Innovation at Scale: Ginkgo Bioworks’ Approach to Revolutionizing Industries

This article was originally published on ETFTrends.com.

We live in the age of the elevator pitch, catchy soundbites, and companies promising to revolutionize every industry under the sun. No other field attracts more visionaries than healthcare. After all, who doesn’t like the idea of living a longer and healthier life? All these futurists must contend with the reality that biology is the most complex machine available to us. Enter Ginkgo Bioworks, a company that aims to “make biology easier to engineer.”

The company harnesses the power of AI and robotics to automate complex biological tasks. It's a holding in the underlying indexes for the ROBO Global Healthcare Technology and Innovation ETF (HTEC) and the ROBO Global Artificial Intelligence ETF (THNQ).

Imagine a future where, thanks to Ginkgo's innovations, a person can return from an airport equipped to detect emerging pandemics early. They can then stroll through their naturally fluorescent garden, sit down to a dinner of delicious lab-grown fish, and sip on a gut-friendly, disease-preventing probiotic drink. With a contented smile, they relax in the knowledge that should they ever contract a serious illness, a cure could be developed swiftly, all thanks to synthetic biology powered by Ginkgo’s Technology Network.

Yet the path to this utopia is not without its challenges. This, after all, is its very pitch: Biology is complex, but even in its immense complexity, it can be decoded and simplified with sufficient data. And that is a challenge Ginkgo is poised to meet.

Ginkgo Bioworks' Background

Ginkgo Bioworks — established in 2009 by MIT scientists including Tom Knight, Reshma Shetty, CEO Jason Kelly, Barry Canton, and Austin Che — is a leader in synthetic biology. Known as the "organism company," Ginkgo excels in programming cells to perform diverse functions. Using advanced software and hardware in their foundries, the team engineers, edits, and prints DNA to create specialized microorganisms.

The company designs organisms that produce specific substances or execute unique functions, with applications across pharmaceuticals, food, agriculture, and industrial sectors. Heading into 2024, Ginkgo is placing a greater emphasis on pharmaceutical development and expanding its involvement in nonbiosecurity government projects.

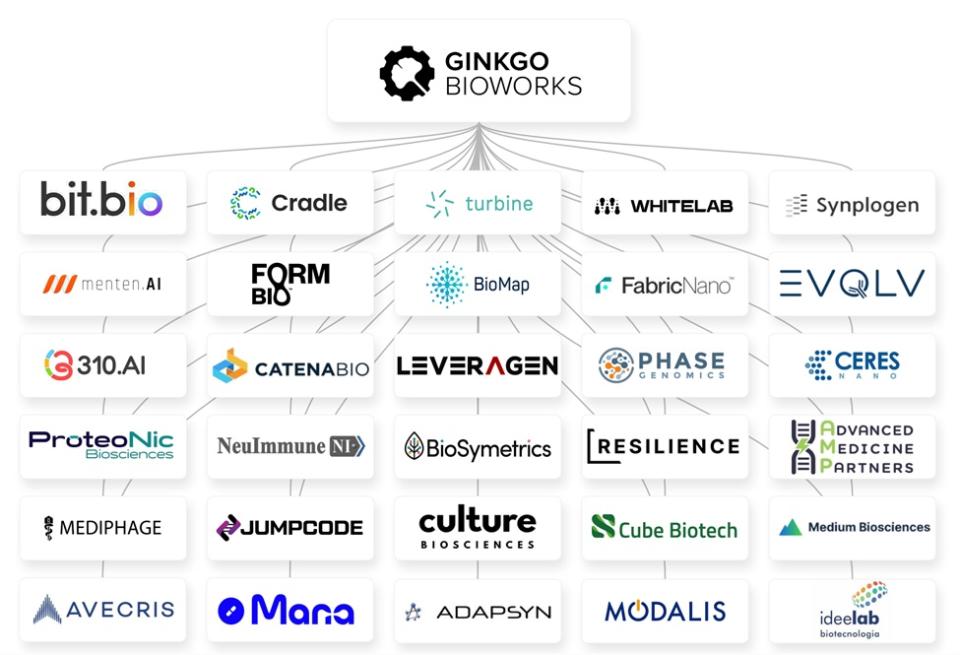

Figure 1: Exploring Diversity: Ginkgo Bioworks' Extensive & Varied User Base (nonexhaustive)

Source: Ferment 2024 presentation

Ginkgo Bioworks has stablished numerous partnerships across various industries, offering a compelling value proposition: reducing R&D spending, accelerating project timelines, minimizing capital expenditures, and shifting from fixed to variable cost structures for their clients. A key advantage of its platform over traditional cell engineering, which is often manually conducted in customers’ labs, is its scalability.

