This Analyst Sees a 14-Bagger in Sorrento (SRNE) Stock

In January, Sorrento Therapeutics (SRNE) -- a biotech specializing in cancer pain alleviation, but with no profits and only $25 million in trailing revenue -- rejected a $1 billion buyout offer from an unidentified private equity fund, which had valued the company's shares at "up to $7."

Sorrento management said the offer "significantly undervalues the company" -- which at first glance seems a strange statement to make, given that Sorrento stock currently costs just a little more than $2 a stub, and the entire company is worth less than $400 million.

But just because it's strange doesn't mean it's untrue -- which brings us to H.C. Wainwright.

Wainwright analyst Raghuram Selvaraju released a note updating investors on new "Phase 1b" clinical trial results on Sorrento's lead pain management drug candidate, resiniferatoxin (RTX). Reviewing the status of 14 patients involved in the clinical study, Selvaraju observes that, so far, "no dose-limiting toxicities (DLTs) have been reported," while "positive outcomes have thus far been observed in three subjects," including but not limited to "a decrease in pain scores."

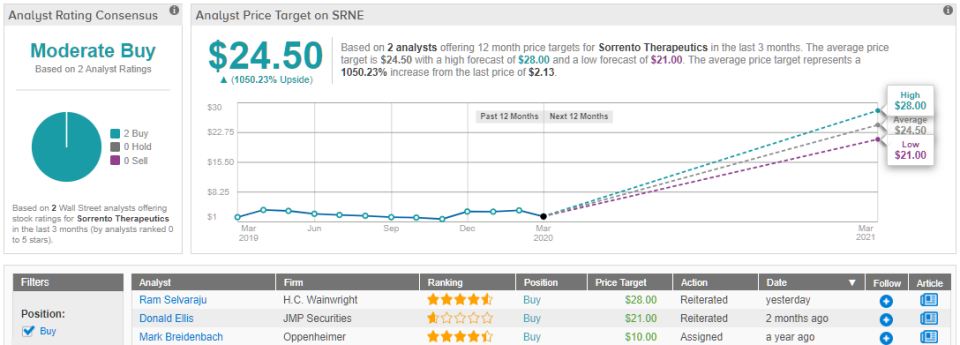

Commenting that these results so far "bode well for future RTX development," Selvaraju reiterated his call for Sorrento stock to rise roughly 14-fold in value to a target price of $28 a share over the next year. (To watch Selvaraju's track record, click here)

Selvaraju believes RTX could be useful for treatment of joint-related pain in cancer patients, as well as injected as an epidural for broader treatment of "intractable cancer pain." A "dearth of effective treatment options" alternative to RTX, argues the analyst, could lead to rapid approval of the drug, especially because doctors are seeking "new non-opioid pain medications" that they can use "in the wake of the emergence of the opioid-based painkiller addiction crisis in the U.S."

Being a "highly potent agent," RTX would appear to fit the bill.

Looking ahead, Selvaraju notes that Sorrento will be meeting with the FDA to discuss end-of-Phase 2 results in the next few months and, if all goes well, the drug could enter into Phase 3 "later this year."

At the same time -- but not necessarily related to those Phase 3 trials -- Selvaraju believes the end of this year (Q4) could see Sorrento finally turn profitable with a $0.01 per share GAAP profit. The company would still be unprofitable for the year, but Q4 could turn out to be a turning point for Sorrento in more ways than one.

And even if Sorrento fails to hit the profitability mark, Selvaraju sees sales for the company more than doubling this year -- and more than doubling over 2019 levels in each of Q3 2020 and Q4 2020.

All in all, of the three analysts tracked on TipRanks, who have put forward recommendations for Sorrento stock over the past year, Selvaraju's target is by far the most aggressive. Donald Ellis at JMP Securities thinks Sorrento stock could be worth closer to $21 a share. Mark Breidenbach of Oppenheimer says $10 -- but all three agree with Sorrento itself, that the stock is worth more than the private equity firm bid for it. (See Sorrento stock analysis on TipRanks)

generic

generic