat.

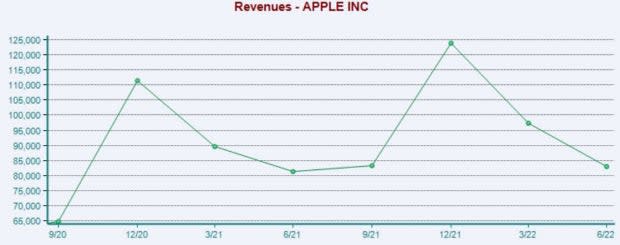

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, the market has liked what it’s seen from the company as of late, with shares moving upward following each of its last four quarterly prints.

Putting Everything Together

Apple shares have been relatively strong in 2022, outperforming the general market across several timeframes and indicating that buyers have defended the stock higher than others.

Valuation multiples have fallen extensively amid the adverse price action in 2022, with the company’s shares now trading just below their five-year median forward earnings multiple.

Analysts have primarily been bullish in their earnings outlook, with estimates suggesting Y/Y upticks in revenue and earnings.

The company has been the definition of consistency within its quarterly results, and the market has liked what it’s seen from the quarterly releases as of late.

Heading into the print, Apple AAPL carries a Zacks Rank #3 (Hold) paired with an Earnings ESP Score of 0.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

generic

generic