Samsung races to beat Intel to market with glass substrates for chips — revolutionary tech boosts processing capabilities

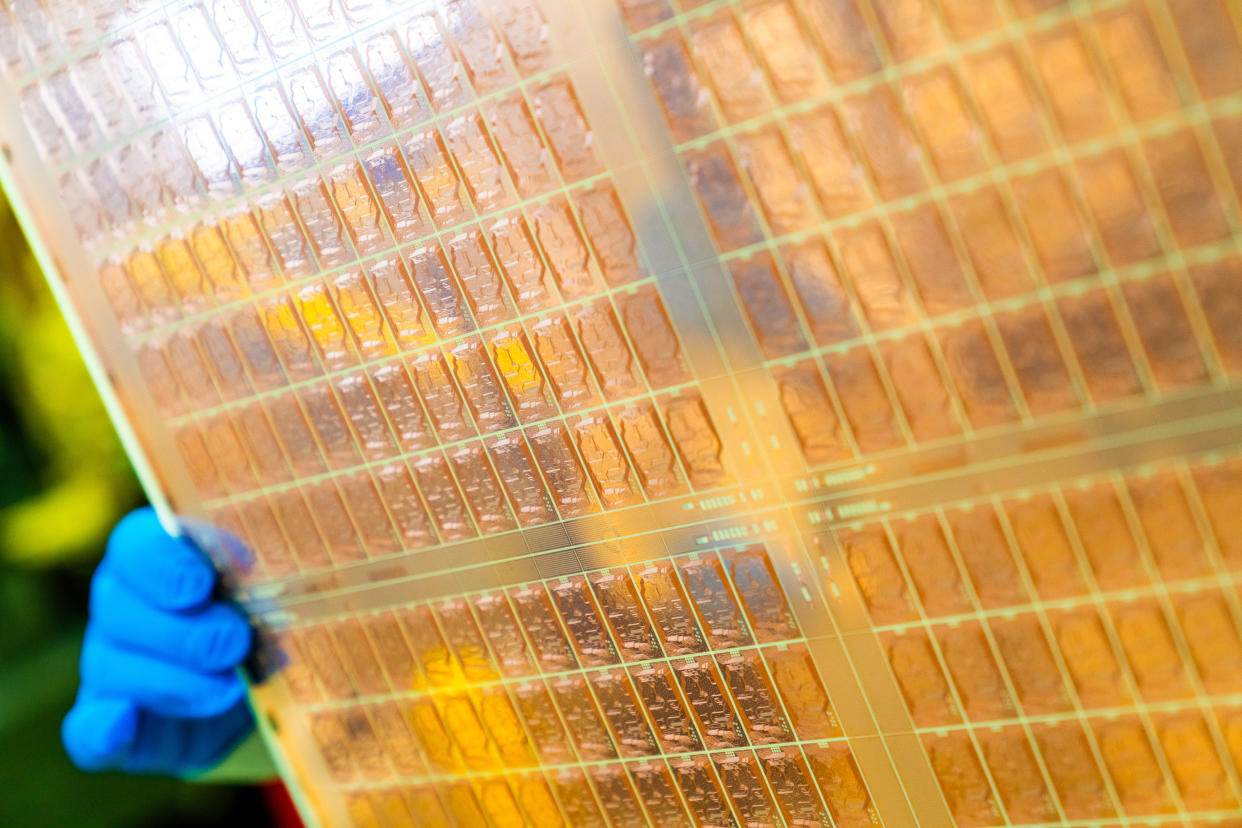

Glass substrates promise to offer substantial benefits for multi-chiplet system-in-package (SiP) designs that are expected to become increasingly popular in the coming years. Being one of the world's largest chipmakers, Samsung cannot omit glass substrates, so it recently assembled a coalition of its own groups to research, develop, and commercialize glass substrates by 2026, reports Sedaily.

Samsung has assembled a coalition consisting of its Samsung Electro-Mechanics, Samsung Electronics, and Samsung Display divisions to develop and commercialize glass substrates in the shorted time possible. In fact, Samsung Electro-Mechanics announced back at CES its intention to mass-produce glass substrates by 2026.

"As each company possesses the world's best technology [on their markets], synergy will be maximized in the promising field of glass substrate research, and it is also necessary to watch how the glass substrate ecosystem of the Samsung alliance will be established," an industry insider told Sedaily.

Samsung Electronics is expected to focus on the integration of semiconductors and substrates, while Samsung Display will specialize in glass processing. This collaborative approach is aimed at enhancing the group's competitive edge.

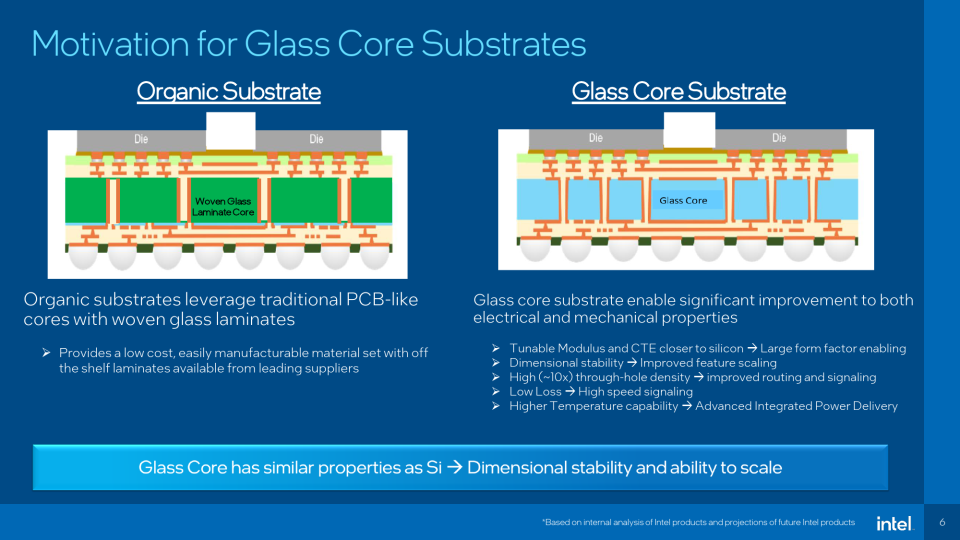

Glass substrates provide numerous advantages over conventional organic substrates. They offer exceptional flatness, which enhances the depth of focus for lithography, and outstanding dimensional stability for interconnects. These properties are crucial for next-generation SiPs that incorporate multiple chiplets. Additionally, glass substrates exhibit superior thermal and mechanical stability, enabling them to withstand higher temperatures while making them more durable for datacenter applications. Intel, which has been working on glass substrates for almost a decade, announced plans to adopt glass substrates for commercial products by 2030, anticipates that these characteristics will allow for a significant increase in interconnect density, which is essential for the power delivery and signal routing of next-generation SiPs.

In addition to Intel, Japanese company Ibiden, a leading semiconductor substrate manufacturer, has entered the glass substrate R&D arena, according to Sedaily. Ibiden announced its plans to focus on glass substrates as a new business venture in October last year. Similarly, in South Korea, SKC, an affiliate of SK Group, has established a subsidiary, Absolics, to explore mass production of substrates in collaboration with top semiconductor companies like AMD, which emphasizes the importance of substrates for next-generation processors.