Samsung Pay vs Apple Pay vs Android Pay: Which Should Replace Your Wallet?

I have a wallet problem. Between my credit cards, debit cards, loyalty cards, and driver’s license, the slab of old cowhide I stuff into my back pocket every morning is just too thick. I’m honestly one piece of paper away from my wallet exploding like George Costanza’s.

That’s where mobile wallet apps come in. Designed to hold virtual versions of your credit, debit, and loyalty cards, mobile wallet apps will eliminate the need for us to carry around traditional wallets. At least, that’s what companies like Apple, Google, and now Samsung are promising.

Today, Samsung officially unveiled its competitor to Apple Pay and Android Pay. But before you decide to trade in that mouldering hunk of leather and go virtual, there are a few things you need to know.

The first thing you’re probably asking yourself is, “How secure are these mobile wallets?” The answer is that they’re probably more secure than your actual wallet. When you make a payment using a mobile wallet, it doesn’t use your debit or credit card number; instead, it employs a randomly generated number assigned to your card called a token. These tokens change with each transaction you make, so no one can duplicate them. That’s a lot safer than a traditional credit card, which if lost or stolen can be used multiple times before you get around to cancelling it.

What’s more, if you lose your phone, you don’t have to worry about someone using your credit card, because your card number isn’t stored on your handset. Each of these mobile wallets also requires you to use a password or your fingerprint to pay for items, so there’s even more security keeping your card safe.

However, mobile wallets come with some sizable gotchas. For one thing, they’re only available for smartphones released in the last year or so. And not all banks, credit cards, wireless carriers, or stores support all of these mobile payment options.

Are mobile wallets ready to really replace your actual wallet? I tested each of these three mobile wallet apps to find out. While each has its benefits, only Samsung’s is truly ready for prime time, thanks to its wide support among merchants.

Samsung Pay

Samsung’s aptly named Samsung Pay service is the newest of the three major mobile wallets, so I’ll start with it first.

Samsung Pay uses two technologies to allow you to pay for things almost anywhere you go: NFC (near-field communication) and MST (magnetic secure transfer). NFC uses a special chip in your phone that lets it communicate with NFC-enabled payment terminals.

(How would you know? Most NFC-enabled terminals have some kind of signage indicating they use the technology. The problem is, only a small percentage of retailers have payment terminals that support NFC.)

That’s where MST comes in. This is the same technology that regular credit card readers use. So you can use Samsung Pay at any nearly credit card swipe terminal in the U.S. — making it the most widely accepted mobile wallet on the market. No one else comes close.

To use Samsung Pay, you swipe up from the bottom of your phone’s home screen to pull up your available credit cards. You then either enter your pin or use your fingerprint to verify your identity. The phone sends out alternating NFC and MST signals; whichever system your phone detects first is the one it will use to complete your transaction.

But Samsung Pay only works with Samsung’s newest handsets — the Galaxy S6, Galaxy S6 Edge, Galaxy S6 Edge+, and Galaxy Note5. As Samsung releases more phones in the future, you can expect them to also work with Samsung Pay.

Carriers: For now, at least, Samsung Pay only works with AT&T, Sprint, and T-Mobile. Verizon customers are left out in the cold, and there’s no official word on whether the two companies will come to an agreement.

Banks: At present only three banks support Samsung Pay — US Bank, Bank of America, and Citi, though more are coming.

Stores: Samsung Pay is accepted at nearly any store that has a credit card swipe machine, as it uses both MST and NFC technologies.

The exception? Samsung Pay won’t work at stores that require you to dip your credit card rather than swipe it. According to Samsung, that’s because the signal your phone sends out isn’t strong enough to be used with dip-style card readers. That means if you want to use your Galaxy S6 to fill up your tank, you’re probably out of luck (unless the gas pump happens to support NFC).

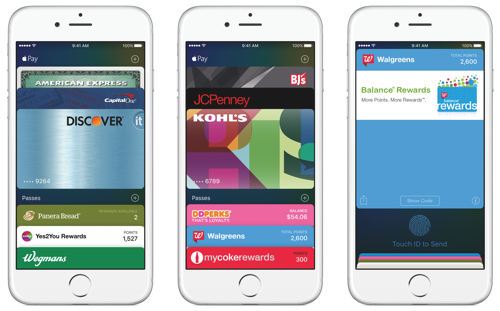

Apple Pay

Unlike Samsung Pay, Apple Pay only uses NFC technology, which means it can only be used at retailers with NFC-enabled payment terminals. That significantly limits the number of places you can use Apple Pay, so don’t automatically assume you’ll be able to pay for your microwave burritos at the corner market using your iPhone.

That said, you can use Apple Pay to pay for items inside a number of apps, including Uber, Best Buy, and Starbucks. This means you can just use your fingerprint to make payments, rather than having to enter your credit card information into each app.

To use Apple Pay, you place your phone next to a participating retailer’s NFC-enabled payment terminal. Your iPhone will wake up and bring up your default credit card. You then place your finger over your phone’s fingerprint reader, and you’re set.

Apple Pay is currently only available on the iPhone 6, iPhone 6s, iPhone 6 Plus, iPhone 6s Plus, and the Apple Watch. It’s safe to assume that future iPhones and Apple Watches will also support the service.

Carriers: Each of the Big Four U.S. carriers supports Apple Pay.

Banks: Apple Pay has been out for more than a year and works with more than 500 banks in the U.S. and 13 in the U.K. You can also use Apple’s handy list of all of the banks that support Apple Pay, to see if you can use the service

Stores: You can use Apple Pay at 700,000 stores, including American Eagle, Express, Macy’s, McDonald’s, Rite Aid, Walgreens, Winn Dixie, and of course, Apple Stores. You can also use Apple Pay at a ton of Coke vending machines.

Android Pay

Just like Apple Pay, Android Pay works only at retailers that have NFC-equipped payment terminals. That automatically limits the amount of stores where you can use your Android phone instead of cash.

Android Pay doesn’t currently with any apps, but Google says it’s working on app integration in the future.

To use Android Pay, you simply have to unlock your phone and place it over a compatible NFC payment terminal. Your handset will automatically detect your default credit card, and that’s that.

It works with any Android-powered smartphone phone running Android KitKat 4.4 or later that has a built-in NFC chip. That means there are dozens of Android phones out there compatible with Android Pay.

Carriers: The Big Four. It comes pre-loaded on smartphones from AT&T, T-Mobile, and Verizon; it can be downloaded on Sprint phones.

Banks: Android Pay works with just 13 banks. That’s significantly fewer than Apple Pay, though Google will be adding more in the future.

Stores: Like Apple Pay, Android Pay uses NFC technology, which means you’ll only be able to use the service in stores with NFC-compatible payment terminals. According to Google, Android Pay is accepted at more than 1 million retailers.

The best mobile wallet is …

Apple Pay is compatible with the most banks, and Android Pay works with a huge number of smartphones, but when it comes to mobile wallets, Samsung Pay is the one service that proves mobile wallets are ready for prime time.

Sure, it isn’t accepted by as many banks as Apple Pay. And yes, it only works with certain Samsung phones. But the fact that you can use Samsung Pay at both NFC-enabled payment terminals and regular credit card readers makes it far more useful than its competitors.

If you’re thinking about upgrading your phone, and want to leave your credit cards at home, Samsung Pay is your best option — at least for today.

Email Daniel at dhowley@yahoo-inc.com; follow him on Twitter at @DanielHowley or on Google+.