Accenture (ACN) to Gain From Advocate Buyout: Here's How

Accenture plc ACN yesterday announced that it has completed the acquisition of Advocate Networks, LLC, a technology consultancy and managed services provider of Technology Business Management (“TBM”) solutions. Financial terms of the deal have been kept under wraps.

Headquartered in Norcross, GA, Advocate’s in-depth technology expertise and wide range of services are aimed at helping organizations generate business value, achieve cost savings and modernize their technology platforms.

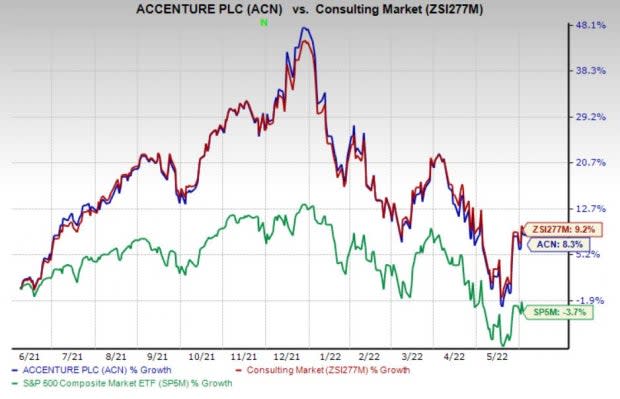

Over the past year, shares of Accenture have gained 8.3% compared with 9.2% growth of the industry it belongs to and 3.7% loss of the Zacks S&P 500 composite.

Image Source: Zacks Investment Research

How Will Accenture Benefit?

Advocate’s team of more than 85 professionals will be joining Accenture’s Technology Strategy & Advisory practice. Advocate’s complete suite of TBM services, from strategic advisory to TBM-as-a-service (TBMaaS), complements Accenture’s cloud and digital transformation services and end-to-end capabilities for TBM.

Considering the growing need of organizations expecting their technology investments to boost innovation and transform business operations, the latest deal seems to be a strategic move on Accenture’s part to strengthen its portfolio.

Keith Boone, Accenture’s North America Technology Strategy & Advisory lead, stated, "With the powerful combination of Accenture and Advocate, we will offer a multitude of industry-leading resources and capabilities to help our clients measure the value of technology initiatives in a clear, quantifiable manner."

Zacks Rank and Stocks to Consider

Accenture currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Business Services sector that investors can consider are Cross Country Healthcare CCRN, Gartner IT and Avis Budget CAR, each sporting a Zacks Rank #1 at present.

Cross Country Healthcare has an expected earnings growth rate of 54.2% for the current year. CCRN has a trailing four-quarter earnings surprise of 29.2%, on average.

Cross Country Healthcare has a long-term earnings growth rate of 6.9%.

Gartner’s shares have gained 10.6% in the past year. IT delivered a trailing four-quarter earnings surprise of 24.2%, on average.

The Zacks Consensus Estimate for Gartner's current-year earnings has moved up 13.6% in the past 90 days.

Avis Budget has an expected earnings growth rate of 59.8% for the current year. CAR delivered a trailing four-quarter earnings surprise of 102.1%, on average.

Avis Budget has a long-term earnings growth rate of 19.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

generic

generic