State of the internet: 5 takeaways from the annual Internet Trends report

This article, State of the internet: 5 takeaways from the annual Internet Trends report, originally appeared on TechRepublic.com.

Mary Meeker

Image: Kleiner, Perkins, Caufield, and Byers

At the time of its inception, there probably wasn't a single person who could have predicted how the internet would grow to shape our daily lives. Almost every human being in the world is affected by the internet in one way or another, directly or indirectly.

Mary Meeker, a partner at venture capital firm Kleiner, Perkins, Caufield, and Byers, delivered her "State of the Internet" presentation on May 27, 2015, showcasing some of the key data points on the growth of the internet. The presentation of her Internet Trends Report is an annual tradition for Meeker, and this year's 196-slide presentation took place at the Code Conference from Re/Code.

The report runs the gamut from the growth of the internet, to key trends, to how the internet has affected major markets. For those that might now have time to dive deep into the report, here are the top takeaways from Meeker's Internet Trends data.

1. Internet growth

Many thought leaders have long considered 1995 to be the kick-off for the growth of the internet. According to Meeker's report, there were 35 million internet users worldwide in 1995, which was about 0.6% of the total population at the time.

Two decades later, in 2014, 2.8 billion users represent 39% of the population. Asia contributes 51% of users, Europe claims 19%, the US has 10%, and the rest of the world makes up the remaining 21%. The growth of internet usage is still strong, as is the number of new users, but it is slowing compared to the previous few years.

Image: Mary Meeker

The number of mobile phone users also exploded, growing from 80 million users in 1995 to 5.2 billion users in 2014. Despite this explosive growth, the strength of new smartphone subscriptions is still healthy, but slowing. Mobile data traffic is slowing slightly, overall, but mobile video traffic is growing slowly and steadily since 2012. Another interesting fact is that daily time spent with digital media has grown heavily since 2008, driven almost exclusively by smartphone use.

All of this internet use is contributing to the growth of internet companies as well. The total market cap of the top 15 internet companies in 1995 was roughly $16.8 billion. In 2014, it was $2.4 trillion.

The internet has affected the consumer sector the most, and business comes in second place. Healthcare and government have been impacted the least by the internet so far.

2. Advertising

Many online ventures are supported exclusively by advertising. However, television advertising is still ahead of online advertising by a pretty hefty margin in the US. Television use is measured at 37% and television ad spending is 41%.

Time spent on the internet is clocked at 24% with ad spend at 23%. However, time spent with mobile is also measured as 24%, but ad spending only comes in at 8%, meaning there is a major disparity in meeting the opportunity. Meeker calculates this as a $25 billion opportunity in the US.

It seems that these discrepancies are being corrected as mobile advertising is growing strongly while internet advertising seems to be slowing down, according to Meeker.

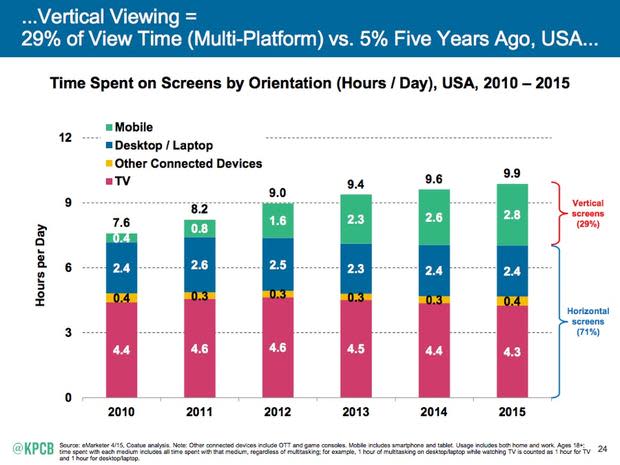

As mobile advertising grows, ad platforms have had to adapt and new platforms have been adopted. Short videos, carousel ads, and buy buttons are just some of the innovations powering the growth in mobile advertising. More and more users are viewing ads on vertical screens, meaning advertisers will need to optimize for the experience to improve conversion.

Image: Mary Meeker

3. Behaviors

Second only to the consumer market, the enterprise space has been one of the most highly-impacted by the growth of the internet. Meeker alluded to how this impact has shaped the business world by quoting the following tweet by Box founder Aaron Levie:

"Enterprise software used to be about making existing work more efficient. Now, the opportunity for software is to transform the work itself," Levie said.

