Amazon’s (NASDAQ:AMZN) Earnings Volatility Likely to Continue

This article first appeared on Simply Wall St on the 4th of August.

Key Takeaways from This Analysis:

Second quarter results were better than expected and better than they appear at first glance.

Earnings volatility may continue due to the impact of Rivian's stock price, USD strength, and energy costs.

The valuation seems reasonable, but upside may be limited in the medium term.

Amazon.com’s ( NASDAQ:AMZN ) second-quarter results last week were mixed, with a revenue beat and an EPS miss. Nevertheless, the results and guidance were clearly better than the market expected as the stock price closed 16.7% higher the following day. While the stock does appear to be reasonably valued, there are also several reasons to expect ongoing earnings volatility.

Second-quarter earnings summary

Revenue: Up 7% year-on-year to $121.23 bln and $2.09 bln higher than consensus estimates.

Normalized EPS: $ -0.20 vs $0.76 in the second quarter last year and $0.32 lower than consensus estimates.

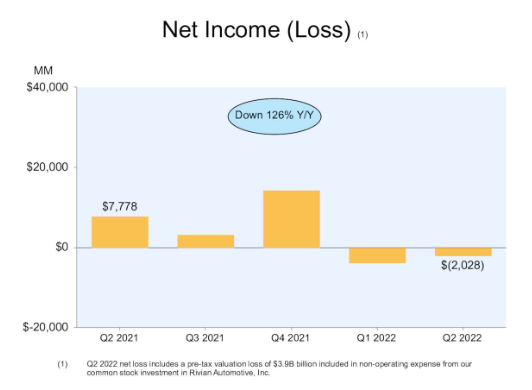

$2 billion net loss resulted from $3.9 bln loss on stake in Rivian Automotive ( NASDAQ: RIVN ).

AWS: $19.7 billion vs. $19.56 billion expected, up 33% year-on-year, but down from 37% growth last quarter.

Advertising: $8.76 billion vs. $8.65 billion expected, up 18%, compared to growth of 23% last quarter.

Third quarter guidance:

Net sales: $125 to $130 bln, vs $126.56 bln consensus

Operating income: $0 to $3.5 bln, down from $4.9 bln in the third quarter of 2021.

Rivian’s Volatility is Amazon’s Volatility

Amazon’s operating margin has always been quite tight because the company reinvests its cashflows to fund further growth. This means that the volatility of Amazon’s 17.5% stake in Rivian creates massive changes to the company’s net income. Rivian held its IPO in November last year which resulted in an $11.8 bln profit for Amazon in the fourth quarter of 2021. Since then, Rivian’s share price has fallen as much as 80%, resulting in $11.5 bln in write-downs for Amazon.

Amazon provided third-quarter guidance for revenue and operating income which doesn’t include investments like the stake in Rivian. Any changes to the value of this stake will further affect net income and EPS.

In addition to the Rivian stake, there are a few other factors that are likely to imp[act the bottom line in the next few quarters. Like many of the largest US companies, the strength of the USD is rescuing the value of offshore earnings for Amazon. This effect could continue, or reverse and provide a tailwind to earnings in the future.

During the earnings call, Amazon’s CFO Brian Olsavsky also mentioned that volatility in energy prices is impacting the company’s margins.

Finally, Amazon’s Prime Day sale was held during the third quarter this year, while it was held during the second quarter last year. This will provide the company with a boost in sequential sales, but create an unrealistic comparison with the third quarter of 2021.

Amazon share price vs Valuation

Amazon is trading on a price-earnings ratio of 118.4x when calculated using the last 12 months of earnings. This is a lot higher than the Simply Wall St Fair Ratio of 72.6x. The fair P/E is a new feature on the Simply Wall St stock reports which approximates the expected P/E ratio by accounting for earnings growth forecasts, profit margins, and risk factors.

The forward P/E based on the consensus EPS forecast for the full 2023 is 56x. This implies there would be some upside, and a share price of about $172 would be fair at the end of 2023. This lines up approximately with the 12-month analyst forecast of $174, as illustrated below.

Simply Wall Street’s discounted cash flow model estimates a higher value at $288. However, this model is based on long-term cash flow forecasts and several assumptions which are very likely to change, so it’s really just a reference price.

What this means for investors

Amazon has been a disappointing investment over the last two years as rising costs capped margins and then revenue growth slowed dramatically. After the last set of results were released we mentioned that cash flows should improve as capital expenditure was reduced. This is still the case, but the Rivian investment and other factors may result in ongoing volatility in earnings, so the share price volatility could continue too.

Check out our full analysis for Amazon.com to keep track of other key metrics and potential risks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

generic

generic