Ginkgo’s technology improves as it grows, unlike in-house efforts that typically do not scale as well. Additionally, it’s important to note that Ginkgo does not develop any products directly; instead, it enhances its partners’ capabilities through their advanced synthetic biology platform.

Ginkgo's platform is made from an extensive codebase, a proprietary library of genetic designs and biological parts that supports the design, writing, and debugging of DNA for organism engineering. This allows Ginkgo to create highly specialized microbes tailored for specific functions, ranging from producing bio-based compounds to enhancing industrial processes.

Multiple Services Across a Unique Platform

The company’s primary service is strain improvement, through which it optimizes microorganisms to increase production efficiency, stability, and cost effectiveness. This is especially vital in sectors like pharmaceuticals, where precision and yield can dramatically impact production viability and economics.

Additionally, Ginkgo offers specialized enzyme engineering services to develop enzymes for various applications, including chemical production and consumer goods. These engineered enzymes can improve process efficiencies and contribute to more sustainable manufacturing practices. Their expertise also extends to biosecurity. During the pandemic, Ginkgo launched Concentric by Ginkgo to enhance COVID-19 testing and epidemiological tracking, assisting public health efforts, educational institutions, and businesses in managing virus spread.

Ginkgo’s collaborative platform approach allows it to partner with companies from concept to commercial scale-up, integrating synthetic biology into various business operations. By providing comprehensive synthetic biology capabilities, Ginkgo Bioworks is driving biotechnological innovations, aiming to transform industries by making biology easier to engineer and more functionally diverse.

That said, it is not the only company working on the engineering of cells. There are plenty of others out there changing the DNA of cells to make them do something different. However, not one of these other firms is doing so with a model underpinned by a very large number of partnerships and acquisitions the way that Ginkgo is doing. Its newly unveiled Technology Network boasts 27 companies with claims of more to come.

It does seem that almost every month brings the announcement of a new deal or partnership. Conglomerate discounts exist for a reason — there is a risk that management may struggle to integrate all the pieces. On the other hand, customers generally seek access to as much technology as possible. There is also merit in pursuing multiple opportunities. Only time will tell if Ginkgo’s strategy proves successful.

Figure 2: Gingko Bioworks' Technology Network

Source: Ferment 2024 presentation.

Ginkgo Bioworks' Multitude of Partnerships

Ginkgo Bioworks possesses a unique technology stack in the highly trending industry of AI and robotics. Supported implicitly by industry leaders such as Novo, Pfizer, Moderna, and Bayer, Ginkgo has formed a vast number of partnerships with smaller firms at the forefront of biological engineering.

It has a solid two-year runway featuring decreasing operational expenses, positive revenue fundamentals, and enhanced revenue streams in the form of government research contracts and an increased proportion of major pharma deals front-loading revenue. Compared to its previously share-based compensation, everything seems promising.