The internet has changed aspects of business such as payments, communications, HR, recruiting, and data analysis by making them easier to engage and understand. Consumers have been affected as well, especially in terms of communication. Messaging apps have altered the dynamic of how we communicate, with WhatsApp and Facebook messenger leading the charge globally. This also changes the way companies are building applications, as it making features like notifications a necessity for some types of tools.

User-generated content is on the rise across mediums, whether text, audio, or video. Users age 12 to 24 years old are generally considered the trendsetters for platforms and content, with many focused heavily on mobile use and social media.

This expansion of the internet across new platforms does have some dire consequences. Cyber security risks are bigger and more complex than they have been in recent years, with mobile devices as one of the key drivers of this threat. Despite these new risks, Meeker said there is a security skills gap in the enterprise.

4. Work

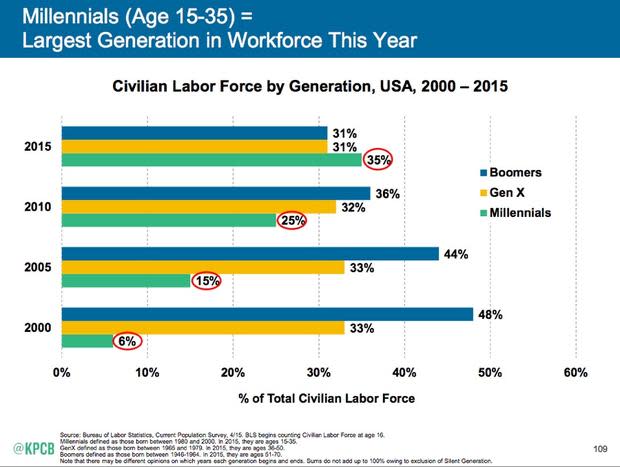

Over the past several decades, few things have changed as much as work and people. Millennials, those born between 1980 and 2000, are the largest generation in the workforce as of 2014 and their desires reflect the technology they grew up with. Of millennial workers, 34% prefer to collaborate online, 45% want to use personal smartphones for work, and 41% are likely to purchase and download applications to use for work with their own money.

Image: Mary Meeker

Because of the growth in internet and mobile connectivity, as mentioned above, more new workers are looking to flexible jobs such as freelancing or contracting. The number of freelance employees is growing and many are finding and completing their work online. Of online tools impacting freelance work, social media is the strongest. Of freelancers surveyed, 69% said that social networking has "drastically changed dynamics of networking," according to Meeker's report.

Because the internet has made it easier to buy and sell products and services, many users are turning to online platforms such as Airbnb, Uber, and Etsy to make some extra money or find more flexibile work. The rise of these online marketplaces present a host of opportunities and challenges for both consumers and businesses, but the bigger issue is the regulatory confusion regarding these businesses. Moving forward, all parties will need to work together to shape the regulatory landscape for these new businesses.

5. Markets

As far as big markets go, China is the biggest internet market in terms of "sheer mass," according to Meeker. Companies like Chinese tech giant Tencent are leading social while Melishuo and Mogujie are heading up social commerce. In addition, internet M&A and e-commerce are growing in China. Xiaomi is leading smartphone shipments in the country and spearheading part of the IoT revolution as well.

India could be on track to be the next big internet market. It's growth is trending upwards for user penetration and could be improved by emerging catalyst companies. India currently has 232 million internet users growing at 37% year over year, making it the third biggest internet market. It tops the list in new user additions with 63 million new users in 2014. Mobile and e-commerce are the driving factors behind India's internet use.

The top internet companies leading the public market are all familiar names to most internet users. Here are the top 10 of the 20 Meeker listed:

Apple

Google

Alibaba

Facebook

Amazon

Tencent

eBay

Baidu

Priceline

Salesforce.com

Public and private companies are higher than they were in 1999, but still below the peak they reached in 2000 during the dot-com boom. The recent high valuations of certain companies have led many people to speculate that we are in a boom and getting close to a bust. While there is some overvaluation, Meeker points out that there is also some undervaluation as well.

According to Meeker, the "race is won by those that build platforms & drive free cash flow over long-term (a decade or more)."