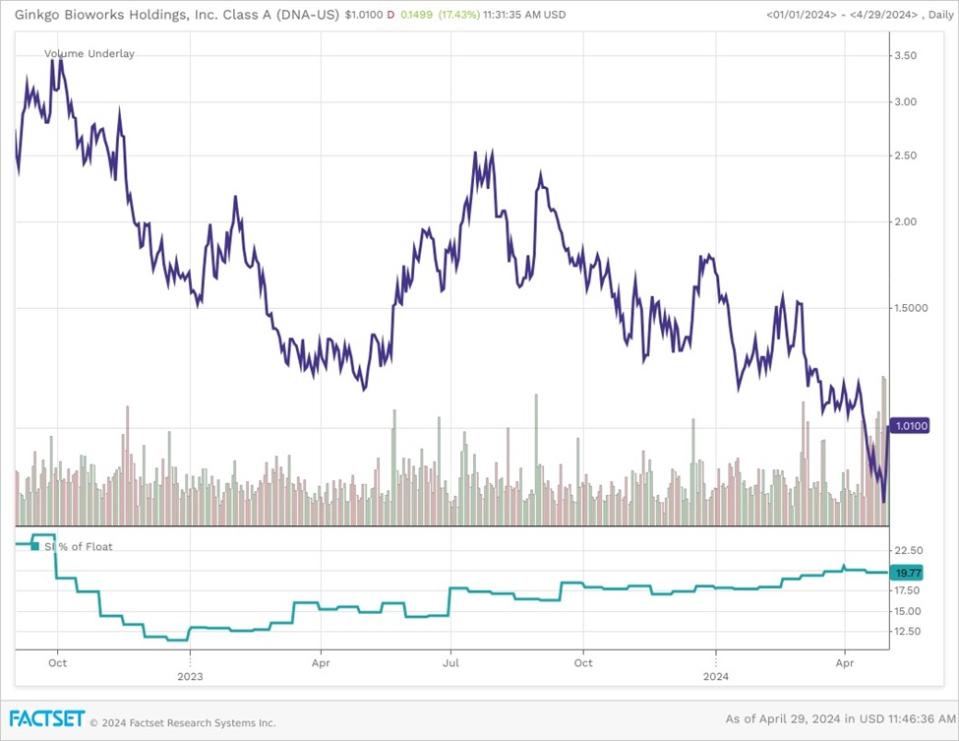

That said, before Monday’s short squeeze, the company was trading below $1 ($0.86), with approximately 20% of its float shorted (around 17 days to cover). It also currently trades at all-time lows despite maintaining a market capitalization of over $2 billion. This presents a stark mismatch between its perceived potential and its market valuation.

Figure 3: Ginkgo Bioworks: Price, Volume & Percentage of Float Shorted, 01/01/2024-04/29/2024

Source: FactSet

Pricing Ginkgo presents a challenge, as one could argue it has no direct peers. Other bioengineering firms focus on their proprietary pipelines, and contract research organizations (CROs) concentrate mainly on clinical phases II & III. But none mirrors Ginkgo’s scope.

The CEO envisions the company aligning with major tech firms, comparing its impact to that of Apple’s AppStore in the latest earnings call. Achieving this vision will require navigating numerous challenges.

A Complicated Situation

Is Ginkgo's elaborate setup a hindrance to its success? The company's complexity is evident, with its newly launched technology network incorporating 27 partner companies and three acquisitions this year alone, including Patch Bioscience, Proof Diagnostics, and Reverie Labs. Despite the hurdles, Ginkgo continues to push the boundaries of synthetic biology, striving to reshape the industry.

There is no doubt that Ginkgo has an abundance of talent, both from the founding members and from the continuous acquisitions and partnerships. Its CEO is a very efficient communicator and says the right things. He has reasonable answers for most investor concerns and a logical plan to move the company forward — a plan that he appears to be implementing. Unfortunately, from the outside, it's easy to believe that much of the success of its venture hinges on the capability of AI to act as a transformative tool, accelerating and enhancing the development of treatments.

Figure 4: Ginkgo Bioworks Revenue, EBITDA * EPS

The next few years will be pivotal for Ginkgo Bioworks. Beginning with a potential reverse stock split to align the company's share price perception more closely with its market capitalization, Ginkgo's revenue growth will be crucial. The company will have the opportunity to demonstrate its financial health independent of pandemic-related boosts. We also will have more evidence of the efficiencies of AI-powered drug discovery. According to its CEO, if the principles of scale economics hold true, centralized automated labs could dominate the industry much like cloud computing has. Only time will tell if it really is a company that has the right economics and is simply waiting for the market to catch up.

Final Thoughts

Ginkgo Bioworks is at the forefront of innovative and potentially transformative technologies in the field of biotechnology. The future is always uncertain. As such, the realization of advanced technologies akin to those in Jason Kelly's favorite movie, Vesper, may be a distant dream. However, Ginkgo's efforts are undeniably intriguing and hold the potential to make significant strides in the industry.

The company's dedication to pushing the boundaries of what is possible in biotechnology is commendable. Its developments are sure to capture the attention of both industry experts and curious onlookers alike. As Ginkgo continues to make progress, it will be fascinating to witness the impact of its work. It will also be interesting to see how it may shape the future of the field.

Whether you're a technology enthusiast, investor, or simply curious about the next big thing in biotech, Ginkgo's journey is one to watch.

For more news, information, and strategy, visit the Disruptive Technology Channel.

VettaFi LLC (“VettaFi”) is the index provider for HTEC and THNQ, for which it receives an index licensing fee. However, HTEC and THNQ are not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of HTEC and THNQ.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM